简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

With The Addition Of A New DFSA License, Plus500 Expands Its MENA Presence

Abstract:Plus500 said on Monday that it has obtained a license from the Dubai Financial Services Authority (DFSA) to join the lucrative Middle Eastern markets.

Plus500 Receives DFSA License

The London-listed firm said that the new license will provide substantial development potential by enabling the broker to extend its capabilities to consumers in the UAE.

“We are delighted to have received license authorization from the DFSA in the UAE, and we are excited to bring our market-leading technology capabilities to customers in the region. This is the latest realization of our strategy to enter new markets, develop new products, and deepen engagement with our customers,” stated David Zruia, CEO of Plus500.

The DFSA license is extensively used by brokers who want to enter the Middle Eastern markets. In recent years, several brokers, such as Zenfinex, XTB, and MutiBank Group, have received DFSA accreditation.

Plus500's Global Expansion Goal

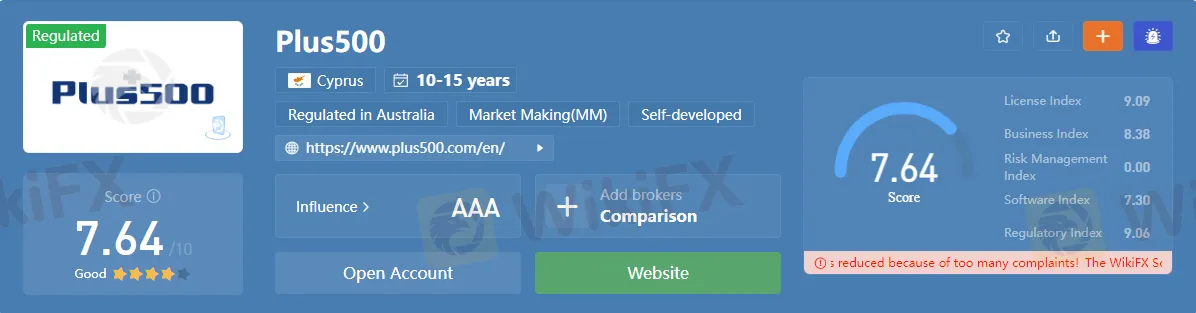

Plus500, headquartered in Israel, was launched in 2008 and provides forex trading services as well as CFDs on various asset classes such as stocks, indices, cryptocurrencies, ETFs, and options. It is one of the few retail FX/CFD brokers that is publicly traded.

Furthermore, it is one of the brokers that has substantially invested in technology and solely provides trading services via its own trading platform.

Plus500 has greatly tightened its regulatory standards over the years and currently possesses twelve licenses internationally. Over the last three years, the firm has secured licenses in the United States, Japan, Estonia, and Seychelles. It entered the US and Japan via the acquisition of two domestically controlled enterprises in those countries.

The broker received the new DFSA license after finishing the fiscal year 2022 with $832 million in revenue and $454 million in EBITDA. Both statistics were up from the previous year and met the company's expectations.

It is currently focusing on expansion in the United States, and in Q3 2022, it will develop a US-specific proprietary futures trading platform. It discontinued a seven-year partnership with the Spanish football club Atletico Madrid in October to establish a four-year sponsorship agreement with the Chicago Bulls, a professional basketball team headquartered in the United States.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Is the stronger dollar a threat to oil prices?

Oil prices dropped more than 1% on Wednesday, mainly due to the strengthening of the dollar and the increase in U.S. fuel inventories, which collectively suppressed the price rise.

RM5.9M Lost to "Davidson Kempner Capital Management" Facebook Scam

A private contractor in Malaysia faced a devastating loss of over RM5.9 million after falling victim to a fraudulent investment scheme promoted on Facebook. Tempted by the scheme’s impressive claims and credentials, the victim began investing in September 2024. The investment process required him to download an application called A-Trade, which was readily available on the Apple Store.

Is There Still Opportunity as Gold Reaches 4-Week High?

Gold Continues to Rise, can the Bulls Keep Going? Recently, gold prices have been on the rise, especially following the release of the non-farm payrolls data, as demand for gold as a safe-haven asset continues to increase.

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

The latest data shows that Japan’s base wages in November rose by 2.7% year-on-year, marking the largest increase in 32 years, fueling speculation about a potential BOJ rate hike, but Governor Kazuo Ueda’s dovish remarks in December have shifted market expectations toward a potential delay in policy adjustments.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator