简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is it OK to invest in Rakuten Securities Australia?

Abstract:Today, WikiFX is going to review a forex broker named Rakuten Securities Australia (RSA) for investors and traders.

The currency market, which is filled both opportunities and risks, is unpredictable. While many investors have gained considerable returns after investing in the forex market, those who suffered great losses have learned painful lessons. Today, WikiFX is going to review a forex broker named Rakuten Securities Australia (sec.rakuten.com.au/) for investors and traders. WikiFX is going to evaluate this broker according to various aspects such as general information & regulation, feedback from social media and exposure by investors.

Regulatory Status

First let's search “Rakuten Securities Australia” on WikiFX APP to take a look at the details page. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/9341447788.html), Rakuten Securities Australia currently is regulated by the Australia Securities & Investment Commission (ASIC) under license number 418036, as well as by the Financial Services Agency (FSA) in Japan under license number 5010701021660.

Besides, Rakuten Securities Australia has been given by WikiFX a high rating of 9.00/10. WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is. Rakuten Securities Australia excels at all the key dimensions - license index, business index, risk management index, software index and regulatory index.

General Information

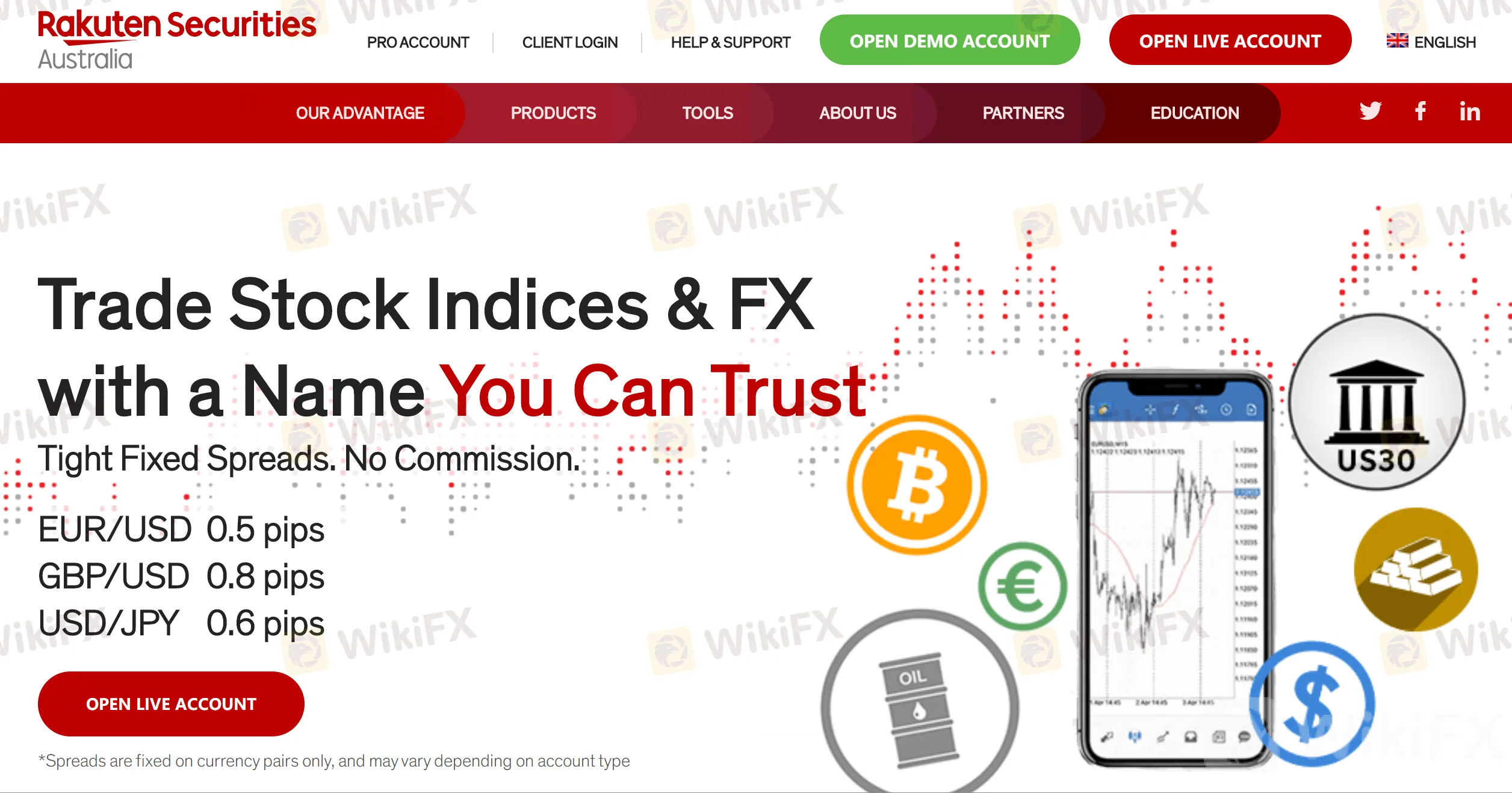

WikiFX also paid a visit to the broker's official website to find out more.

Rakuten Securities Australia Pty Ltd is a forex, indices and metals broker under Rakuten Securities, Inc. With its head office in Tokyo, Rakuten Securities, Inc. is one of the major online brokers in Japan and across Asia servicing over 2.6 million clients since 1999. Rakuten Securities Australia (RSA) can be reached in the way shown in the screenshot below:

There are four trading account types for investors to choose from at Rakuten Securities Australia, namely Retail, Pro 1, Pro 2 and Pro VIP:

The broker offers tight fixed spreads and no commission is charged:

Rakuten Securities Australia provides clients with access to the world's financial markets through the MetaTrader 4 (MT4) platform which is used by millions of traders around the globe. MT4 is widely regarded as the most popular online forex and CFD trading platform for traders of all experience levels. MT4 platform has a fully customisable and user-friendly interface along with a short learning curve and vast array of tutorials to familiarise yourself with the platform.

The brokers homepage claims to offer the following deposit & withdrawal methods. There are no fees for domestic transfers however banks overseas may charge international transaction fees.

Rakuten Securities Australia provides several options for forex account funding. You can add money to your account in one of four currencies including the US dollar (USD), the Australian dollar (AUD), the Euro (EUR) and the British Pound (GBP). You can open multiple accounts funding each with a different currency. When you initially fund your account, you will need to choose one of the four base currencies.

Rakuten Securities Australia on Social Media

As of July 29th, 2022, Rakuten Securities Australia does have official accounts on major social websites - Facebook, Twitter, Youtube, LinkedIn.

It seems hard to find negative comments related to this broker on these social media, where it doesnt have much popularity.

Exposure related to Rakuten Securities Australia on WikiFX

On WikiFX, the Exposure section consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

Three traders who have invested in Rakuten Securities Australia complained that the withdrawal would cost 20% personal income tax and that he couldnt even withdraw funds after paying the tax.

Another investor complained about severe slippage problem:

Source: https://www.wikifx.com/en/exposure/exposure/9341447788.html

Conclusion

Rakuten Securities Australia is a regulated broker. And it has a decent score given by WikiFX. However, it still has a long way to go since WikiFX has received many complaints related to this broker. For your money safety, please do more research and make yourself comfortable before making a decision. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator