简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sardis Markets

Abstract:Sardis Markets, established in 2022 and headquartered in the United Kingdom, is a dynamic trading platform offering a broad array of financial instruments. Despite not being regulated, the firm provides access to Forex, metals, indices, commodities, stocks from the EU and US, and cryptocurrencies. It appeals to diverse trading preferences with three distinct account types featuring varying deposit requirements, leverage, and spreads. The firm enhances its service with educational resources, responsive customer support, and competitive bonuses, aiming to empower traders at all levels.

| Sardis Markets | Basic Information |

| Company Name | Sardis Markets |

| Founded | 2022 |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

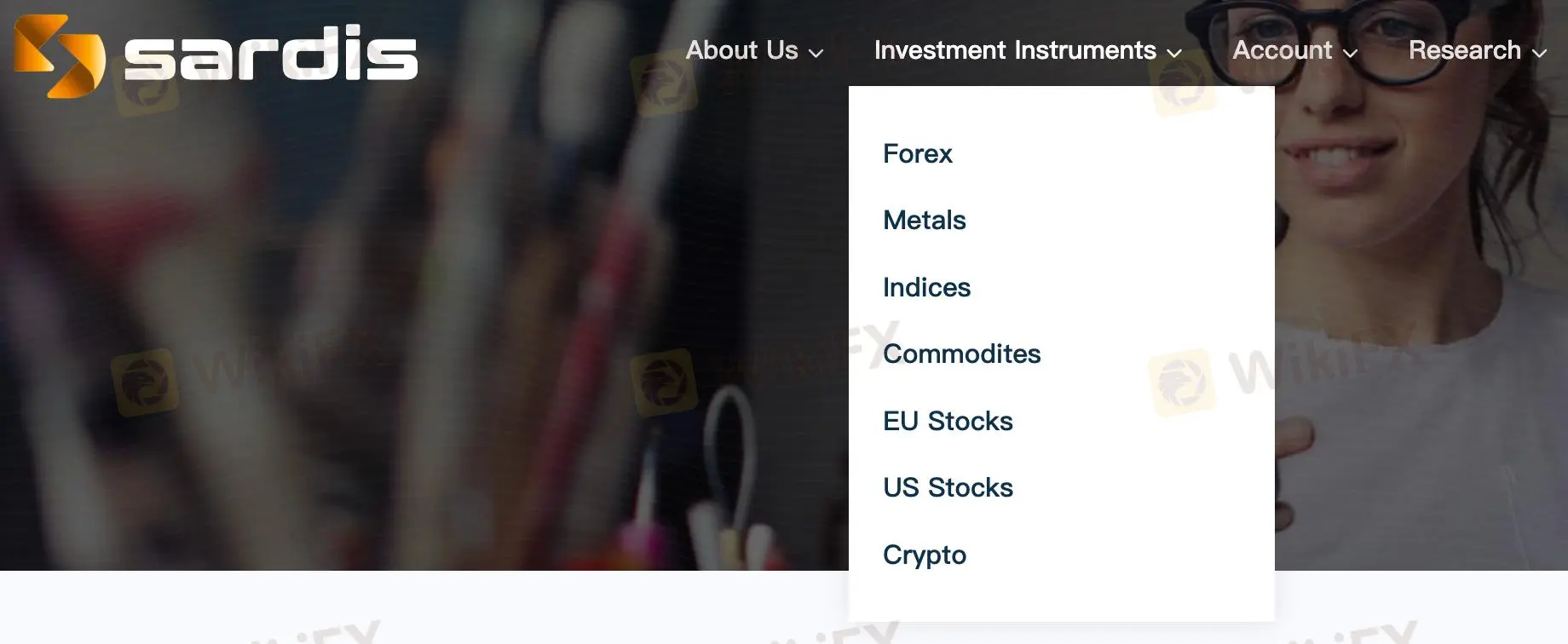

| Tradable Assets | Forex, Metals, Indices, Commodities, EU Stocks, US Stocks, Crypto |

| Account Types | Standard, Professional, VIP |

| Minimum Deposit | $200 (Standard), $3,000 (Professional), $10,000 (VIP) |

| Maximum Leverage | 1:400 |

| Spreads | Starts from 1 pip for Professional and VIP, 5 pips for Standard |

| Commission | Low (Specific rates not provided) |

| Deposit Methods | Instant Deposit Methods |

| Trading Platforms | Online trading platform, MetaTrader 4/5 |

| Customer Support | Email: info@sardismarkets.me, Phone: +382 68 139 645, +44 (7418) 359 899 |

| Education Resources | Daily newsletter, daily news updates, daily technical analysis |

| Bonus Offerings | High bonuses |

Overview of Sardis Markets

Sardis Markets is a modern broker launched in 2022, aiming to offer a comprehensive trading environment with a variety of instruments including Forex, Metals, Indices, Commodities, EU Stocks, US Stocks, and Crypto. Located in the UK, the broker facilitates trading through popular platforms such as MetaTrader 4 and 5, supported by educational resources to guide traders. However, its lack of regulatory oversight is a considerable risk factor that potential clients must consider.

Is Sardis Markets Legit?

Sardis Markets is not regulated by any recognized financial regulatory authority. This lack of regulation means that there is no oversight ensuring that Sardis Markets adheres to the financial industry's standards and practices, which can increase the risks associated with trading and investing through this broker.

Pros and Cons

Sardis Markets presents a versatile trading platform that accommodates a wide spectrum of traders through its diverse asset offerings and multiple account types tailored for different levels of trading experience. The platform's integration of robust trading tools, including MetaTrader 4 and MetaTrader 5, complements its comprehensive educational and support services, which are designed to enhance the trading experience and help traders navigate the markets more effectively. However, the absence of regulatory oversight casts a shadow over these benefits, introducing potential risks associated with lack of compliance and security measures that regulated brokers typically uphold.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Trading Instruments

Sardis Markets offers a diverse range of trading instruments, including Forex pairs, precious metals, indices, commodities, EU stocks, US stocks, and cryptocurrencies.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| Sardis Markets | Yes | Yes | Yes | No | Yes | Yes | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

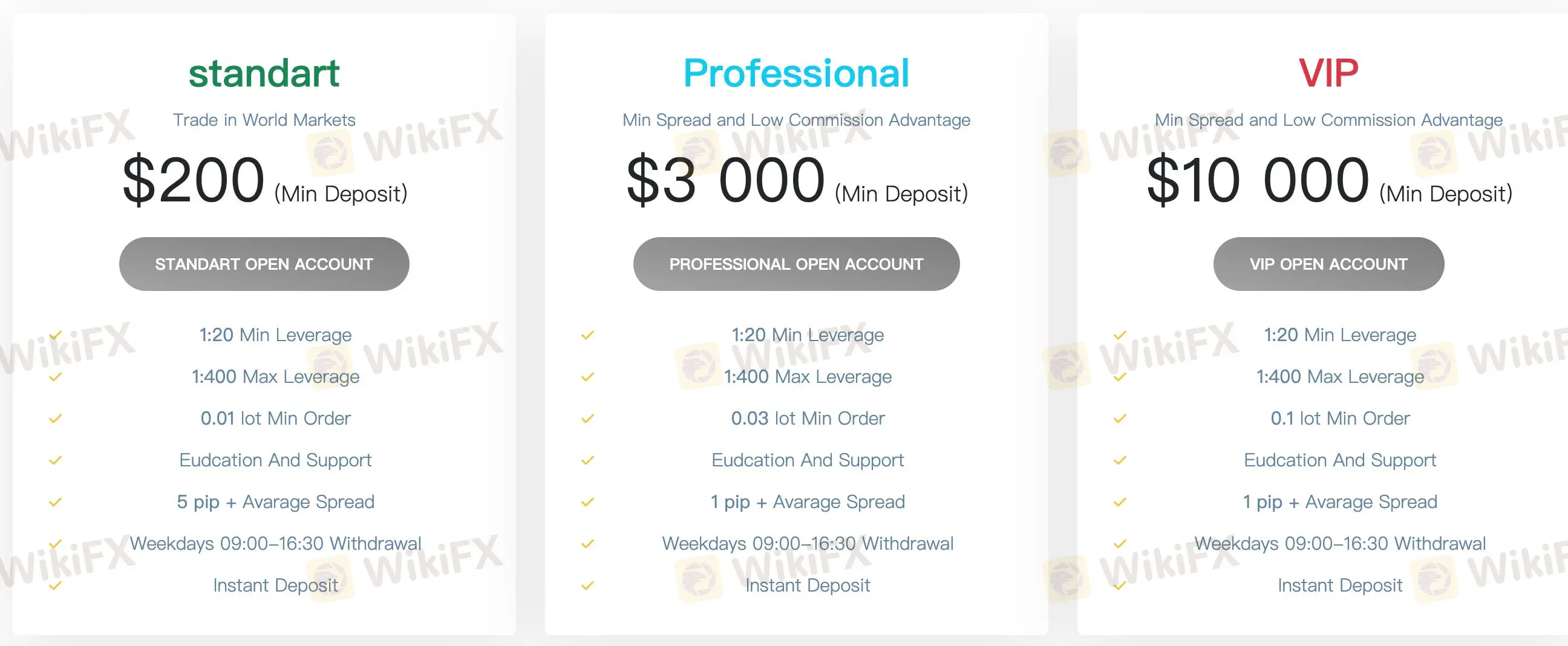

Account Types

Sardis Markets provides three tailored account types for traders at different levels:

1. Standard Account: Suitable for beginners, it requires a $200 minimum deposit and offers leverage from 1:20 to 1:400, with a 0.01 lot minimum order size and a 5 pip average spread. This account includes educational support and features instant deposits and weekday withdrawals.

2. Professional Account: Targeted at experienced traders, this account requires a $3,000 minimum deposit and offers the same leverage as the Standard, but with a 0.03 lot minimum order size and a reduced 1 pip spread. It features low commission costs, along with the usual educational support and quick transaction features.

3. VIP Account: Designed for high-net-worth individuals, this account demands a $10,000 minimum deposit and offers enhanced trading conditions with a 0.1 lot minimum order size and a 1 pip spread, maintaining the leverage options of the other accounts. It includes all standard support and transaction features offered in the other accounts, tailored for premium clients.

Additionally, Sardis Markets also offers demo accounts for all types of account options.

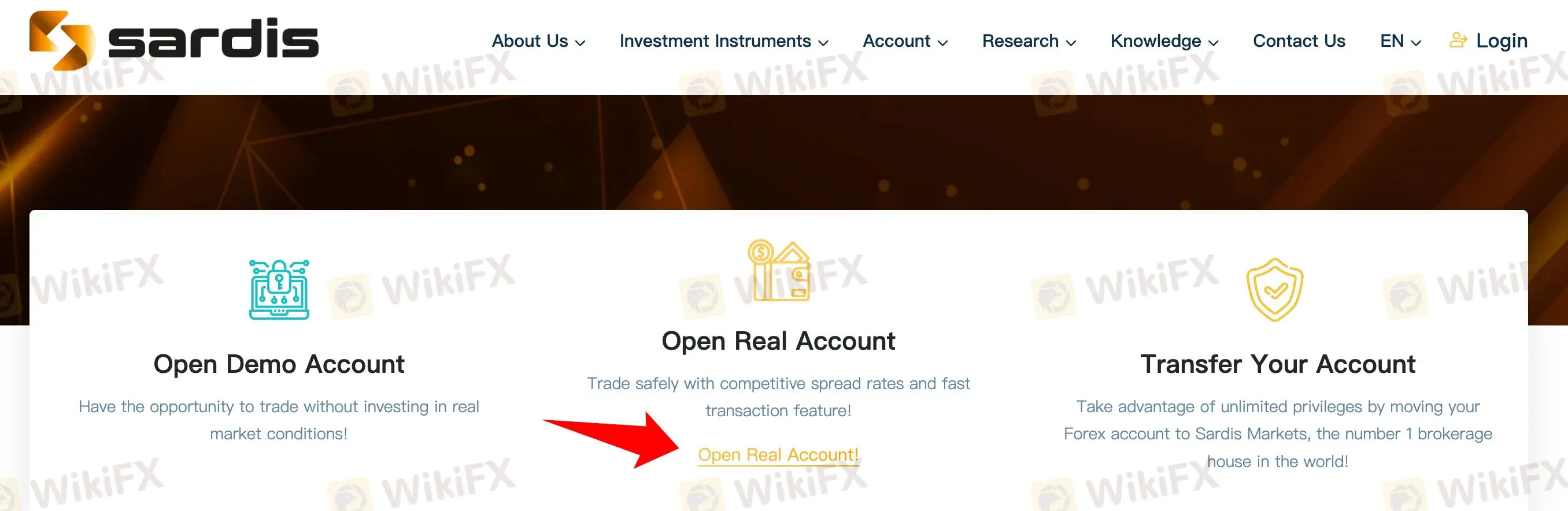

How to Open an Account

To open an account with Sardis Markets, follow these steps.

Visit the Sardis Markets website. Look for the “ Open Real Account” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

Leverage

Sardis Markets offers leverage options ranging from a minimum of 1:20 to a maximum of 1:400 across all its trading account types.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Sardis Markets | Capital Bear | Quadcode Markets | Deriv |

| Maximum Leverage | 1:400 | 1:5 | 1:30 | 1:1000 |

Spreads and Commissions

Sardis Markets offers variable spreads starting from 1 pip for professional and VIP accounts, and an average spread of 5 pips for standard accounts. The professional and VIP accounts also benefit from low commission rates.

Deposit & Withdraw Methods

Sardis Markets supports instant deposit methods with minimum deposits set at $200 for Standard accounts, $3,000 for Professional accounts, and $10,000 for VIP accounts. Withdrawals are processed on weekdays from 09:00 to 16:30.

Trading Platforms

Sardis Markets offers a secure and user-friendly online trading platform available in 35 languages, featuring high-speed trading and built-in tools for price chart analysis. Additionally, clients can utilize the popular MetaTrader 4 and MetaTrader 5 platforms.

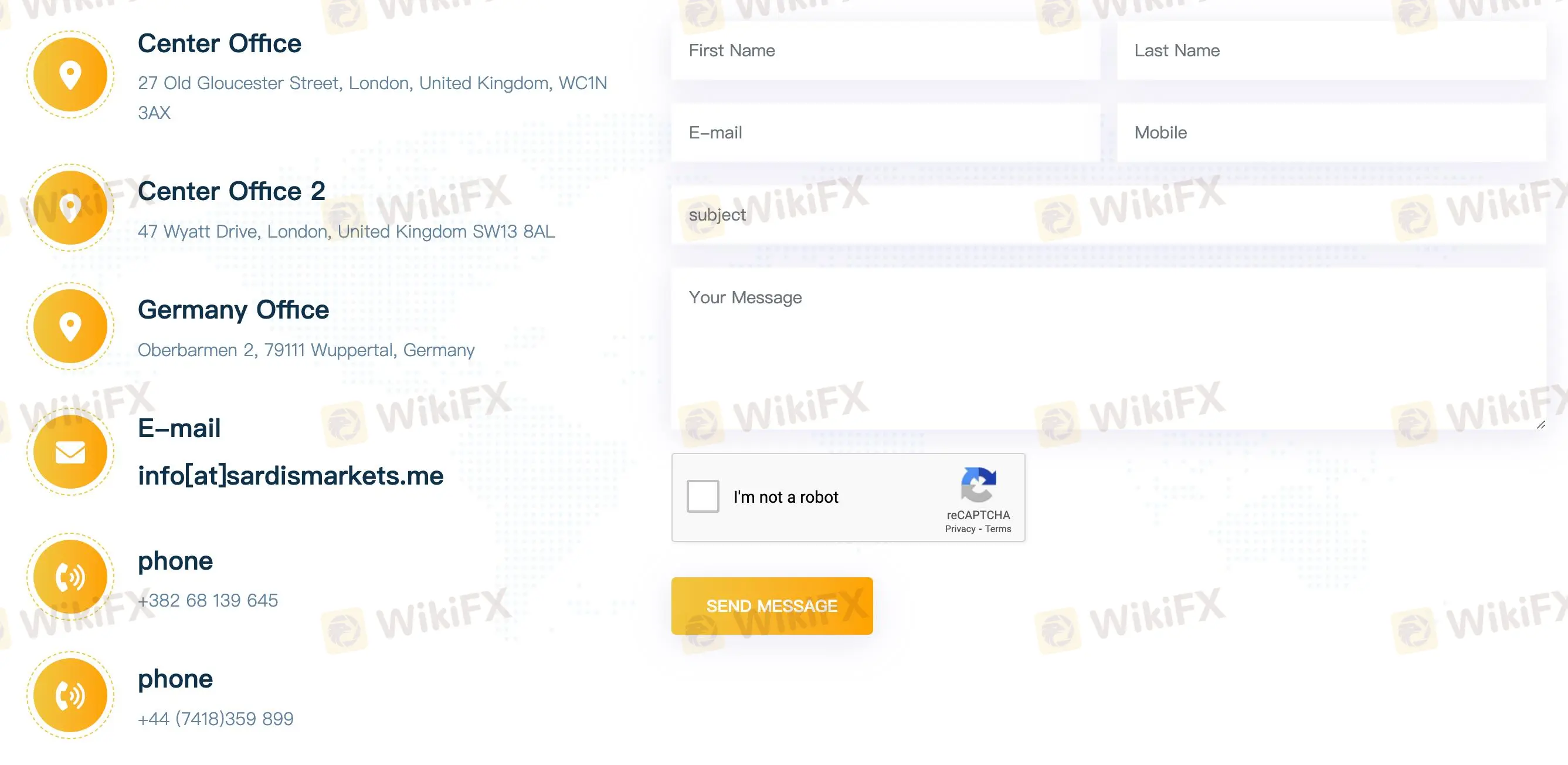

Customer Support

Sardis Markets provides customer support through its main offices in London, United Kingdom, and an additional office in Wuppertal, Germany. Clients can contact support via email at info@sardismarkets.me, or through two phone numbers: +382 68 139 645 and +44 (7418) 359 899.

Educational Resources

Sardis Markets offers educational resources that include a daily newsletter, daily news updates, and daily technical analysis to support informed trading decisions.

Bonus

Sardis Markets offers high bonuses to its clients, enhancing the potential for earnings in Forex trading by leveraging these bonuses along with high leverage opportunities to trade in multiples of the initial funds.

Conclusion

Sardis Markets caters to a wide range of traders with its diverse offerings and robust trading platforms. While the broker offers significant advantages such as a variety of account types, competitive trading conditions, and extensive support resources, the lack of regulation remains a major concern. Potential traders should weigh the benefits of Sardis Markets' services against the risks associated with its unregulated status.

FAQs

Q: What regulatory status does Sardis Markets have?

A: Sardis Markets operates without formal regulation from any recognized financial authority, meaning it lacks official oversight which is typical for financial service providers.

Q: What types of assets can I trade with Sardis Markets?

A: Sardis Markets allows trading in Forex, various metals, indices, commodities, stocks from both EU and US markets, and cryptocurrencies.

Q: What are the account options at Sardis Markets?

A: You can choose from Standard, Professional, or VIP accounts, each offering different conditions tailored to varying levels of trading experience and investment.

Q: How can I contact Sardis Markets for support?

A: Support can be reached via email at info@sardismarkets.me or phone at +382 68 139 645 and +44 (7418) 359 899.

Q: Does Sardis Markets offer educational resources?

A: Yes, they provide a daily newsletter, news updates, and technical analysis to help traders make informed decisions.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Italy’s CONSOB ordered seven unauthorized investment websites blocked, urging investors to exercise caution to avoid fraud. Learn more about their latest actions.

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

STARTRADER warns against counterfeit sites and apps using its brand name. Protect yourself by recognizing official channels to avoid fraudulent schemes.

Dukascopy Bank Expands Trading Account Base Currencies

Dukascopy Bank now offers AED and SAR as base currencies for trading, expanding options for clients to fund accounts in Dirham and Riyal.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator