简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

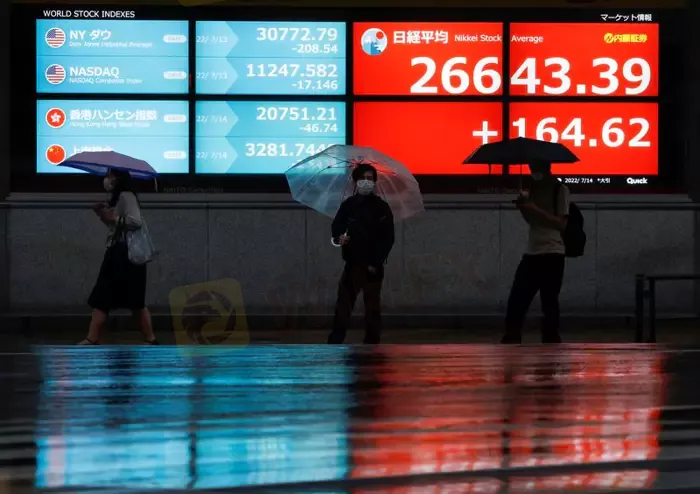

Asian stocks gain as investors weigh risk from Pelosi Taiwan visit

Abstract:Asia-Pacific bond yields followed U.S. Treasury yields higher on Wednesday and the dollar continued its climb after Federal Reserve officials signalled they are nowhere near done raising interest rates.

Stocks rose in volatile trading across Asia on Wednesday and the dollar pared early gains as investors weighed the potential fallout from U.S. House Speaker Nancy Pelosis visit to Taiwan, which has angered China.

Bond yields were also helped as demand for the safest assets eased despite heightened tensions between the United States and China, which views Taiwan as a breakaway province.

“In the longer term, there will be more frictions between the U.S. and China,” said Redmond Wong, Greater China market strategist at Saxo Markets in Hong Kong. “We have already been seeing selling from overseas investors in Chinese equities.”

Japan‘s Nikkei closed up 0.53%, rebounding from Tuesday’s two-week closing low, while Hong Kong‘s Hang Seng gained 0.83% and Taiwan’s TAIEX index rebounded from earlier losses to gain 0.2% at the close.

MSCI‘s broadest index of Asia-Pacific shares rose 0.19%, helped by the rally in Japan as bargain hunters came in following Tuesday’s decline to a two-week closing low.

Australias AXJO fell 0.41% and Chinese blue chips lost 0.13%.

“Obviously, as investors in China, we would not like to see tensions escalate,” said Thomas Masi, vice president and co-portfolio manager of the GW&K Emerging Wealth Strategy.

“And we don‘t see the benefit necessarily of this trip, but there could be something that we don’t understand. On a risk-reward basis, should tensions ease, theres a lot more upside in these stocks.”

FTSE futures were down 0.20% and Euro STOXX 50 futures dropped 0.08% ahead of markets opening in Europe.

U.S. stock futures jumped 0.32%, following the S&P 500s 0.67% drop overnight.

A trio of Fed policymakers signalled on Tuesday that there would be no let up in the tightening campaign aimed at taming the highest inflation since the 1980s, even though it will take rates to a level that will more significantly curb economic activity.

Two of them, San Francisco Fed President Mary Daly and Chicago Fed President Charles Evans, are widely regarded as doves.

Traders now see a chance of around 39.5% that the Fed will hike by another 75 basis points at its next meeting in September.

The benchmark U.S. 10-year Treasury yields were around 2.71% in Tokyo, not far from the overnight high of 2.774% following a 14 basis point surge.

The U.S. dollar index, which gauges the currency against the yen and five other major peers, was 0.188% lower at 106.25, having rebounded as much as 1.43% overnight following its slide to a nearly one-month low at 105.03.

Gold gained 0.57% higher to $1,769.73 per ounce, but following a 0.68% retreat the previous session.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Quadcode Markets: Trustworthy or Risky?

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator