简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GStock

Abstract:GStock is allegedly a forex broker registered in the United Kingdom that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500 and floating spreads on the web-based trading platform via three different live account types.

Note: GStock is to operate via the website - https://gstocklegal.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | shares, forex currency pairs, and cryptocurrencies |

| Account Type | Opti Trade, Standard Trade and Maxi Trade |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread (EUR/USD) | 0.5 pips |

| Commission | N/A |

| Trading Platform | web |

| Minimum Deposit | $250 |

| Deposit & Withdrawal Method | crypto and e-wallets |

GStock is allegedly a forex broker registered in the United Kingdom that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500 and floating spreads on the web-based trading platform via three different live account types.

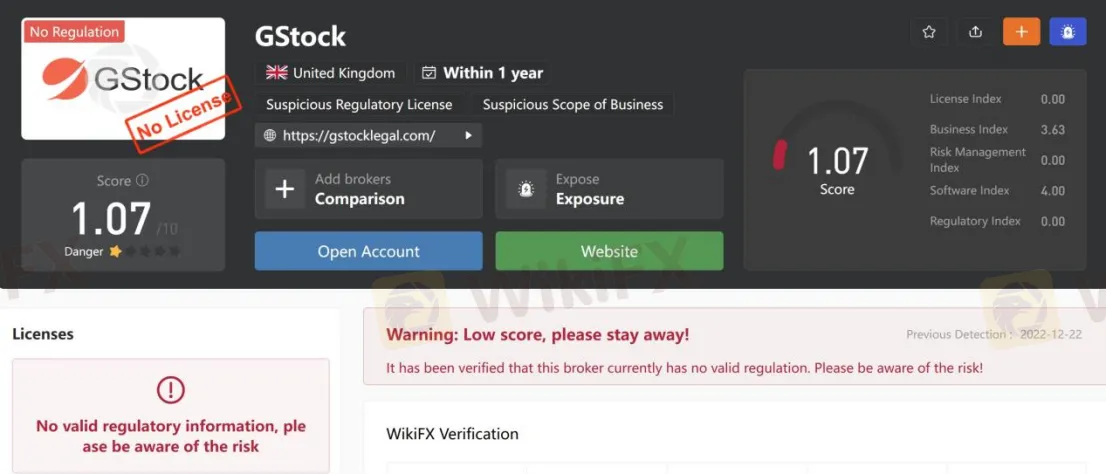

As for regulation, it has been verified that GStock currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.07/10. Please be aware of the risk.

Market Instruments

GStock advertises that it offers access to a wide range of trading instruments in financial markets, including shares, forex currency pairs, and cryptocurrencies.

Account Types

GStock claims to offer three types of trading accounts, namely Opti Trade, Standard Trade and Maxi Trade, with minimum initial deposit requirements of $250, $500 and $1,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The specified leverage for different account types at GStock varies between 1:100 and 1:500. Clients on the Opti Trade account can experience leverage of 1:100, and the Standard Trade and Maxi Trade accounts can enjoy a higher leverage of 1:200 and 1:500 separately. However, according to the regulations, British and Australian brokers have to limit their clients to 1:30, while US brokers cant provide more than 1:50.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

Spreads on the benchmark EUR/USD pair are 0.5 pips.

Trading Platform Available

Instead of the world's most advanced and popularly-used MT4 and MT5 platforms, GStock gives traders a web trader. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

GStock supports deposits via crypto and e-wallets, but only a BTC wallet as the sole withdrawal method, with a processing fee of 320 Satoshi, which equals to $0.0635, more or less. The minimum initial deposit requirement is said to be $100.

Customer Support

GStocks customer support can be reached by telephone: +44 2080896557, email: support@gstocklegal.com. Company address: 59 Devons Road, London, E3 3DW.

Pros & Cons

| Pros | Cons |

| • Multiple trading instruments and account types offered | • No regulation |

| • Website inaccessible | |

| • Tight spreads | • Lack of popular payment methods |

Frequently Asked Questions (FAQs)

| Q 1: | Is GStock regulated? |

| A 1: | No. It has been verified that GStock currently has no valid regulation. |

| Q 2: | Does GStock offer the industry-standard MT4 & MT5? |

| A 2: | No. Instead, GStock offers a web trader. |

| Q 3: | What is the minimum deposit for GStock? |

| A 3: | The minimum initial deposit at GStock is said to be $100. |

| Q 4: | Is GStock a good broker for beginners? |

| A 4: | No. GStock is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Bitfinex hacker Ilya Lichtenstein was sentenced to 5 years for stealing 120K Bitcoins as the cryptocurrency soars past $93K amid bullish market trends.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator