简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AvaTrade Review:Pros & Cons to Explore

Abstract:This article reveals several important aspects of AvaTrade, including trading products offered, trading costs, spreads and commissions, trading platforms, deposit and withdrawal, pros and cons for your reference.

Overview

1. Introduction

2. Regulation

3. WikiFX Field Survey

4. Market Instruments

5. Account Types

6. Fees, Commissions and Spreads

7. Deposit & Withdrawal

8. Trading Platforms

9. Customer Support

10. Eduacational Resources

11. Conclusion

A Brief Introduction

To help you decide if AvaTrade is a good fit for your trading needs, this review examines the pros and cons of this global forex brokerage, including the trading products offered, trading expenses, spreads and commissions, trading platforms, deposit and withdrawal and more.

About AvaTrade

Established in 2006, AvaTrade is an online forex and CFD broker belonging to the AvaTrade Group of financial companies, headquartered in Ireland, with its operations in Japan, Australia, and the British Virgin Islands. AvaTrade has now grown to offering retail investors Forex trading, Cryptocurrencies trading, Commodities trading, Indices trading, Stocks trading, Bonds trading, Vanilla Options trading, ETFs trading, CFDs trading, Spread Betting trading, and Social trading. AvaTrade gives its clients access to a wide selection of trading platforms, multilingual customer support.

A Glance of Basic Information of AvaTrade:

| ⌚️Founded Year | 2006 |

| Regulated by | ASIC, CBI, FSCA, FSA |

| Headquartered | Ireland |

| Min. Deposit | 100 USD |

| Spreads | 0.9 pips |

| Commissions | Low |

| Trading Platform | MetaTrader 4, MetaTrader 5, AvaOptions, DupliTrade, ZuluTrade, WebTrader |

| ☎️ Live Support | 5 x 24 |

| Trading instruments | Metals, Commodities, Stocks, FX Options, Oil, ETFs, Options, Crypto currencies, CFDs, Indexes, Shares, Spread Betting, Indices, Forex, Bonds |

| Account currency | AUD, JPY, GBP, USD, EUR, CHF |

| Number of clients | Over 400,000 clients |

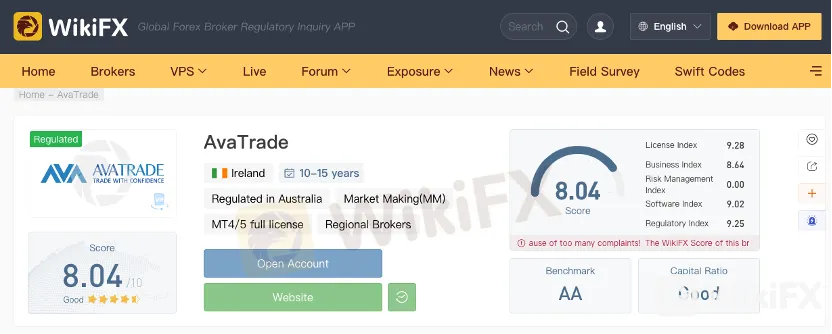

On the WikiFX website, AvaTrade gets an overall score of 8.04 based on five indexes: License Index, Business Index, Risk Management Index, Software Index and Regulatory Index.

AvaTrade is on the list of 2022 10 Best Forex Brokers in the world, for being well-regulated, offering access to a wide selection of trading platforms, transparent and fair cost structure, excellent for copy trading, convenient deposit and withdrawal process.

View more details from the following video:

Pros and Cons of AvaTrade

The advantage and disadvantage of AvaTrade are listed below:

| Pros✅ | Cons ❌ |

| Regulated in multiple jurisdictions | High minimum balance requirements for bank transfer |

| Offers an extensive range of tradable assets | High inactivity Fees |

| High leverage in the stock, commodity, and FX markets | No price alerts via Webtrader |

| Transparent fee structure, low trading fees | Customer service can be enhanced. |

| Multiple trading platforms available | Not accepting US traders |

| Automated and social trading supported | |

| Negative Balance Protection |

WikiFX Field Survey

To see if the physical location of AvaTrade's licensed company is consistent with the address on its official license. As scheduled, members of the WikiFX Field Survey team traveled to Tokyo, Japan, to meet with representatives from the dealer AVATRADE. To verify that the dealer has a physical location, look for the dealer's emblem on the street address that is visible to the public. After being welcomed by firm employees and the president, investigators were given permission to take images inside the business. However, investors are advised to make a well-informed decision based on this field survey.

Regulation

WikiFX shows that AvaTrade has five entities regulated in respective jurisdictions. We should also point out that this brokerage is not regulated by the FCA, the UK's tier-one regulatory agency, which may be a major con in terms of regulation.

| Regulatory Authorities | Entities | License Type & Number |

|

AVA Capital Markets Australia Pty Ltd | 504072 |

|

Ava Trade Japan K.K | 2010401081157 |

|

AVA Trade EU Limited | Unreleased |

|

AVA CAPITAL MARKETS (PTY) LTD | 45984 |

|

AVA Trade EU Limited | 504072 |

Market Instruments

AvaTrade provides access to more than 1250 trading instruments across different asset classes, including Forex Exchange, Commodities, Precious Metals, Cryptocurrencies, Indices, Bonds, Stock, ETFs, Options

Account Types

| ✅Pros | ❌Cons |

| Swap-free accounts offered | No micro accounts |

| Acceptable initial capital | High requirement for professional account |

| Negative balance protection |

A Standard account and a demo account are the only two account types available to most traders at AvaTrade, with minimum initial deposit to open this account from $100 via credit cards, $500 via wire transfer.

professional traders can open MAM accounts so that they can simply handle several accounts on behalf of their clients. For a professional account, you must meet two of the following requirements:

✅A sufficient volume of transactions has taken place throughout the last year.

✅Relevant financial services sector experience

✅A portfolio of over €500,000 (including cash saving and financial instruments)

For Muslim traders, AvaTrade offers “swap free accounts” that function in conformity with Islamic Sharia Principles of overnight interest-free trading.

Negative balance protection is also available at AvaTrade. This assures that customers will not lose more than the amount in their accounts.

Fees, Commissions and Spreads

| ✅Pros | ❌Cons |

| Low CFD fee | Average forex fee |

| Commission-free trading environment | High inactivity fee |

As a commission-free broker, AvaTrade does not charge a fixed fee for trading. Whatever you trade on AvaTrade, this is true.

However, AvaTrade is not completely free. Spread is charged on every transaction. For example, if you qualify as a professional trader, the spread cost for EURUSD is 0.6 pips instead of the standard 0.9 pips.

Forex-The forex trading is based on the standard spread in normal market conditions, with spread cost= spread*trade size. The spread cost for a 3,000 EUR/USD trade with 3 pips spread is $0.90 (0.0003*3000).

Commodities - Trading in commodities is governed by the Standard Spread, sometimes known as the “Spread Over Market.” Gold's spread costs 0.29, while Platinum's costs $1.10 above market value.

Cryptocurrencies - The spread for BTCUSD is 0.20% over market, and for Etherum, it is 0.25% over market.

Equities -Except when mentioned, individual stocks trading is subject to 'Spread Over Market'; that is, the current market spread is marked up. There is a 0.13 percent spread cost on Apple and Amazon stock.

Additionally, interest is levied daily for any open position that remains open at the overnight rate. According to the Daily Overnight Interest Buy(or Sell) rate of 0.0%, a fee of €0.11 for the aforementioned 2,000 EUR/USD exchange is calculated as 2,000*0.00%= 0.000055. (Quoted in primary currency).

In terms of GBP/USD and USD/JPY, the average spread costs are 1.16 and 1.11.

Lastly, after three months of inactivity, AvaTrade charges a $50 quarterly inactivity fee. In addition, a $100 annual administration charge will be withheld after 12 months of non-use.

Deposit & Withdrawal

| ✅Pros | ❌Cons |

| No Deposit & withdrawal fee | High deposit requirement via Wire Transfer |

| Multiple payment options available | 10-day withdrawal process time via wire transfer |

AvaTrade allows standard payment options, such as debit card, credit card, e-wallet (Neteller, Skrill, and WebMoney), and bank transfer. If you fill your account via debit, credit, or e-wallet, the minimum deposit required by AvaTrade is only $100. When funding an account via direct deposit, the minimum amount increases to $500. If you deposit at least $1,000 into your account, AvaTrade will assign you a personal account manager to help you get started.

If the account verification process has been completed and accepted by AvaTrade, a withdrawal request will be processed within 24 to 48 hours. Credit cards, debit cards, and e-money all go through this process. While Transferring money by wire transfer can take up to 10 business days to show up in your account.

Trading Platforms

| ✅Pros | ❌Cons |

| Multiple trading platform options | AvaOptions requires a high deposit of $1000 |

| Automated and social trading allowed | The AvaOptions desktop platform slow to load |

Traders with AvaTrade are given a wide selection of trading platform options, including two proprietary trading platforms (AvaTrade WebTrader and AvaOptions), the full MetaTrader suite (MT4 & MT5), ZuluTrade, and DupliTrade (accessible via WebTrader).

AvaOptions: AvaTrade offers AvaOptions, for PC and mobile, to options traders who deposit at least $1,000. Microsoft's.NET Framework 3.5 SP1 is required to run the desktop version on Windows. The platform's interface to be difficult to navigate even for an experienced trader. AvaSocial, the broker's social trading and copy trading tool, is also available to AvaTrade customers. The smartphone app, which is available on both iOS and Android devices, allows users to copy the trade of successful traders.

AvaTradeGO is a trading app offered by AvaTrade, asy to track social trading with its intuitive features. AvaTradeGO provides an excellent user experience, and its notification, price alerts, and charting features assist traders get key financial information for clear market analysis, according to customer reviews.

Automated Trading AvaTrade also offers automated trading platforms like ZuluTrade and DupliTrade. Traders can follow in the footsteps of more experienced traders by using these tools to replicate their trades. AvaTrade features a variety of auto trading tools for experienced traders, as well as a team of advisors who can help you.

Customer Support

| ✅Pros | ❌Cons |

| Online communication available | 7x24 customer care unavailable |

| Phone & Email Support | |

| A “FAQ” section | |

| Multilingual customer support |

AvaTrade's customer care representatives are on call around the clock, five days a week, during regular business hours, whenever the markets are open.

Live chat, phone, and email options are available for clients to get in touch with the company. Traders can get help in a variety of languages, including 21 different countries throughout Europe, 2 countries in Africa, 6 countries across Asia, 4 countries across South America, 2 countries in the Middle East and Australia.

Educational Resources

| ✅Pros | ❌Cons |

| Demo account Available | None |

| Webinars and Educational Videos | |

| Trading for beginners | |

| Trading platform tutorials |

AvaTrade provides a variety of educational resources, which enables clients to trade confidently. This library of ebooks, videos, articles, and webinars will benefit traders of all levels. A demo trading account is also available to AvaTrade users, allowing them to practice trading without risking their own money.

Some of the trading courses and other educational materials offered through AvaTrade include :

Beginners Trading Guides

Professional trading strategies

Economic indicators

Order types

Ebook

Trading videos & well organized tutorials platfrom.

Webinars

AvaTrade Demo Account

Concusion

Regulated by multiple regulatory authorities, AvaTrade offers no-fee withdrawals and deposits, cheap trading costs, and a risk-free test account. When it comes to research and education, AvaTrade has plenty to offer. The high non-trading costs, currency conversion fees, and non 7x 24 customer care might be substantial drawbacks despite the many benefits. Investors should make a comprehensive consideration before trading with this brokerage.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator