简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HXFX Global

Abstract:HXFX Global is a company based in China that operates without valid regulation, posing significant risks to traders. The lack of regulatory oversight means there is little protection for client funds and no assurance of fair business practices. The broker offers three account types with varying minimum deposit requirements, but the absence of detailed spread structures and the reported scam status of its website raise concerns about transparency. While HXFX Global provides access to a range of trading instruments, including currencies, cryptocurrencies, and CFDs, traders should exercise extreme caution due to the unregulated nature of the broker. Additionally, the absence of customer support information and educational tools further diminishes its credibility and trustworthiness in the industry. As the website is reported as a scam and currently inaccessible, traders are strongly advised to avoid HXFX Global and seek reputable alternatives with proper regulatory credentials and transpa

| Aspect | Information |

| Registered Country/Area | China |

| Company Name | HXFX Global |

| Regulation | Unregulated |

| Minimum Deposit | Mini Account: $20, Standard Account: $50, Senior Account: $2,000 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Mini Account: Starting from 1.5 pips, Standard Account: Starting from 1.3 pips;Senior Account: Starting from 1.1 pips (specific spread structures not provided) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Currencies (Forex), Cryptocurrencies (Bitcoin, Litecoin, Ethereum), CFDs (Gold, Silver, Stocks, Stock Indexes, Oil, Other Commodities) |

| Account Types | Mini Account, Standard Account, Senior Account |

| Customer Support | Information not provided |

| Payment Methods | Bank Wire Transfer, Credit/Debit Card, E-Wallets, Cryptocurrency Deposits, Internal Transfer |

| Educational Tools | None |

Overview

HXFX Global is a company based in China that operates without valid regulation, posing significant risks to traders. The lack of regulatory oversight means there is little protection for client funds and no assurance of fair business practices. The broker offers three account types with varying minimum deposit requirements, but the absence of detailed spread structures and the reported scam status of its website raise concerns about transparency. While HXFX Global provides access to a range of trading instruments, including currencies, cryptocurrencies, and CFDs, traders should exercise extreme caution due to the unregulated nature of the broker. Additionally, the absence of customer support information and educational tools further diminishes its credibility and trustworthiness in the industry. As the website is reported as a scam and currently inaccessible, traders are strongly advised to avoid HXFX Global and seek reputable alternatives with proper regulatory credentials and transparent services.

Regulation

HXFX Global currently operates without valid regulation, lacking oversight from recognized financial authorities. While the broker claims regulation by the Vanuatu Financial Services Commission (VFSC), VFSC's reputation for limited oversight and less stringent requirements raises concerns. Additionally, the broker's association with the Australian Securities and Investment Commission (ASIC) through authorized representative (AR) registration means regulatory responsibility lies with the ASIC-regulated company, potentially leading to accountability issues. Moreover, there is no concrete evidence of regulation by the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA), as stated by HXFX Global. This lack of robust regulation poses risks to client funds and protection, making it essential for traders to exercise caution and consider brokers with verifiable regulatory credentials for a safer trading environment.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

HXFX Global presents both advantages and disadvantages for traders to consider. On the positive side, it offers a range of trading instruments and various account types with high leverage, potentially appealing to traders seeking diverse market opportunities. However, significant concerns arise due to the lack of clear regulatory oversight, limited information on trading costs, and reports of its website being labeled as a scam and inaccessible. Traders should exercise caution and explore alternative brokers with stronger regulatory credentials and a more reliable reputation in the industry.

Market Instruments

HXFX Global offers a range of trading instruments to its clients. According to the information provided, these instruments include:

Currencies (Forex): The broker provides access to a variety of currency pairs, with over 20 currency pairs available for trading. This allows traders to engage in forex trading and take advantage of currency fluctuations in the global market.

Cryptocurrencies: HXFX Global also offers cryptocurrency trading, with three major cryptocurrencies available: Bitcoin, Litecoin, and Ethereum. This provides traders with opportunities to speculate on the price movements of these digital assets.

CFDs (Contracts for Difference): The broker offers a diverse range of CFDs, covering more than 40 assets. These assets include popular options like gold, silver, stocks, stock indexes, oil, and other commodities. CFDs allow traders to speculate on the price movements of various financial instruments without owning the underlying assets.

The following table provides a detailed summary of the trading instruments offered by HXFX Global:

| Trading Instruments | Details |

| Currencies (Forex) | Over 20 currency pairs available for trading. |

| Cryptocurrencies | Bitcoin, Litecoin, and Ethereum trading options. |

| CFDs | A diverse range of CFDs, including gold, silver, stocks, stock indexes, oil, and other commodities, totaling over 40 assets. |

Please note that while HXFX Global offers a selection of trading instruments, it's crucial to consider the regulatory status and overall reputation of the broker before engaging in any trading activities to ensure a secure and reliable trading experience.

Account Types

HXFX Global provides three distinct trading account types, each designed to cater to the varying needs and preferences of traders:

Mini Account:

Minimum Deposit: $20

Maximum Leverage: 1:500

Spreads: Starting from 1.5 pips

The Mini account is an ideal choice for novice traders or those looking to start with a modest initial investment. With a low minimum deposit requirement of $20, it offers accessibility to the forex market without a significant financial commitment. Traders can benefit from a generous maximum leverage of 1:500, allowing for potential exposure to larger market positions. However, it's important to be cautious with high leverage due to increased risk. The spreads for this account type start at 1.5 pips, although detailed information about the spread structure is not provided.

Standard Account:

Minimum Deposit: $50

Maximum Leverage: 1:500

Spreads: Starting from 1.3 pips

The Standard account is suitable for traders seeking a more comprehensive trading experience. It requires a minimum deposit of $50, providing access to potentially tighter spreads compared to the Mini account. Like the Mini account, it offers a maximum leverage of 1:500, allowing traders to amplify their market exposure. The spreads for this account type start at 1.3 pips, although specific details about the spread structure are not provided.

Senior Account:

Minimum Deposit: $2,000

Maximum Leverage: 1:500

Spreads: Starting from 1.1 pips

The Senior account is tailored for experienced traders who are willing to make a more substantial financial commitment. It requires a minimum deposit of $2,000 and is expected to offer the tightest spreads among the account types, starting at 1.1 pips. This account type also provides a maximum leverage of 1:500, allowing for significant market exposure and potential benefits for seasoned traders.

It's important to note that while HXFX Global outlines these account types and their associated minimum deposit requirements, leverage, and indicative spreads, detailed information about trading conditions and spread structures may not be provided on the broker's website. Traders are encouraged to contact HXFX Global directly or visit their official website for a more comprehensive understanding of each account's features and benefits before selecting the most suitable option. Additionally, considering the broker's regulatory status is crucial when evaluating its offerings.

Leverage

HXFX Global offers a maximum trading leverage of up to 1:500. Leverage allows traders to control larger positions in the market with a relatively smaller amount of capital. While high leverage can amplify potential profits, it also increases the level of risk, as both gains and losses are magnified. Traders should exercise caution when using high leverage and ensure they have a good understanding of risk management strategies to protect their investments. Additionally, the choice of leverage should align with an individual trader's risk tolerance and trading strategy.

Spreads and Commissions

HXFX Global offers varying spreads depending on the chosen trading account, with indicative starting spreads provided for each type. The Mini account starts with spreads from 1.5 pips, the Standard account offers potentially tighter spreads starting from 1.3 pips, and the top-tier Senior account provides traders with the tightest spreads, starting from 1.1 pips. However, specific details about the spread structure, such as whether they are fixed or variable, are not available in the provided information. Information about explicit commissions is also not mentioned, making it advisable for traders to seek comprehensive details on all trading costs, including potential commissions, swap rates, and other fees, before selecting an account type. Additionally, considering the broker's regulatory status and reputation is crucial when evaluating its offerings.

Deposit & Withdrawal

Deposit Methods:

Bank Wire Transfer: Traders can fund their accounts by transferring funds directly from their bank accounts to their HXFX Global trading accounts. This method is known for its reliability and security.

Credit/Debit Card: HXFX Global may accept deposits via major credit and debit cards, providing a convenient and quick way for traders to fund their accounts.

E-Wallets: The broker could offer popular e-wallet options such as PayPal, Skrill, or Neteller, allowing traders to deposit funds securely and efficiently.

Cryptocurrency Deposits: HXFX Global might also support cryptocurrency deposits, enabling traders to use digital currencies like Bitcoin, Litecoin, or Ethereum to fund their accounts.

Withdrawal Methods:

Bank Wire Transfer: Traders can withdraw their profits by requesting a bank wire transfer to their linked bank accounts, ensuring a secure and straightforward withdrawal process.

Credit/Debit Card: Withdrawals to credit or debit cards may be available, allowing traders to access their funds conveniently.

E-Wallets: Withdrawals through e-wallets like PayPal, Skrill, or Neteller could be offered, providing a faster withdrawal option for traders.

Cryptocurrency Withdrawals: For traders who deposited using cryptocurrencies, they may have the option to withdraw their profits in the same cryptocurrency or convert them to another currency of their choice.

Internal Transfer: HXFX Global might allow for internal transfers between trading accounts held by the same trader, simplifying fund management.

Trading Platforms

HXFX Global offers the widely recognized MetaTrader 4 (MT4) trading platform, known for its user-friendly interface, advanced charting tools, and support for automated trading systems through Expert Advisors (EAs). Traders can access MT4 through desktop downloads, web-based versions, and mobile apps for iOS and Android. MT4's extensive library of technical indicators and versatility makes it suitable for traders of all experience levels. However, it's essential to consider the broker's regulatory status and reputation when evaluating the platform's suitability.

Customer Support & Educational Resources

The available information does not provide specific details about the customer support options or educational resources offered by HXFX Global. Traders are encouraged to visit the broker's official website or contact their customer support directly to inquire about the available support channels, such as email or phone, as well as any educational materials or resources that may assist traders in their trading journey. Evaluating the broker's customer support and educational offerings can be essential for traders seeking assistance and guidance in their trading endeavors. Additionally, considering the broker's regulatory status is crucial when assessing the overall reliability and trustworthiness of its services.

Summary

HXFX Global operates without clear regulatory oversight, making it a risky choice for traders. While it offers a variety of trading instruments and account types with high leverage, its lack of verifiable regulation and limited information on spreads and commissions raise concerns about the safety of client funds and the transparency of its services. Additionally, reports of its website being down and labeled as a scam further underscore the need for caution, and traders are advised to consider alternative brokers with established regulatory credentials and a trustworthy reputation.

FAQs

Q1: Is HXFX Global a regulated broker?

A1: No, HXFX Global currently operates without clear regulatory oversight, which raises concerns about the safety of client funds and protection.

Q2: What trading instruments does HXFX Global offer?

A2: HXFX Global provides trading options in currencies (Forex), cryptocurrencies (Bitcoin, Litecoin, Ethereum), and Contracts for Difference (CFDs) on various assets, including gold, silver, stocks, stock indexes, oil, and other commodities.

Q3: What are the minimum deposit requirements for HXFX Global accounts?

A3: HXFX Global offers three account types with varying minimum deposit requirements: Mini Account ($20), Standard Account ($50), and Senior Account ($2,000).

Q4: What is the maximum leverage offered by HXFX Global?

A4: HXFX Global offers a maximum trading leverage of up to 1:500, allowing traders to control larger positions with a relatively smaller capital investment. However, using high leverage involves increased risk.

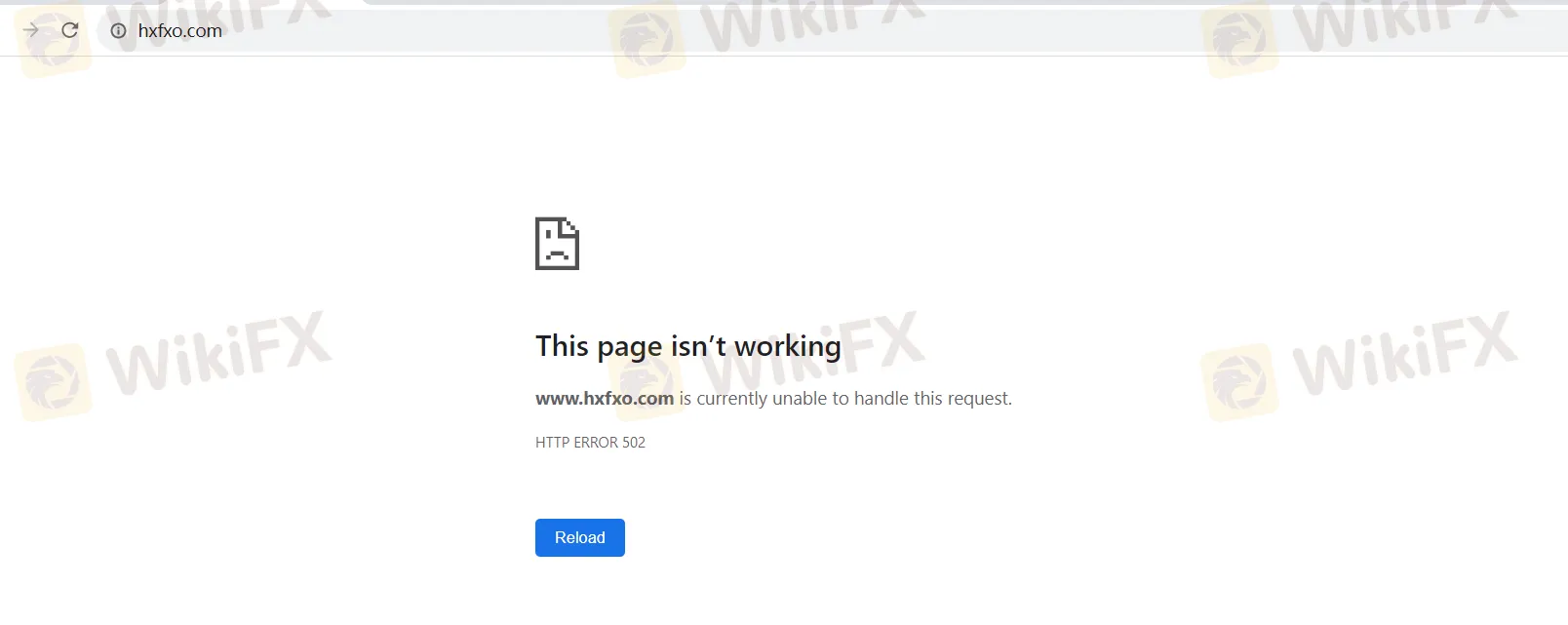

Q5: Is HXFX Global's website currently accessible?

A5: HXFX Global's website has been reported as a scam and appears to be down. Traders are advised to exercise caution and consider alternative, reputable brokers for their trading needs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator