简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best Indicators for Forex Scalping

Abstract:The forex market, commonly known, features high liquidity and volatility, making it an ideal environment for scalping strategies. Forex scalping is a fast-paced trading technique where traders aim to leverage small price gaps created by the bid-ask spread. This method involves making dozens, or even hundreds, of trades in a single day, with each trade holding the potential to generate small profits. Given the high frequency and short duration of trades—often minutes or even seconds—scalping requires a deep understanding of market indicators to make quick and smart decisions. The success of forex scalping relies not just on the selection of trades but also on trading indicators that can provide real-time insights into market trends, momentum, and potential reversal points. Smart scalpers are those who can quickly analyze and act on market information, with a help filter out market noise and identify trading opportunities.

The forex market, commonly known, features high liquidity and volatility, making it an ideal environment for scalping strategies. Forex scalping is a fast-paced trading technique where traders aim to leverage small price gaps created by the bid-ask spread. This method involves making dozens, or even hundreds, of trades in a single day, with each trade holding the potential to generate small profits. Given the high frequency and short duration of trades—often minutes or even seconds—scalping requires a deep understanding of market indicators to make quick and smart decisions. The success of forex scalping relies not just on the selection of trades but also on trading indicators that can provide real-time insights into market trends, momentum, and potential reversal points. Smart scalpers are those who can quickly analyze and act on market information, with a help filter out market noise and identify trading opportunities.

Best Indicators for Forex Scalping

Selecting the right indicators is essential for any scalping strategy. These tools can help traders identify entry and exit points, understand market trends, and make predictions about future movements. Some of the best trading indicators that are greatly useful for forex scalping include:

Moving Averages: Identify the direction of the market trend.

Momentum Indicators (such as RSI and MACD): Gauge the strength of market movements.

Volume Indicators: Assess the robustness of price movements.

Volatility Indicators (such as Bollinger Bands and ATR): Determine the market's instability, which can signal potential trading opportunities.

Moving Averages in Scalping

Moving averages are pivotal in scalping, providing a smoothed-out price trend over a specific period. There are various types of moving averages, including the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Scalpers often use short-period EMAs to capture the latest price movements, enabling quick decisions on entry and exit points. By analyzing moving averages in different time frames, scalpers can identify potential trend reversals and momentum shifts, crucial for making profitable trades in the fast-moving forex market.

Momentum Indicators for Profitable Scalping

Momentum indicators are essential tools for identifying the speed of price movements, helping scalpers to catch new trends early or to signal when a trend is coming to an end. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are among the most popular momentum indicators in scalping. They provide signals about overbought or oversold conditions, enabling traders to anticipate potential market reversals. Correctly interpreting these indicators allows scalpers to enter and exit trades at optimal moments, maximizing their chances of profiting from small price changes.

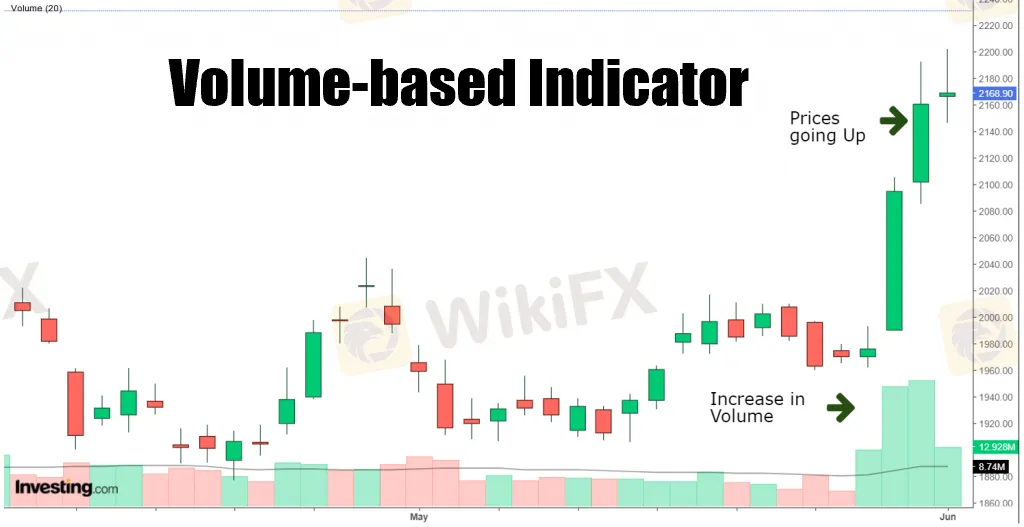

Volume Indicators for Flexible Scaping

Volume indicators play a crucial role in confirming the strength behind price movements, especially important in scalping where the margin for error is small. Indicators such as the Volume Oscillator or the Chaikin Money Flow provide insights into the buying and selling pressure behind price trends. A sudden increase in volume can confirm a new trend, while a decrease might indicate its weakening, guiding scalpers in their trading strategies.

Volatility Indicators for Effective Scalping

Volatility indicators measure the rate and magnitude of price changes, offering scalpers insights into the market's instability. High volatility periods can present more trading opportunities but also higher risk. Bollinger Bands, for instance, consist of an upper and lower band encompassing a moving average, which expands or contracts based on market volatility. Scalpers use these bands to identify overbought or oversold conditions, potential breakouts, and price targets for both buying and selling.

Stochastic Oscillator for Smart Scalping

The Stochastic Oscillator is a momentum indicator that compares the closing price of a currency to its price range over a certain period. It generates overbought or oversold signals, indicating potential reversal points. Scalpers can use these signals to determine entry and exit points, taking advantage of the currency price's short-term fluctuations. By setting specific thresholds (such as 20 for oversold and 80 for overbought conditions), traders can filter out less promising trades and focus on those with higher potential for profit.

Relative Strength Index (RSI) for Efficient Scalping

The RSI is a popular indicator among scalpers for its effectiveness in identifying overbought or oversold conditions. It measures the magnitude of recent price changes to evaluate overvalued or undervalued conditions in the price of a currency pair. Scalpers use the RSI to pinpoint potential reversal points, entering trades when the indicator moves out of the overbought (typically above 70) or oversold (typically below 30) areas, suggesting a possible return to a median price level.

Bollinger Bands for Dynamic Scalping

Bollinger Bands are exceptionally useful for scalping due to their dynamic nature, adjusting to market volatility. The bands widen during periods of high volatility and contract during low volatility, offering visual cues about the market's state. Scalpers use these indicators to identify potential breakouts or breakdowns, entering trades based on the currency price's position relative to the bands. For instance, a price pushing past the upper band may indicate a strong upward trend, suggesting a buying opportunity.

Fibonacci Retracement Levels for Rational Scalping

Fibonacci retracement levels are a tool derived from the Fibonacci number sequence, used to identify potential support and resistance levels based on previous market movements. Scalpers apply these levels to determine strategic entry and exit points, capitalizing on the market's natural tendency to retrace a portion of its movements before continuing in the direction of the trend. The key Fibonacci levels—23.6%, 38.2%, 50%, 61.8%, and 78.6%—serve as markers for possible reversal points.

MACD Indicator for Wise Scalping

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. Scalpers use the MACD to spot changes in momentum, direction, and duration of currency price trends. The crossover of the MACD line and the signal line provides entry and exit signals, while the divergence from the currency price action can indicate potential reversals. This dual functionality makes the MACD a versatile tool for scalpers, enabling them to respond quickly to market changes.

Ichimoku Kinko Hyo for Comprehensive Scalping

The Ichimoku Cloud offers a comprehensive view of the market by integrating multiple indicators into one chart. This indicator provides information on future price momentum and potential areas of support and resistance, all crucial for making smart scalping decisions. The cloud's various components—the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span—work together to signal trend direction, momentum, and strength. Scalpers use the Ichimoku Cloud to identify trend continuations or reversals, enhancing their trading strategy with a broader market perspective.

Pivot Points in Forex Scalping

Pivot points are a tool used to determine critical support and resistance levels based on the previous trading session's highs, lows, and closing prices. Scalpers use pivot points to identify potential reversal points and make quick trades based on the currency price's reaction to these levels. By calculating daily pivot points, scalpers can adapt their strategies to the day's trading conditions, targeting small price movements around these key levels.

Price Action in Scalping

Price action trading involves analyzing the movement of the price itself, rather than relying solely on technical indicators. Scalpers who use price action look for patterns in the price movements, such as spikes, reversals, and breakouts, to make their trading decisions. This approach requires a deep understanding of market dynamics and the ability to interpret subtle changes in price behavior, making it a powerful, though challenging, strategy for scalping.

Combining Indicators for Scalping Success

No single indicator provides all the answers for successful forex scalping. Instead, combining different indicators can create a more robust and reliable trading strategy. For example, a scalper might use moving averages to determine the market trend, RSI to identify overbought or oversold conditions, and pivot points to find potential support and resistance levels. By using multiple indicators in conjunction, scalpers can validate their trading signals, increasing their chances of executing successful trades.

Risk Management in Forex Scalping

Effective risk management is crucial for scalpers, given the high volume of trades and the small profit margins per trade. Strategies for managing risk include setting stop-loss orders to limit potential losses, managing position sizes to avoid overexposure, and continuously monitoring open trades. Successful scalpers always know their exit strategy before entering a trade, ensuring that potential losses are kept within acceptable limits.

Best Practices for Forex Scalping

To become a proficient scalper, there are some useful tips for your reference:

Develop a thorough understanding of the forex market and its indicators.

Practice discipline in entering and exiting trades.

Keep abreast of economic news and events that could impact currency prices.

Continuously refine and test your scalping strategy with a demo account before going live.

Forex scalping can be a profitable trading strategy, but it requires fast decision-making, an in-depth understanding of market indicators, and strict discipline in risk management. By mastering the use of these indicators and adhering to best practices, traders can enhance their scalping techniques, aiming for consistent profits in the fast-paced world of forex trading.

Conclusion

Mastering forex scalping demands dedication, quick reflexes, and an in-depth knowledge of market indicators. By understanding and correctly applying the indicators discussed, scalpers can understand the forex market with greater confidence and efficiency. Remember, success in scalping comes not just from knowing which indicators to use but from developing a comrehensive trading strategy that includes sound risk management practices. With persistence and continuous learning, forex scalping can be a highly rewarding trading solution.

Frequently Asked Questions (FAQs)

Is Price Action a good trading strategy?

Price action trading is a discretionary strategy that relies on technical analysis of raw price data and charts. When executed by skilled traders, it can be an effective approach. However, it requires extensive chart reading abilities and screen time. For traders willing to dedicate effort to mastering price action, it provides a versatile method. But its highly subjective nature means it may not suit those unwilling or unable to become proficient chart analysts.

What are indicators for one-minute scalping?

Moving averages - Short period MAs like 5, 10, 20 can identify short term trend direction. Crossovers can signal entries.

Stochastic oscillator - Identifies overbought/oversold levels for exit and entry signals. Faster settings like 5,3,3 are ideal for 1-minute charts.

Relative strength index (RSI) - Quickly shows overbought/oversold. 70/30 default levels can be adjusted for scalping.

MACD - Crossover of signal and MACD lines can provide trade signals. Use shorter periods like 5/35/5.

Volumes - Essential for assessing momentum and trade intensity. High relative volume adds confidence.

Support/resistance - Key intraday levels based on price action. Look for bounces off levels as entry signals.

What is the best moving average period for scalping?

For scalping, shorter moving average periods are generally most effective for identifying the short-term trend. Some common moving average periods used in scalping strategies are:

5 period MA - Very responsive to recent price action. Good for very short-term trend direction.

10 period MA - Still reactive to price but smoothes out noise. A popular choice for 1-minute charts.

20 period MA - Less reactive than 10 period but can filter out market noise. Works well with other indicators.

50 period MA - Can work well for assessing overall market direction for context. Too slow for entries/exits.

Many scalpers will use two MAs together, such as the 10 and 20 period MAs, and look for crossovers to signal changes in trend direction. Others may use the 5 or 10 MA alone on a 1-minute chart to trade price swings along the trend. The best MA periods depend on preferences, time frame, and market volatility. In general, focusing on faster MAs under 20 periods is recommended for scalping strategies to react quickly to price moves. But it's good to experiment to find the MA lengths that fit your trading style.

Scalping VS Day Trading: Which is harder?

Scalping generally requires faster reaction times and can be more psychologically demanding due to the ultra short-term nature of trades. Scalpers must quickly enter and exit positions capturing small profits repeatedly throughout the day. This demands very close focus on price action and fast execution.

Day trading provides more time to analyze the market and enter trades based on strategies. The broader intraday moves allow larger profit targets and do not require as quick reactions as scalping.

Overall, scalping is considered more challenging due to the intense focus required to repeatedly capture small profits on very short timeframes throughout the trading session. Day trading also requires skill, but the broader price swings allow more room for error.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator