简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Pros and Cons of Forex Demo Accounts

Abstract:Most reputable forex brokers will provide demo accounts for traders to practice forex trading by using virtual money. As most traders know, live accounts are set up for trading in a real trading environment and trading with live accounts will inevitably have to take some risks. By contrast, demo accounts are not only intended for beginners to practise trading in a risk-free environment and build up experience with trading but also for advanced traders who want to test their trading strategies and explore the offering of a broker before registering a live account.

Overview

1. Brief Introduction

2. The Pros and Cons of Forex Demo Accounts

3. Some Tips for Opening Forex Demo Accounts

4. Conclusion

1. Brief Introduction

Most reputable forex brokers will provide demo accounts for traders to practice forex trading by using virtual money. As most traders know, live accounts are set up for trading in a real trading environment and trading with live accounts will inevitably have to take some risks.

By contrast, demo accounts are not only intended for beginners to practise trading in a risk-free environment and build up experience with trading but also for advanced traders who want to test their trading strategies and explore the offering of a broker before registering a live account.

2. The Pros and Cons of Forex Demo Accounts

Pros

1) Free Demo

You don't need to invest any actual money when you open a forex demo account. Demo accounts and virtual funds are provided by your broker, and both of them are free of charge. A demo account lets you make unlimited virtual trades, unlike real trading, which has hidden fees charged.

2) Take Zero Risk

It is important to understand that trading can come with risk, so it is a good idea to practice trading with a risk-free demo account first. Using a demo account, you will incur losses and gains that are completely virtual. Since you are trading with virtual funds, you don't have to worry about taking risks.

3) Explore the Market Instruments

You can trade all the same financial instruments in real time with a demo account as you can with a real account. Trading currencies, commodities, index CFDs, precious metals, and other financial instruments are all available at your fingertips. Trading currencies, commodities, index CFDs, precious metals, and other financial instruments are all available at your fingertips.

4) Try out and Practice New Strategies

Forex demo accounts aren't just for beginners, as we mentioned. Demo accounts allow you to try out a new trading strategy to see if it works before you commit. In the event it doesn't work out as planned, you won't lose your money. Instead, you'll gain valuable insight into how the strategy performs under different market conditions. Once you're sure of your strategy's effectiveness, practice it on a demo account for as long as you need.

5) Improve your Trading Skills

Practising and learning different trading techniques can be done on demo accounts and they can also help you brush up on your trading skills. The trading platform can be practised without real risk, so you can learn it inside out without worrying about real money. The key to becoming a successful trader is to make sure you read all the charts correctly and are fully prepared to pull the trigger when the time is right.

6) Test the Brokers Services

Demo accounts give you a preview of your future client-broker relationship, so feel free to ask questions and contact support at any time. In this way, you can make common beginner mistakes and learn from the brokers without having to deal with the usual financial consequences. In addition, this is a good time to experiment with different trading platforms and brokers to find the one that suits you best.

Cons

1) Limited Virtual Funds and Fixed Duration

Demo accounts are often funded with the initial amount set up with an online forex broker, so they cannot be withdrawn from or deposited into virtual funds. Additionally, demo accounts are usually restricted to a fixed period after which they expire. If this happens, you might lose your demo trading history or have it terminated at an inconvenient time.

2) Real Trading Conditions May Differ

Trading on forex demo accounts seems to be very realistic and uses real exchange rates as they happen, but they can be quite different in the real world, especially during rapid market reactions surrounding major economic data releases or when a major news event is announced.

3) Tend to Overtrade

The thrill of entering a deal and taking risks can cause some people to trade excessively due to their enjoyment of trading. You should not get into the habit of constantly pulling the trigger as a trader, instead sit on your hands. People sometimes get into the bad habit of indulging their love of trading to an extreme degree when using a demo account because there is no actual risk of financial loss, other than the opportunity cost of not taking the trades on a live account. Their failure to succeed on a live account is ultimately the result of this.

4) Emotional Responses May Differ

Managing your emotional reactions appropriately is one of the key elements of successful trading. It doesn't matter if you lose when playing with virtual money. The risk of loss or gain is heavily influenced when you trade with your own money. When you trade with your own money, however, your emotions, thoughts, and decisions are heavily influenced.

3. Some Tips for Opening Forex Demo Accounts

First of all, to find the best forex demo account for your needs, you might want to review those available from several online brokers with varying features to make an informed decision about which broker is the most suitable one for your particular trading style.

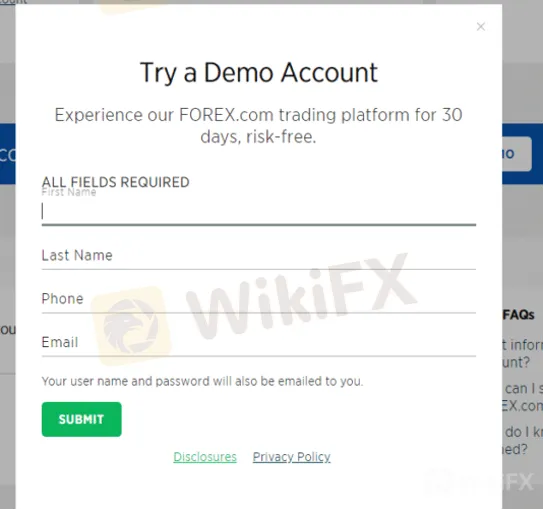

Besides, when opening a demo account, you will be asked to enter some personal information to identify yourself and to fund the demo account with virtual money.

If you feel uncomfortable providing your real personal information to a broker you do not know well, you can often open a demo forex trading account using a fictitious name, address, and contact information.

Likewise, if you are concerned that your e-mail address will be sold to third parties such as email marketers, you can also create a new e-mail account for receiving messages regarding the demo forex account.

4. Conclusion

Overall, forex demo accounts can be useful for testing out trading strategies without having to worry about excessive losses or making a real deposit, as well as providing traders with a way to practice trading with some of the worlds most reputable trading platforms such as the state-of-the-art MetaTrader4 and MetaTrader5. From these aspects, forex demo accounts do deserve a place in the forex trading toolbox.

Nevertheless, forex demo trading has some common cons that everyone should be aware of and do their best to compensate for. Keep in mind that never indulge too much in the demo trading environment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator