简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

VICTORIA CAPITAL-Some Important Details about This Broker

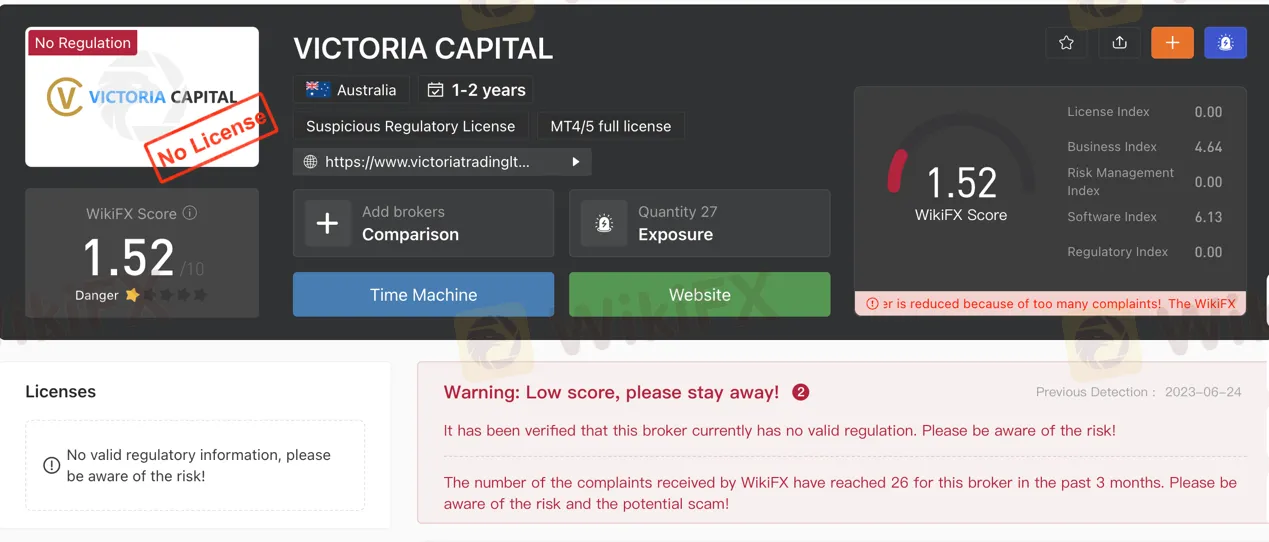

Abstract:VICTORIA CAPITAL seems to be a brokerage house registered in Australia, and this broker was not established long, with an operating time of less than one year. However, when it comes to regulatory information, VICTORIA CAPITAL has let us down for it is not regulated by any regulatory authority. That’s why WikiFX has given this broker a very low score of 1.41/10.

| Aspect | Information |

| Registered Country/ Area | Australia |

| Founded Year | 1-2 years |

| Company Name | VICTORIA CAPITAL FINANCIAL TRADING PTY LTD |

| Regulation | No valid regulatory information |

| Minimum Deposit | $250 |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | MT4/MT5 full license |

| Tradable Assets | Commodities, Forex, Indices, Stocks |

| Account Types | Single account for all traders |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Unavailable |

General Information

VICTORIA CAPITAL is a broker based in Australia that operates without valid regulation, posing potential risks to traders. The absence of regulation raises concerns about the legitimacy and reliability of the broker. Moreover, the platform has received a significant number of 26 complaints within the past three months, as reported by WikiFX. These complaints suggest potential scams or fraudulent activities associated with Victoria Capital, highlighting the need for caution and thorough risk assessment before engaging with the broker. Traders should exercise due diligence and consider alternative options with stronger regulatory oversight.

Victoria Capital offers a limited selection of trading instruments across four categories: commodities, forex, indices, and stocks. While commodities such as crude oil and household products are available, the broker lacks diversity in forex trading pairs, excluding exotic or minor pairs. The platform also provides a range of indices from different markets and a small number of stocks from the manufacturing and tech industries. However, it is important to note that the broker's unconventional approach offers only one account type for all traders, lacking customization and tailored features to suit individual needs. Additionally, the customer support provided by Victoria Capital is unreliable, with slow response times and a lack of direct contact options, raising concerns about the platform's integrity and commitment to user satisfaction.

Considering the absence of regulation, numerous complaints, and negative reviews associated with withdrawal difficulties and poor customer support, traders are advised to exercise caution and explore more trustworthy and regulated alternatives to ensure a safer trading experience.

Is VICTORIA CAPITAL Legit?

Victoria Capital is a broker that lacks valid regulation, as confirmed through verification. It is important to note the absence of regulation when considering engaging with this broker, as it may pose a risk. Additionally, it has come to light that WikiFX has received a significant number of 26 complaints regarding Victoria Capital in the past three months. This further emphasizes the need for caution, as there is a potential risk of encountering scams or fraudulent activities. It is advised to exercise due diligence and thoroughly assess the associated risks before making any decisions related to Victoria Capital.

Pros and Cons

Victoria Capital has both pros and cons that should be considered when evaluating this broker. On the positive side, Victoria Capital offers a range of trading instruments, providing opportunities for traders to diversify their portfolios. Additionally, they provide the MT5 trading platform, known for its reliability and advanced features. Traders can also customize the platform to suit their preferences, and a demo account is available for testing strategies. However, there are significant drawbacks to be aware of. Victoria Capital lacks valid regulation, which may raise concerns about the safety and security of funds. The broker has also received a significant number of complaints on WikiFX, suggesting potential issues or fraudulent activities. Furthermore, they offer only one account type for all traders, limiting customization options, and their customer support is reported to be lacking and unreliable. Additionally, transparency regarding trading fees is lacking, which can make it challenging to assess the true costs associated with trading.

| Pros | Cons |

| Offers a range of trading instruments | Lacks valid regulation |

| Provides the MT5 trading platform | Received a significant number of complaints on WikiFX |

| Allows customization of the trading platform | Provides only one account type for all traders |

| Offers a demo account for testing strategies | Customer support is lacking and unreliable |

| Transparency regarding trading fees is lacking |

Market Instruments

Commodities

Within the commodities category, members have access to commodities like crude oil, energy, and household products such as sugar and wheat.

Forex

The forex market is a main activity on the platform, with major currency pairs being available for trading. However, it's important to note that the broker doesn't provide a wide variety of trading pairs, meaning that exotic or minor pairs are not available for diversifying risks.

Indices

Indices are particularly suitable for day traders, and Victoria Capital offers a selection of indices from America, Asia, and Europe. These indices provide opportunities for traders to speculate on the performance of specific markets.

Stocks

Lastly, Victoria Capital offers a limited number of stocks from the manufacturing and tech industries for trading. This allows traders to engage in the stock market and potentially benefit from fluctuations in these sectors.

Pros and Cons

| Pros | Cons |

| Offers trading instruments across four classes | Limited variety of trading pairs in the forex market |

| Provides access to commodities like crude oil and energy | Does not offer exotic or minor currency pairs for diversification |

| Offers a selection of indices from America, Asia, and Europe | Limited number of stocks available from manufacturing and tech industries |

Account Types

SINGLE ACCOUNT FOR ALL: The account types offered by Victoria Capital are rather unconventional as they provide only one account option for all traders. This means that both experienced and novice traders have access to the same set of trading conditions, without any differentiation or specific features tailored to their individual needs. This approach may appear unusual and potentially unfair, as it does not cater to the diverse requirements and preferences of different types of traders.

It is worth noting that Victoria Capital's decision to offer a single account type for all traders may have certain implications. On one hand, it eliminates any confusion or complexity that may arise from having multiple account options with varying features. On the other hand, it may limit the flexibility and customization options available to traders who have distinct trading strategies or risk appetites. Traders who are accustomed to choosing from a range of account types may find this lack of variety and personalization somewhat restrictive.

Pros and Cons

| Pros | Cons |

| Provides a simple and straightforward account structure | Lacks differentiation and specific features tailored to individual needs |

| Eliminates confusion and complexity | Limits flexibility and customization options for traders |

| Avoids potential confusion from multiple account options | Restricts variety and personalization for traders with distinct strategies |

Minimum Deposit

In almost every jurisdiction, Victoria Capital requires a minimum deposit of $250 to open an account. This acceptable minimum deposit amount is consistent across various regions.

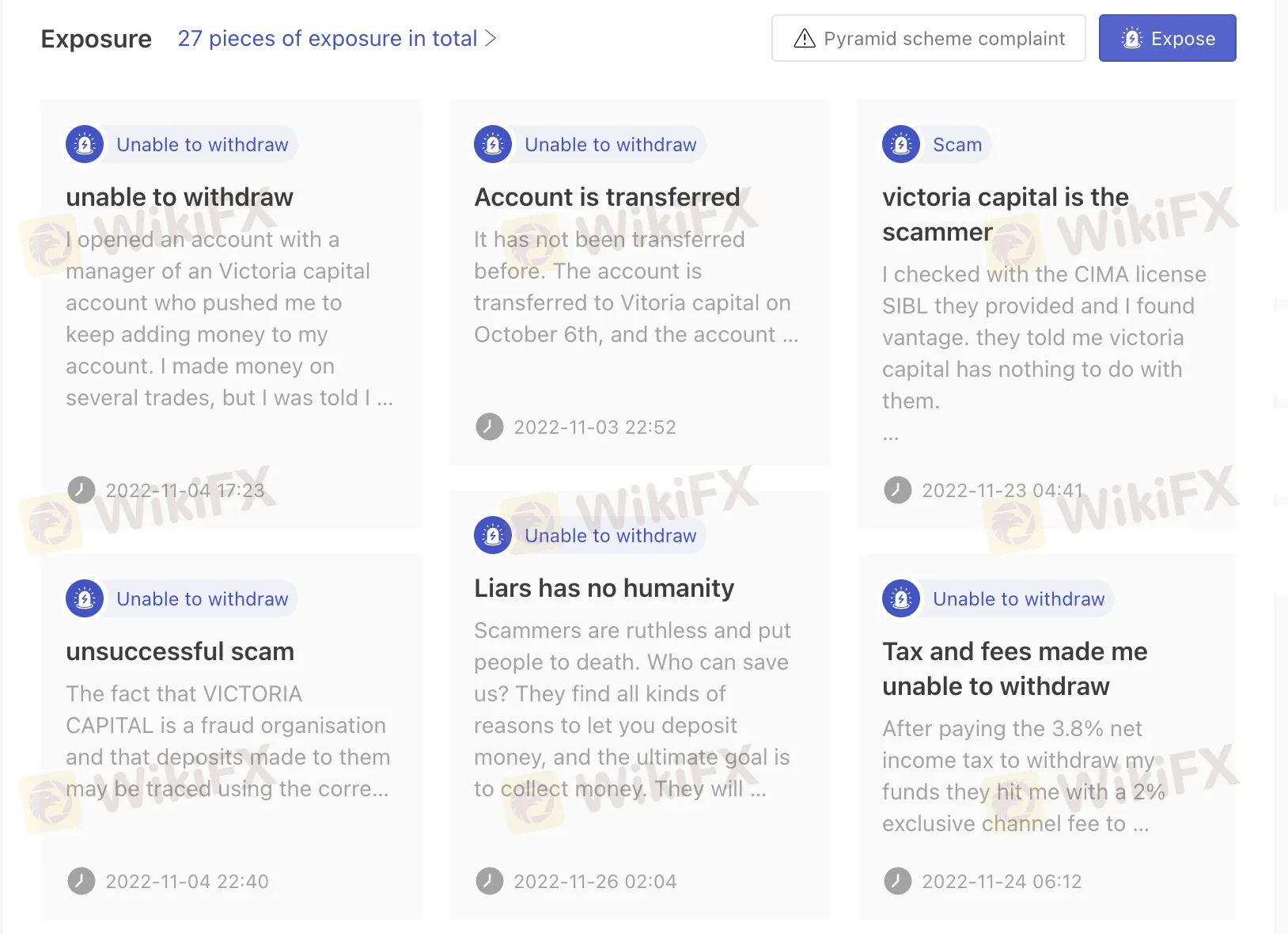

Negative Reviews

Many victims complained on the website that they have been defrauded by this broker. This VICTORIA CAPITAL deducted their deposits, rejected their withdrawal requests, making them suffer a significant loss.

Trading Platform

Victoria Capital provides the MT5 trading platform, catering to the needs of advanced traders. The platform is known for its reliability and stability, ensuring a smooth trading experience. It offers a wide range of advantages to its users. One notable feature is the availability of over 50 technical indicators, allowing traders to analyze market trend. Additionally, Victoria Capital offers a demo account, enabling traders to test different strategies under simulated market conditions. The platform also allows for customization, allowing users to personalize it according to their trading preferences. Furthermore, the MT5 platform includes various automated trading options, thanks to the availability of multiple robots. Lastly, stability is a key aspect of the platform, enhancing the security of users' trading activities.

| Pros | Cons |

| Provides the MT5 trading platform known for reliability and stability | Lacks valid regulation |

| Offers over 50 technical indicators for market trend analysis | Customer support can be slow |

| Provides a demo account for testing different strategies | Provides only one account type for all traders |

| Allows customization of the platform according to users' preferences | Automated trading options can be complexStability enhances security |

| Includes various automated trading options through multiple robots |

Customer Support

The customer support provided by Victoria Capital is significantly lacking and unreliable. Traders who have invested with this broker are well aware of the numerous issues they encounter. Unfortunately, communication with the platform is virtually non-existent post-signing up. Instead of providing direct contact information for staff members or the broker, Victoria Capital utilizes a message board system where users are expected to leave messages. However, the response time is alarmingly slow, often taking more than two weeks to receive any feedback. The broker does not offer live chat or an automated bot to address more persistent issues, indicating a deliberate attempt to avoid communication with users. Given these circumstances, it is strongly advised to steer clear of this platform.

Reviews

Victoria Capital has received numerous negative reviews and complaints from users, indicating several issues with the platform. The most prominent concern revolves around the inability to withdraw funds, with users reporting difficulties and delays in accessing their money. Some have mentioned being asked to pay taxes or additional fees before withdrawal, only to experience further obstacles and delays in the process. Customer support is also a significant concern, as users have reported a lack of responsiveness and unavailability of direct contact with the broker. There have been allegations of fraud, scams, and misleading practices associated with Victoria Capital. It is crucial to exercise caution and be aware of these risks when considering any involvement with this platform.

Conclusion

In conclusion, Victoria Capital is a broker that lacks valid regulation, which poses a risk for potential traders. The significant number of complaints received by WikiFX further raises concerns about the platform, suggesting the possibility of encountering scams or fraudulent activities. Victoria Capital offers a limited range of trading instruments, and its unconventional approach of providing only one account type may not cater to the diverse needs of traders. The minimum deposit requirement is $250, and the platform lacks transparency regarding trading fees. While it utilizes the reliable MT5 trading platform with various advantages, customer support is notably lacking and unreliable, with slow response times and a lack of direct contact options. Negative reviews and complaints highlight issues such as difficulties in fund withdrawals, additional fees, and allegations of fraud. Considering these disadvantages, it is advised to approach Victoria Capital with caution and conduct thorough risk assessment before engaging with the platform.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

FAQs

Q: Is Victoria Capital a regulated broker?

A: No, Victoria Capital lacks valid regulation, posing potential risks.

Q: What is the WikiFX Score for Victoria Capital?

A: The WikiFX Score for Victoria Capital is 1.52/10, indicating danger.

Q: How many complaints has Victoria Capital received on WikiFX?

A: Victoria Capital has received 26 complaints on WikiFX in the past three months.

Q: What trading instruments are offered by Victoria Capital?

A: Victoria Capital offers commodities, forex, indices, and limited stocks for trading.

Q: What is the minimum deposit required by Victoria Capital?

A: The minimum deposit required by Victoria Capital is $250.

Q: What trading platform does Victoria Capital provide?

A: Victoria Capital provides the MT5 trading platform with advanced features.

Q: How is the customer support of Victoria Capital?

A: The customer support of Victoria Capital is unreliable and lacks responsiveness.

Q: Are there any issues with fund withdrawals at Victoria Capital?

A: Users have reported difficulties and delays in fund withdrawals at Victoria Capital, along with additional fees and obstacles in the process.

Q: What are the reviews and complaints about Victoria Capital?

A: Victoria Capital has received negative reviews and complaints regarding fund withdrawals, customer support, and allegations of fraud and misleading practices.

Q: Should I be cautious when considering Victoria Capital?

A: Yes, it is advised to exercise caution and thoroughly assess the associated risks before engaging with Victoria Capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator