简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

$4.3bn Got Stolen in Crypto!!

Abstract:According to a recent study by the cybersecurity and data privacy firm Privacy Affairs, the value of cryptocurrency stolen by hackers in the first 11 months of the year increased by 37% to $4.3 billion in 2022. The company stated that FTX's demise was the biggest cryptocurrency scam to date this year, with about $1 to $2 billion in unrecovered customer funds.

The failure of FTX, Axie Infinity's Ronin Network attack in March ($615 million), the Wormhole crypto bridge hack in February ($320 million), the JuicyFields.io scam in July ($273 million), and the Unique-Exchange.co/PARAIBA world scam also in July ($267 million) are the top five cryptocurrency scams committed this year, according to Privacy Affairs.

The Wintermute hack in September cost 160 million dollars, the Beanstalk DeFi project flash loan attack in April cost 182 million dollars, the Nomad cross-chain bridge attack in August cost 190 million dollars, the Elrond blockchain exchange hack in June cost 113 million dollars, the Harmony Horizon Bridge hack in June cost 100 million dollars, and the Mango Market flash loan attack in October cost 100 million dollars.

The cybersecurity company claims that young people between the ages of 20 and 40 are more vulnerable to scams that are carried out via WhatsApp (9%) and Telegram (7%), Facebook (26%), Instagram (32%), and Telegram (26%). The company also discovered that the top three coins chosen by scammers for their fraudulent activities are Bitcoin (70%), Tether (10%), and Ether (9%).

Giving a more detailed breakdown of the figures, the company stated that 97% of all cryptocurrency stolen during the first quarter of the year used DeFi protocols.

Americans lost $329 million to cryptocurrency scammers during the first quarter of this year, when compared country by country. Additionally, throughout 2022, Australian investors lost $166 million. Additionally, since the year's beginning, investors in Hong Kong have lost $50 to cryptocurrency fraud.

In the meantime, there are increasingly more instances of cryptocurrency flash loan scams. A flash loan attack takes place when a con artist takes advantage of a platform's smart contract security to borrow sizable sums of money with no security.

Over $308 million was lost as a result of 27 flash loan attacks in Q2 2022. In October 2022, a flash loan attack on the cryptocurrency trading platform Mango Market cost $100 million. According to statistics, flash loan attacks rose 66.7% in Q2 2022 compared to Q1 2022, according to Privacy Affairs founder Miklos Zoltan.

The company also pointed out that while investors lost about $2.8 billion to rug pulls last year, 2022 has seen over 188,000 rug pulls on different blockchains like BNB and Ethereum, with over $2.6 billion devoured by the Turkish crypto exchange, Thodex.

The total loss from rug pulls in Q2 2022 was $37.46 million. According to Zoltan, investors lost $32.7 million in July 2022 because of an exit scam run by Raccoon Network on its IDO/fundraising project.

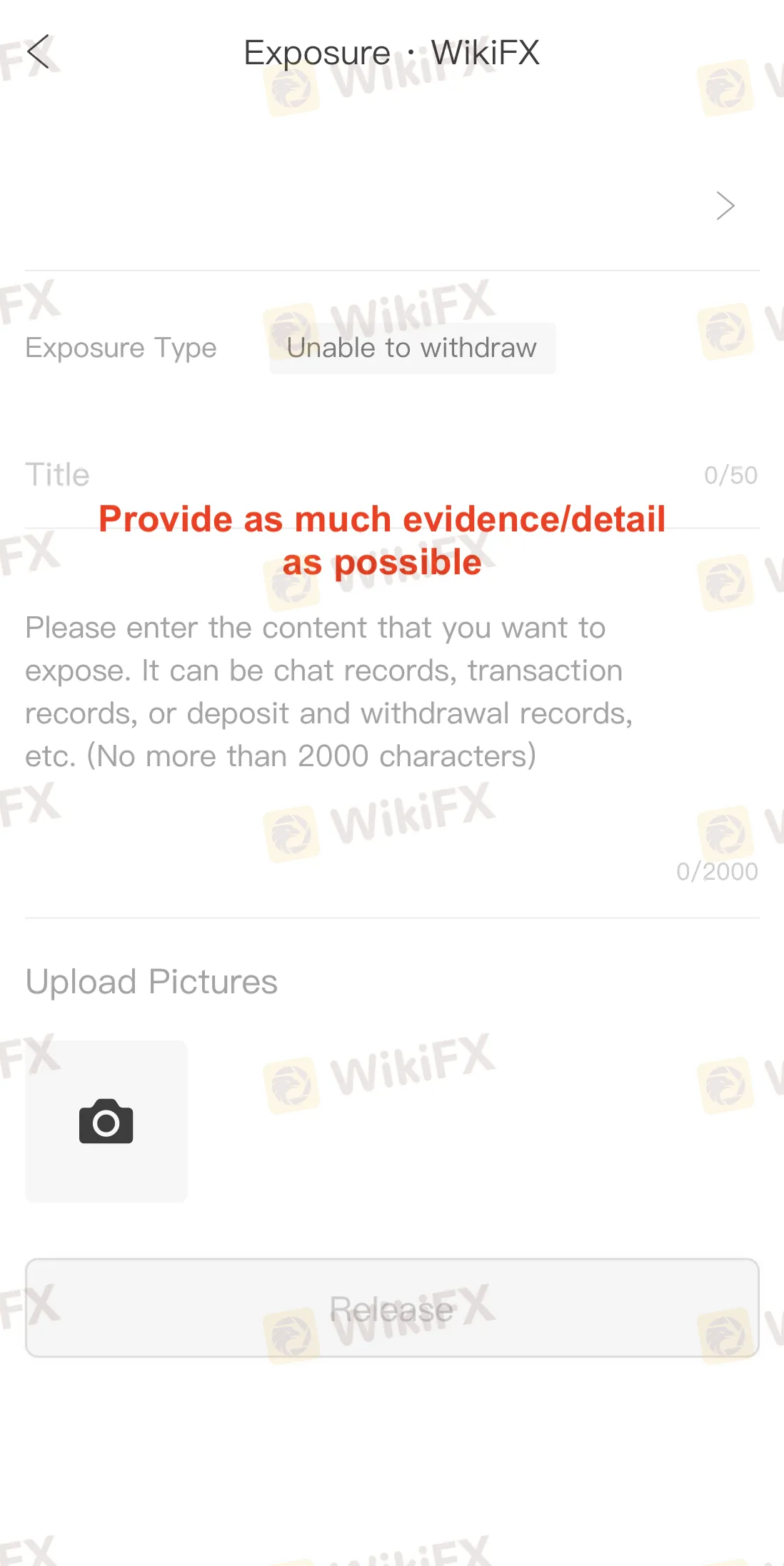

WikiFX is more than just a tool for finding out about the regulatory compliance of foreign exchange brokers; we also act as a mediator in cases where trading clients feel their foreign exchange brokers have not treated them fairly.

Simply download the free WikiFX mobile app from Google Play or the App Store, then adhere to the instructions below:

Please feel free to get in touch with the WikiFX customer service team through the channels listed below if you have any questions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Malaysia has taken a significant step in modernising religious practices by becoming the first country to enable zakat payments through digital assets.

Colorado Duo Accused of $8M Investment Fraud Scheme

ROI Cash Flow Fund duped investors of $8M in a fraudulent forex trading scheme. McPhee and Posey now face wire fraud and money laundering charges.

21 Arrested in Telangana Cryptocurrency Scam

Telangana Police arrests 21 in a cryptocurrency scam. Cybercriminals extorted money, laundered ₹8.2 crore, and transferred it via wallets linked to Dubai.

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Gabriel Hay & Gavin Mayo indicted for $22M crypto fraud. Learn about the Vault of Gems scam and how to avoid NFT rug pull schemes.

WikiFX Broker

Latest News

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

OFX: Is It Good to Go? Broker Review

Financial Educator “Spark Liang” Involved in an Investment Scam?!

21 Arrested in Telangana Cryptocurrency Scam

Currency Calculator