简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EAST Center Group

Abstract: Founded in 2000, EAST Center Group is a financial service company headquartered in Hong Kong with direct branches some other countries including the United States, Vanuatu, Sydney, Australia. EAST Center Group offers a wide selection of trading instruments for both institutional and individual clients from 100 countries, and traders can trade all these products through a single account. With more than 330,000 active traders on MT5, EAST Center Group offers more than 100 trading asses and 24/7 customer support.

| Aspect | Information |

| Company Name | EAST Center Group |

| Registered Country/ Area | Hong Kong, United States, Vanuatu, Sydney, Australia |

| Founded Year | 2000 |

| Regulation | No recognized regulatory authority |

| Minimum Deposit | Not disclosed |

| Maximum Leverage | Ranging from 1:100 to 1:500 |

| Spreads | Floating spreads as low as 0.1 pips (specifics not provided) |

| Trading Platforms | MetaTrader5 (MT5) |

| Tradable Assets | Forex, precious metals, energy commodities, futures, indices |

| Demo Account | Available, offering up to $100,000 in virtual capital |

| Customer Support | 24/7 multilingual support via online chat and contact form |

Overview of East Center Group Limited

Founded in 2000, EAST Center Group is a financial service company headquartered in Hong Kong with direct branches some other countries including the United States, Vanuatu, Sydney, Australia. EAST Center Group offers a wide selection of trading instruments for both institutional and individual clients from 100 countries, and traders can trade all these products through a single account. With more than 330,000 active traders on MT5, EAST Center Group offers more than 100 trading asses and 24/7 customer support.

Is East Center Group Limited legit or a scam?

East Center Group Limited does not currently operate under any recognized regulatory authority. It is important to note that the lack of valid regulation raises concerns about the transparency and oversight of the company's operations. Traders and investors should exercise caution when dealing with an unregulated broker, as it may pose potential risks and lack the necessary safeguards to protect their interests. It is advisable to choose a broker that is regulated by a reputable financial authority to ensure the highest level of security and consumer protection.

Pros and Cons

EAST Center Group offers several advantages to traders. Firstly, they provide access to a diverse range of financial markets, including forex, precious metals, energy commodities, futures, and major global indices. This allows traders to have a wide variety of trading opportunities and potential profit avenues. Secondly, EAST Center Group utilizes the user-friendly MetaTrader5 trading platform, which offers a robust set of features, tools, and indicators for efficient market analysis and execution of trades. Additionally, the availability of demo accounts enables traders to practice their strategies and familiarize themselves with the platform without risking real money. The multilingual customer support provided by EAST Center Group ensures that traders can receive assistance in their preferred language. Furthermore, the various contact options, such as online chat and contact forms, facilitate effective communication and prompt responses to inquiries.

While EAST Center Group offers several advantages, there are some drawbacks to consider. One limitation is the lack of detailed information on spreads and account features, making it challenging for traders to evaluate the costs and conditions associated with their trading activities. Another disadvantage is the undisclosed minimum deposit and withdrawal amounts, which can affect traders' financial planning and decision-making. Furthermore, EAST Center Group does not provide explicit information about the available payment methods, causing uncertainty regarding the convenience and accessibility of funding and withdrawals. Additionally, the lack of regulatory information raises concerns about the oversight and consumer protection provided by the broker. Traders are advised to seek further clarification and conduct due diligence before engaging with EAST Center Group to ensure their specific needs and expectations are met.

| Pros | Cons |

| Access to diverse financial markets | Lack of detailed information on spreads and account features |

| User-friendly MetaTrader 5 trading platform | Undisclosed minimum deposit and withdrawal amounts |

| Availability of demo accounts for practice | Limited information on payment methods |

| Multilingual customer support | Lack of regulatory information |

Market Instruments

With EAST Center Group, traders and investors are provided with access to a diverse range of mainstream financial markets. These markets include foreign exchange (forex), where various currency pairs can be traded. Additionally, EAST Center Group offers opportunities to trade precious metals like gold and silver, enabling investors to participate in the market's fluctuations. Energy commodities such as crude oil and natural gas are also available for trading, allowing individuals to speculate on price movements in these sectors. Furthermore, the broker facilitates trading in futures contracts, which are derivative instruments based on underlying assets like commodities, indices, or currencies. Lastly, major global indices can be traded through EAST Center Group, enabling investors to engage in the performance of prominent stock market benchmarks worldwide.

Account Types

EAST Center Group offers a variety of flexible trading accounts tailored to meet the diverse needs of traders. While specific details regarding the account features are not explicitly provided, the broker aims to accommodate different trading preferences and styles through these accounts. The absence of a dedicated section outlining the detailed features suggests that interested individuals may need to contact the broker directly or consult their customer support to obtain comprehensive information regarding each account type. Engaging with customer support will enable potential clients to understand the specific benefits, conditions, and requirements associated with each account, empowering them to make informed decisions based on their trading goals and strategies.

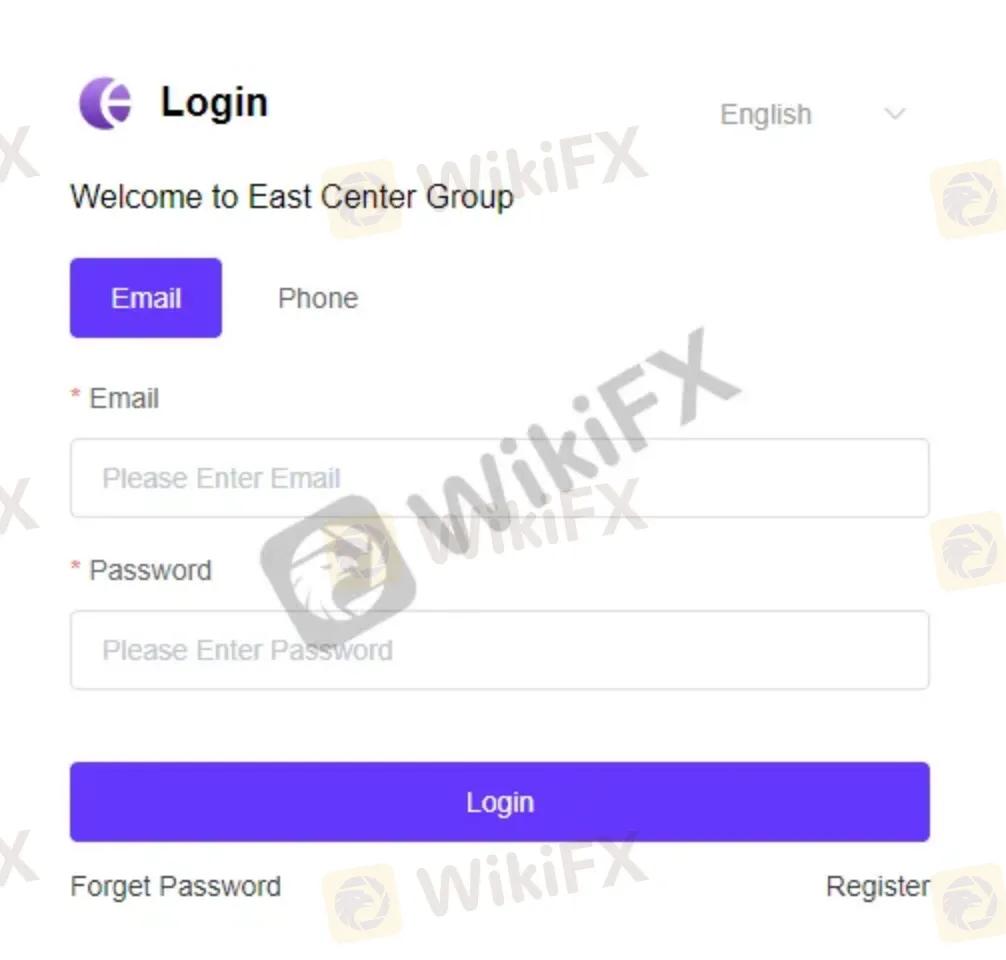

How to open an account?

Opening an account with EAST Center Group is a straightforward and efficient process. To get started, simply click on the “Create Live Account” button and proceed to fill out the required form. Upon completion, you will receive your login information promptly in your email inbox. It's worth noting that all account balances and transactions are settled in USD currency.

Once your account is funded, you can begin trading without delay. The funding process typically involves depositing the desired amount into your trading account using the available payment methods supported by EAST Center Group. The broker may offer various options such as bank transfers, credit/debit cards, or electronic payment systems for convenient funding.

With your account funded, you can access the trading platform provided by EAST Center Group and start executing trades according to your investment strategy and market analysis. It is essential to familiarize yourself with the trading platform's features, tools, and available trading instruments to make informed trading decisions.

Remember that while the account opening process is swift, it is important to carefully consider your trading goals, risk tolerance, and financial circumstances before engaging in any trading activities.

Leverage

EAST Center Group offers flexible trading leverage options, ranging from 1:100 to 1:500. Trading leverage enables traders to control larger positions in the market with a relatively small amount of capital. It can potentially amplify both profits and losses.

While leverage provides the opportunity to make significant gains, it is important to recognize that it also carries inherent risks. Inexperienced traders, in particular, are advised to exercise caution and avoid utilizing excessively high leverage levels. Higher leverage magnifies the potential impact of market fluctuations, increasing the likelihood of significant losses.

It is crucial for traders to carefully assess their risk tolerance, trading experience, and financial situation before determining the appropriate leverage to use. It is generally recommended that inexperienced traders start with lower leverage ratios and gradually increase them as they gain more experience and confidence in their trading abilities.

Ultimately, understanding the risks associated with leverage and implementing proper risk management strategies are vital for maintaining a sustainable and responsible trading approach. Traders should educate themselves on leverage concepts, seek professional advice if necessary, and use leverage judiciously in accordance with their individual circumstances and risk tolerance.

Spreads & Commissions

EAST Center Group proudly advertises the availability of floating spreads as low as 0.1 pips. However, it is important to note that the broker does not provide specific information regarding spreads on individual instruments. The actual spreads can vary depending on market conditions, liquidity, and the specific trading instrument being traded.

Floating spreads typically fluctuate in response to market volatility and liquidity, meaning they may widen or narrow at different times. As a result, the spreads offered by EAST Center Group may differ across various financial instruments such as currency pairs, commodities, or indices.

To obtain precise details on the spreads for specific instruments, it is recommended to consult the broker directly or explore their trading platform. Traders can typically find real-time spread information within the trading platform, allowing them to make informed decisions based on the prevailing market conditions.

Keep in mind that spread costs play a significant role in trading, as narrower spreads generally lead to lower trading costs. Therefore, it is advisable for traders to consider the spread conditions and compare them across different brokers when evaluating the overall trading costs and potential profitability of their chosen instruments.

Trading Platform

EAST Center Group provides its clients with access to the widely recognized MetaTrader 5 (MT5) trading platform. The MT5 platform offers a range of features and functionalities that cater to the needs of traders. Some notable features include:

1. User-friendly interface: The MT5 platform is designed to be intuitive and user-friendly, making it accessible to both novice and experienced traders.

2. Over 50 technical indicators and analytic tools: Traders have access to a comprehensive suite of technical analysis tools, including a wide range of indicators and charting capabilities, to aid in their market analysis and decision-making processes.

3. No requotes and NY4 server: EAST Center Group boasts a top-tier server, specifically the NY4 server, which is known for its reliability and fast execution speed. The absence of requotes ensures that traders can execute their trades without delays or order rejections.

4. Fast execution speed: The MT5 platform offered by EAST Center Group boasts a rapid execution speed of less than 40 milliseconds, allowing for swift order execution and minimizing potential slippage.

5. Personal customer support: EAST Center Group emphasizes the importance of customer support. They provide personal assistance and support to their clients, ensuring that any queries or concerns are promptly addressed.

These features and functionalities offered by the MT5 platform enhance the trading experience for EAST Center Group clients, providing them with robust tools and support to facilitate their trading activities effectively.

The MT5 trading platform can be available on multiple devices including Windows, IPhone, and Android.

Demo Accounts

EAST Center Group offers a demo account for newcomers to practice trading strategies and test the platform without risking real money. The demo account provides up to $100,000 in virtual capital for users to simulate real trading conditions.

Deposit & Withdrawal

Unfortunately, the specific information regarding the minimum deposit and withdrawal amounts is not provided on EAST Center Group's website. Similarly, the available payment methods for depositing and withdrawing funds are not disclosed.

However, it is common for brokers to offer popular payment methods such as credit cards, bank transfers, and e-wallets like Skrill, Neteller, and PayPal. These methods provide convenience and flexibility for traders to manage their funds securely.

To obtain accurate and up-to-date information about the minimum deposit and withdrawal amounts, as well as the available payment methods, it is recommended to contact EAST Center Group directly. Their customer support team will be able to provide detailed information regarding the specific requirements and options for depositing and withdrawing funds from your trading account.

Customer Support

EAST Center Group prides itself on delivering professional and multilingual customer support services. Traders can conveniently access assistance through the online chat feature or by filling out a contact form on the broker's website. The contact form allows traders to provide their essential contact details and submit their inquiries, ensuring a structured and efficient communication process. The dedicated customer support team at EAST Center Group is committed to promptly addressing these inquiries and providing the necessary assistance to traders.

Conclusion

In conclusion, EAST Center Group offers a range of services and features for traders. The advantages include access to diverse financial markets, a user-friendly interface on the MetaTrader 5 platform, and the provision of demo accounts for practice. Additionally, the availability of multilingual customer support and various contact options demonstrates their commitment to client satisfaction. However, some disadvantages include the lack of detailed information on spreads and account features, as well as the undisclosed minimum deposit and withdrawal amounts. Traders should exercise caution and seek further clarification on these aspects before engaging with EAST Center Group.

FAQs

Q: What financial markets can I trade with EAST Center Group?

A: EAST Center Group provides access to a variety of financial markets, including forex exchange, precious metals (such as gold and silver), energy commodities (like crude oil and natural gas), futures, and major global indices.

Q: What leverage options does EAST Center Group offer?

A: EAST Center Group offers flexible leverage options, ranging from 1:100 to 1:500, allowing traders to control larger positions with a relatively small amount of capital.

Q: What payment methods are available for depositing and withdrawing funds?

A: EAST Center Group supports popular payment methods, such as credit cards, bank transfers, and e-wallets like Skrill, Neteller, and PayPal.

Q: Does EAST Center Group provide a demo account?

A: Yes, EAST Center Group offers a demo account that allows traders to practice their strategies and test the trading platform using virtual capital of up to $100000.

Q: How can I contact customer support at EAST Center Group?

A: You can reach EAST Center Group's customer support through the online chat feature on their website or by filling out the contact form with your details and inquiries.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Exness offers traders seamless experiences with its Exness Terminal and Exness Trade app, providing flexibility, advanced tools, and low-cost trading.

ACY Securities Expands Global Footprint with South Africa Acquisition

ACY Securities acquires Ingot Brokers, South Africa, enhancing its global presence and launching LogixTrader in the South African market.

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator