简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

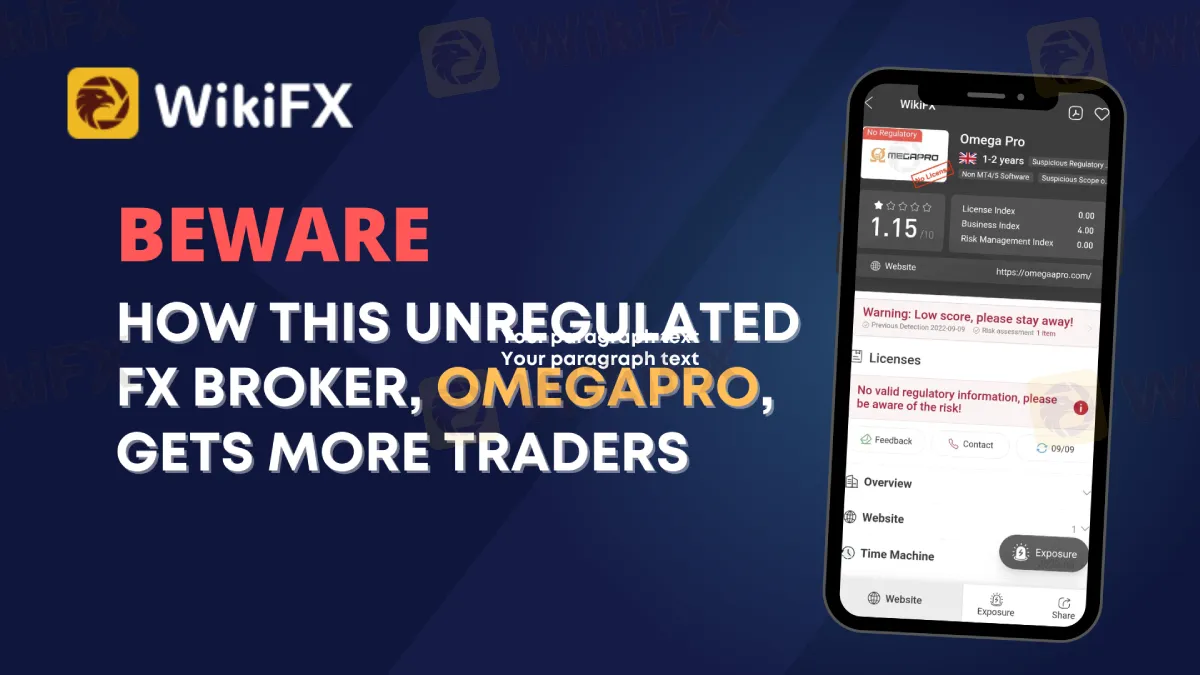

Beware: How This Unregulated FX Broker, Omega Pro, Gets More Traders

Abstract:OmegaPro's recent activities and acquisition and their regulatory status. Omega Pro is a forex broker well-known for hosting large events and bringing in popular artists, players, and celebrities to get more audiences.

Omega Pro is a forex broker well-known for hosting large events and bringing in popular artists, players, and celebrities to get more audiences.

Faryd Mondragón, one of the world's most recognized players from Columbia, has just joined the Omega Pro family as a brand ambassador.

They already held numerous large events and charitable operations from its regional offices in South Africa, Nigeria, India, and other countries by the year 2022.

This broker has an expensive marketing campaign in place to get more traders to use their platform.

Let's talk about OmegaPro and its regulation.

Omegapro, according to its official website, is a broker that enables its customers to trade currency pairings, commodities, equities, and indices. There are over 200 underlying assets with which you may trade.

OmegaPro is also an investment program that provides several packages with up to 300% profits after 16 months. You are permitted to withdraw your daily profits, and compensated packages begin at $150. New clients must pay a registration fee of $29 USD.

Furthermore, OmegaPro features a referral system that enables you to make more money by bringing new customers to its system.

According to their official website, its company headquarters are located in Beachmont Kingstown, St. Vincent and the Grenadines. Omega Pro has never been under to SVG FSA regulation and has never been registered as a business entity.

OmegaPro warned by CNMV

Omegapro is an unlawful investment service, according to the Spanish financial authority CNMV. That, in and of itself, is a strong recommendation to avoid it. Every other financial authority would reach the same conclusion as the CNMV.

How can we prevent dealing with an unregulated broker?

WikiFX has long been a source of broker information for traders. Furthermore, WikiFX never stops informing traders about a broker's regulatory status, which is the most crucial item to consider before investing with them. OmegaPro is not regulated nor licensed to act as a financial service or online forex broker.

WikiFX has almost 39,000 brokers listed on their platfrom both regulated and unregulated and has been working seriously with 30 financial regulators.

OmegePro's status in the WikiFX App

In conclusion, OmegaPro is not authentic. It is a rogue broker and investing service. OmegaPro provides financial and investment services, both of which need financial regulator licenses. That is the legislation in the majority of the world's nations.

OmegaPro, on the other hand, has no license. Its headquarters are in Saint Vincent and the Grenadines, and it is not licensed to provide investment services anyplace in the globe. It implies, among other things, that consumers' savings are not insured. As a result, there will be no returns if money from Omegapro accounts vanishes overnight.

Keep an eye out for additional OmegaPro activities.

WikiFX App may be downloaded through the App Store or the Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Risk Management: Turning Potential Into Profit

In Forex Trading, Without Effective Risk Management, You Risk Huge Losses and the Complete Depletion of Your Account.

Is it a good time to buy Korean Won with the current depreciation?

The exchange rate of the South Korean won in 2025 is expected to be highly uncertain, influenced primarily by the dual challenges of economic slowdown and political instability.

US Dollar Surge Dominates Forex Market

The global forex market continues to show volatility, with the U.S. dollar fluctuating last week but overall maintaining a strong upward trend. How long can this momentum last?

Oil Prices Soar for 5 Days: How Long Will It Last?

Last week, the global oil market saw a strong performance, with Brent crude and WTI crude prices rising by 2.4% and around 5% respectively. Oil prices have now posted five consecutive days of gains. But how long can this rally last?

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

Currency Calculator