简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Open an eToro Demo Account?

Abstract:eToro demo trading account is a wonderful learning tool for new traders. It gives you the freedom to try out new investment methods and learn from your failures without exposing you to any kind of financial danger. Additionally, it also gives you the opportunity to test out eToro's trading platform, allowing you to directly experience the platform's tools and capabilities while simultaneously building your self-assurance to begin investing.

eToro is one of the world's most popular online brokerages for trading cryptocurrencies and stocks. Adding support for Bitcoin (BTC) trading in 2014 made it one of the first online trading organizations to do so. Ethereum (ETH) and Ripple (XRP) were introduced shortly after (XRP).

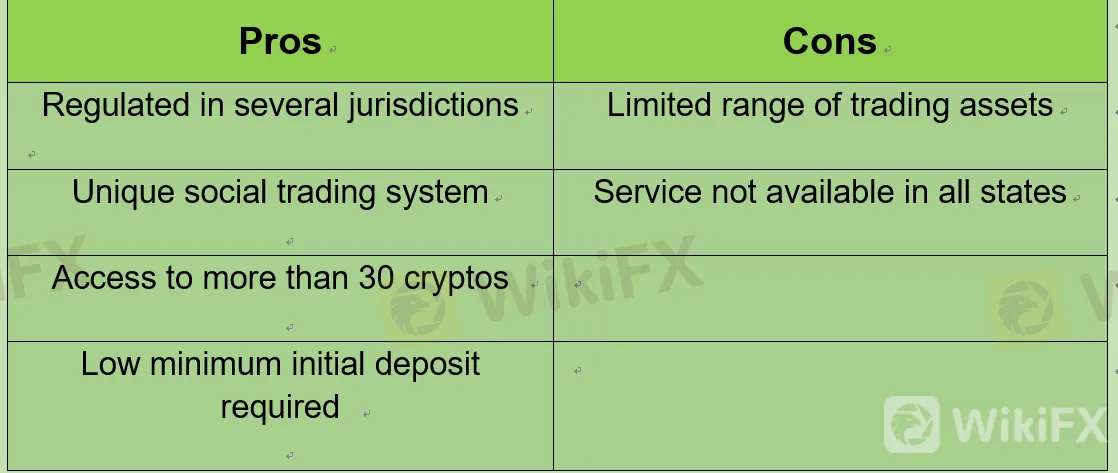

eToro is also an outstanding figure in providing the social trading platform, which allows clients to follow the trades of more experienced traders while also rewarding those investors who openly share their own trading methods. The pros and cons of eToro are listed below:

Furthermore, it is important to highlight the fact that eToro is among the 10 Best Demo Account Forex brokers, a ranking list selected by WikiFX, a global forex broker regulatory inquiry App. Here is the video of 10 Best Demo Account Forex Brokers in 2022 for your reference:

eToro demo trading account is a wonderful learning tool for new traders. It gives you the freedom to try out new investment methods and learn from your failures without exposing you to any kind of financial danger. Additionally, it also gives you the opportunity to test out eToro's trading platform, allowing you to directly experience the platform's tools and capabilities while simultaneously building your self-assurance to begin investing.

The demo account was to help beginners hone their trading skills, however, even experienced investors are seeing the benefit of the demo account since it helps them gain more insight into how the markets function, as well as allows them to discover new opportunities. Aside from that, it is quite easy to switch from a real eToro account to a demo account when you want.

eToro gives you the opportunity to test out all of its features through its demo trading platform, including the following:

Available trading instruments include 20 of the most popular cryptos, stocks, and ETFs.

Your virtual portfolio will be much easier to manage with a streamlined and uncluttered user interface.

You can track the real-time trends of each instrument using cutting-edge analysis tools.

Copy the portfolios of successful traders from across the world by connecting with them on the eToro platform.

Explore the pre-made thematic portfolios that eToro has available.

Leverage functions the same as in real accounts.

How to open an eToro demo account?

An eToro Demo account can be opened in a matter of minutes. An email and five minutes of your time are all that are required. There is no need to provide any credit card information.

1. Go to eToros homepage (https://www.etoro.com/en-us/), and click “Demo Account” where the red arrow indicates;

2. After clicking on that link, you will be brought to the regular sign-up screen for the service. When you get to the following page, you'll be asked for your email address, your username, and your password, and you'll also be required to accept the terms and conditions and the privacy and cookie policy.

3. After you have done that, an email will be sent to the email address you gave by eToro to confirm your account.

Now, all that is required of you is to sign in to your email account, click the green button that says “Verify Your Email,” and confirm the email that was sent to you.

4. Before you can begin your virtual trading trip, there is one more step. A “Real” to a “Virtual” account changeover is needed here. You can access your virtual portfolio by clicking the green text that says “REAL” underneath your profile part, then selecting “Virtual Portfolio,” and finally selecting “Switch to Virtual Portfolio.”

5. Now you can explore all features and functionalities with this demo account, with a total of $100,000 virtual funds available for you to play around with. Unlike real money, these funds do not expire so you can trade in practice mode whenever you want.

This is a list of assets that you have effectively purchased in the virtual world. You can keep track of both your gains and losses. When you make a purchase of an asset, it will be added to your portfolio; when you sell an asset, it will be removed from your portfolio.

On the eToro demo account, you can begin trading in one of two different ways:

1. Choose the “Trade Markets” section to engage in manual trading of any of the assets that eToro makes available, such as ETFs (exchange-traded funds), stocks (classified according to industry or exchange), cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Dash, etc.), stock indices, or major currency pairs on the Forex market.

2. Another way is to find, follow, and copy other traders by visiting the “Copy People” section. In order to identify those who best meet your needs, you can use the search and filter tools (by nation, those who invest in a specific form of financial instrument, those who have a specific profit %, by seniority, by consecutive months of profit, by risk level, etc...).

There is a place on the Watchlist where you can add financial instruments that you are interested in following, so you can study them further before making an investment decision. In addition, the “Invest in CopyPortfolios” section allows you to practice investing with virtual capital here to learn more about how you can diversify your investment with the help of eToro CopyPortfolios.

Is it possible to increase virtual money in the demo accounts?

New eToro demo accounts are automatically credited with 100,000 in virtual funds after they have been opened and verified. You can request additional virtual money by opening a support ticket (to find out whether you are a visitor or an existing user) and getting in touch with its customer service department. Simply indicate how much you would like to add, and they will take care of the rest. The amount of money you can add to a virtual fund on eToro is up to $10,000. Further, eToro can also remove virtual funds from your account, at your request, at a minimum amount of $2,000, at any time, and at any time.

What you can learn from an eToro demo account?

Along with improving your trading skills and putting together an effective trading strategy, you can also learn some of the following things:

You can easily manage your investment portfolio through eToro's user-friendly interface by keeping track of each asset or instrument's real-time price movement and trends with the help of the platform's powerful analytical tools.

Using eToro's copying trading features, you can replicate the strategies and methods used by seasoned traders and high-earning traders, who also use the platform to trade, and most importantly, you will learn how to interact with other traders in the eToro community.

How to acquaint yourselves with all capabilities and features of the eToro platform, learning to trade without having to risk your real money.

Trading leverage, stop loss, take profit, and risk-management tools, all key tools of an experienced trader, can be used to explore the various levels of earning potentials and risks when trading.

How much time should a beginner spend on the eToro Demo account?

Take as much time as you need in a day to practice virtual trading on the eToro demo account until you turn out to be confident enough to trade in the real world. The amount of practice time that matters before you start trading in the real world isn't that important.

As you move from the practice account to the real account gradually, you should begin by risking small amounts of money at first. The only thing you should do is to be as risk-averse as possible so as not to lose everything. The emotions of greed or fear may undermine even the most perfect trading strategies in situations where money is involved.

Wrapping Up

eToros demo account for novice and even intermediate traders seeking a safe place to practice their trading techniques. Not only do they provide tools for self-guided learning via a clear and intuitive layout, but they also let people learn for free. eToro's learning resources, customer support, and CopyTrader are all geared to make the learning curve as painless as possible for new traders.

This does not mean, however, that eToro is faultless. Listed below are a few downsides of the brokerage platform:

Demo accounts offered by other brokerage houses may contain a more diversified range of trading instruments. The eToro platform's price is also a source of dissatisfaction for some investors. eToro's spread costs aren't the cheapest in the business.

Nevertheless, eToro features a user-friendly interface that makes trading accessible to anyone who wants to learn. Potential investors who are interested in trying out trading activities can do so by registering for a free demo account with eToro.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Robinhood Launches Options Trading in the UK by 2025

Robinhood to introduce options trading in the UK by 2025 following FCA approval. Discover how this expansion aligns with Robinhood's strategy for global growth and new features.

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

SEC Warns on Advance Fee Loan Scams in the Philippines

Russia Turns to Bitcoin for International Trade Amid Sanctions

Rs. 20 Crore Cash, Hawala Network, Income Tax Raid in India

Hong Kong Stablecoins Bill Boosts Crypto Investments

BEWARE! Scammers are not afraid to impersonate the authorities- France’s AMF said

Currency Calculator