简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

German Authority BaFin Advises Caution Against FX Broker Kingdom Investments

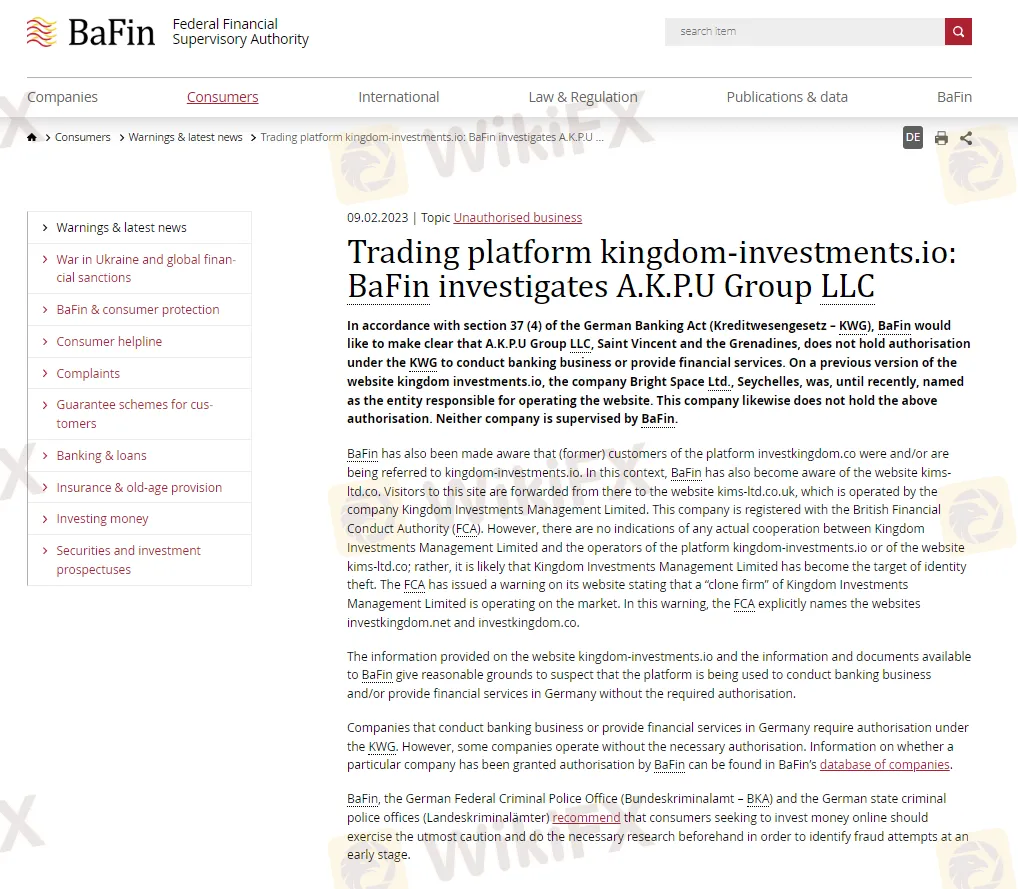

Abstract:The German financial regulator, BaFin, has issued a cautionary warning regarding the dangers of offshore brokers operating within the country's CFDs sector. BaFin has specifically flagged "Kingdom Investments", claiming that the company is running an illegal business without proper authorization and offering German customers CFDs that expose them to FX and cryptocurrency instruments.

The German financial regulator, BaFin, has issued a cautionary warning regarding the dangers of offshore brokers operating within the country's CFDs sector. BaFin has specifically flagged “Kingdom Investments”, claiming that the company is running an illegal business without proper authorization and offering German customers CFDs that expose them to FX and cryptocurrency instruments.

BaFin suspects that Kingdom Investments is a suspicious company as it uses the details of a regulated platform to deceive the public, giving the impression that it is legitimate in Germany. The company goes even further by claiming on its website to offer risk-free trading with powerful strategies. BaFin disputes the company's claimed locations in the United States and Malta.

On the other hand,

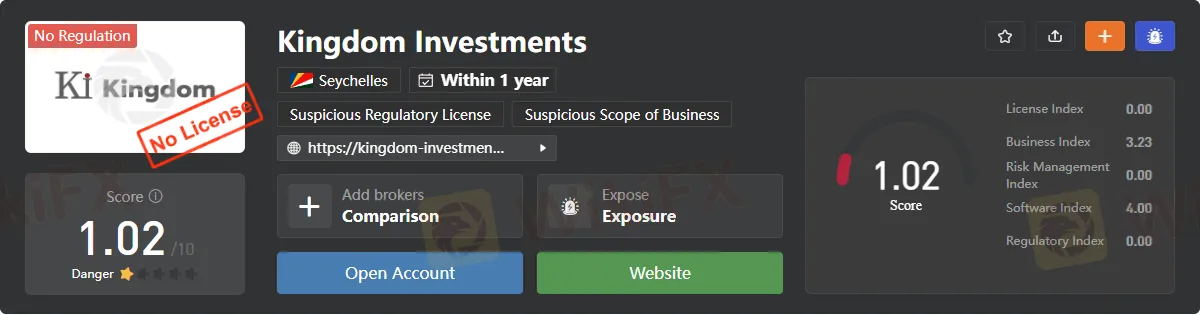

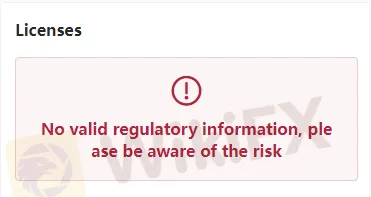

WikiFX, a medium platform of 30 financial authorities worldwide, discovered that the broker Kingdom Investment is not regulated or authorized by any financial authority.

The regulator urges citizens to exercise caution and follow due verification processes, including checking the company's identity and establishment location. BaFin is also keeping a close eye on social media, where it has issued guidelines for potential investors to be wary of promises of excessive returns. In response to the rise of unregulated trading signals on online forums, BaFin has warned against traders using flashy social media profiles to trick inexperienced persons into thinking they can quickly make large profits through online trading.

BaFin warns that these traders do not have the necessary qualifications or accreditation to offer these services and their advice can be inaccurate and carry significant risks. The watchdog is working to keep up with the growth of the crypto market and inform retail investors of the potential risks involved.

Stay informed on the latest news by downloading the WikiFX App on your smartphone.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator