简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Why It Is Essential To Forex Brokers To Be Governed By Major Financial Authorities

Abstract:The importance of being regulated by financial regulators and how it can help manage investment risks.

In recent years, the popularity of online trading has skyrocketed, and with it, the number of online brokers offering trading services. While online trading offers great convenience and flexibility, it also comes with some inherent risks. That's why it's crucial for investors to choose a regulated online broker that's overseen by major financial regulators. In this article, we'll discuss the importance of being regulated by financial regulators and how it can help manage investment risks.

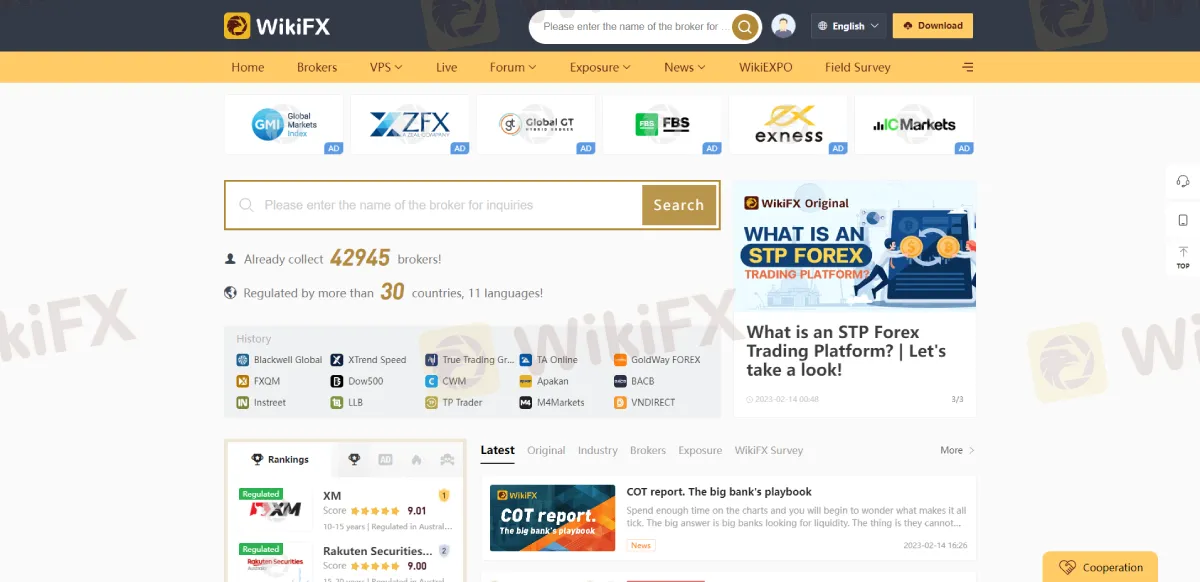

WikiFX as a medium platform of 30 financial regulators, has been listing both regulated and unregulated brokers to provide the public with an easy and convenient way to verify the regulatory status of their chosen broker. It has a feature where you can see the major financial regulators by which a certain broker is regulated.

The importance of being a regulated FX broker.

Firstly, let's define what we mean by financial regulation. Financial regulators are government or non-governmental bodies that oversee and regulate financial institutions and financial markets. They ensure that financial institutions comply with certain standards and codes of conduct, and they also protect investors' interests. By regulating financial institutions and markets, financial regulators help maintain market stability and integrity, prevent fraud and misconduct, and mitigate systemic risks.

The importance of being regulated by financial regulators cannot be overstated, especially for online brokers. The online trading carries significant risks, such as market volatility, technological glitches, and cyber threats.

In the absence of adequate regulation, online brokers may engage in unethical or fraudulent practices that can harm investors. Therefore, by choosing a regulated online broker, investors can have more confidence that their investments are safe and secure.

The good effect of investing in regulated online broker.

Now, let's discuss the benefits of investing in a regulated online broker. First and foremost, regulated online brokers are required to comply with strict rules and regulations set by financial regulators. These regulations are designed to protect investors and ensure that online brokers operate fairly and transparently. For example, regulated online brokers must segregate client funds from their own funds, which helps prevent the misappropriation of funds. Regulated brokers must also adhere to strict anti-money laundering (AML) and know-your-customer (KYC) procedures, which help prevent financial crimes and identity theft.

Moreover, regulated online brokers are subject to regular inspections and audits by financial regulators. These inspections ensure that brokers are complying with regulations and that their financial statements are accurate and transparent. In addition, regulated online brokers must have proper risk management systems and controls in place to manage market and credit risks. This helps prevent broker insolvency or default, which can have disastrous consequences for investors.

Another benefit of investing in a regulated online broker is access to investor protection schemes. Many financial regulators operate investor protection schemes that compensate investors in case a regulated online broker goes bankrupt or defrauds investors. These schemes provide an additional layer of protection for investors and can help mitigate the financial losses that may occur due to broker insolvency.

Lastly, investing in a regulated online broker can enhance an investor's reputation and credibility. By choosing a regulated broker, investors demonstrate that they are committed to ethical investing and responsible financial behavior. This can be particularly important for institutional investors, such as pension funds and endowments, which must adhere to strict ethical and governance standards.

Conclusion

Choosing a regulated online broker is crucial for managing investment risks and ensuring the safety and security of investments. Regulated online brokers are subject to strict rules and regulations set by financial regulators, which help prevent fraud, misappropriation of funds, and other unethical practices. Regulated brokers also have proper risk management systems and controls in place, as well as access to investor protection schemes. By investing in a regulated online broker, investors can have more confidence that their investments are safe and secure, and they can enhance their reputation and credibility as responsible investors.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator