简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Trims Gains, Can This Key Support Hold?

Abstract:Gold rallied above the $2,000 and $2,050 resistance. It even spiked toward $2,150 before the bears appeared. A high was formed near $2,145 and the price corrected lower.

Key Highlights

• Gold prices rallied toward $2,150 before a downside correction.

• It broke a key bullish trend line with support near $2,035 on the 4-hour chart.

• Crude oil prices extended losses and traded below the $72.00 support.

• EUR/USD failed to stay above the key 1.0820 support.

Gold Price Technical Analysis

Gold rallied above the $2,000 and $2,050 resistance. It even spiked toward $2,150 before the bears appeared. A high was formed near $2,145 and the price corrected lower.

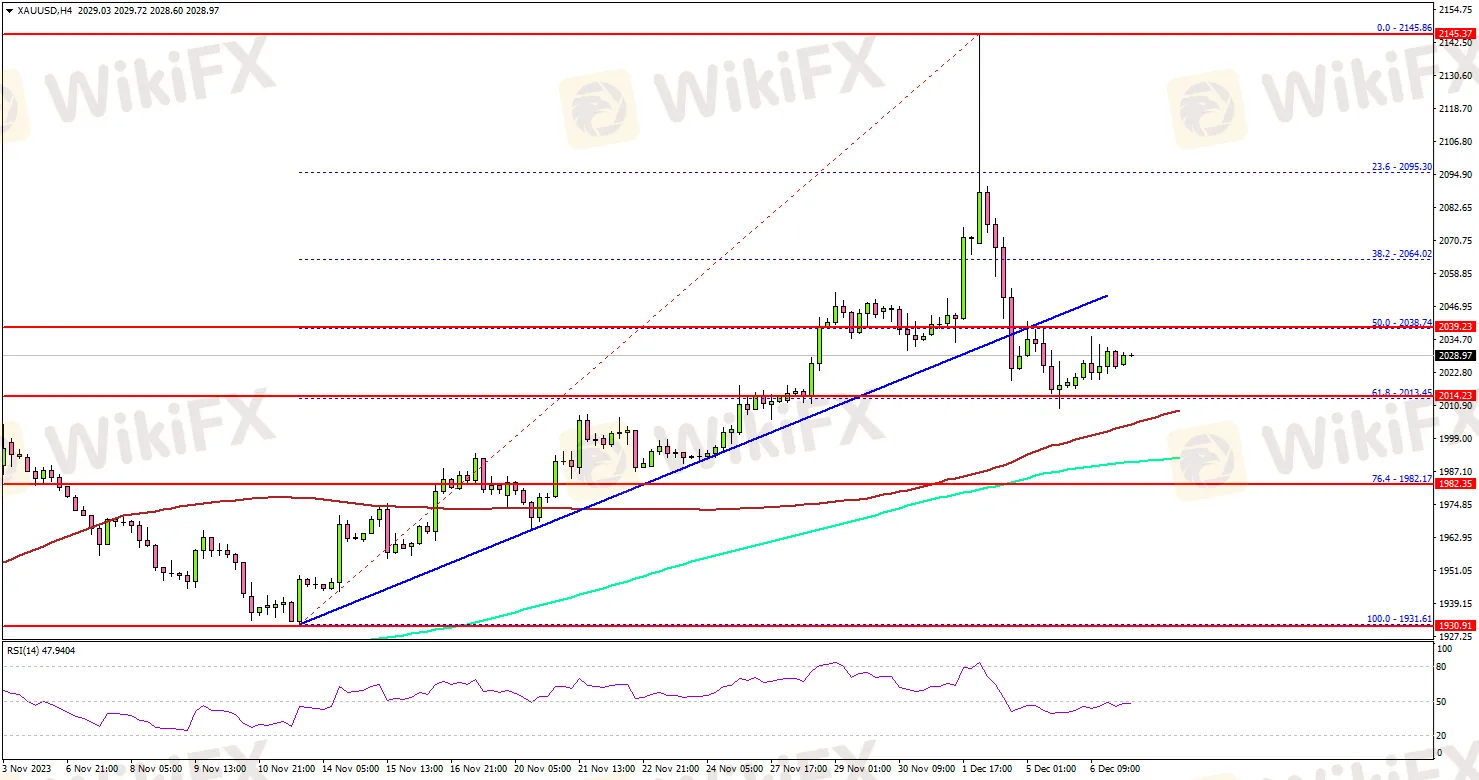

The 4-hour chart of XAU/USD indicates that the price declined heavily below the $2,120 and $2,100 levels. It broke a key bullish trend line with support near $2,035.

The bears were able to push the price below the 50% Fib retracement level of the upward move from the $1,931 swing low to the $2,145 high. The price is now testing the $2,010 support and trading above the 100 Simple Moving Average (red, 4 hours).

The 61.8% Fib retracement level of the upward move from the $1,931 swing low to the $2,145 high is also acting as a support. The next major support could be $1,985 or the 200 Simple Moving Average (green, 4 hours). Any more losses might call for a move toward the $1,960 level.

On the upside, the price is facing resistance near $2,040. An upside break above the $2,040 level could send the price soaring toward the $2,080 resistance. The next major resistance is near the $2,095 level, above which Gold could test $2,120.

Looking at crude oil, the bears remained in action, and they were able to push the price below the $72.00 support.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OANDA Expands TradingView Integration Globally

OANDA completes global TradingView integration, empowering traders in Asia and beyond with seamless access to 1700+ instruments on TradingView charts.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Exness offers traders seamless experiences with its Exness Terminal and Exness Trade app, providing flexibility, advanced tools, and low-cost trading.

ACY Securities Expands Global Footprint with South Africa Acquisition

ACY Securities acquires Ingot Brokers, South Africa, enhancing its global presence and launching LogixTrader in the South African market.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator