简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

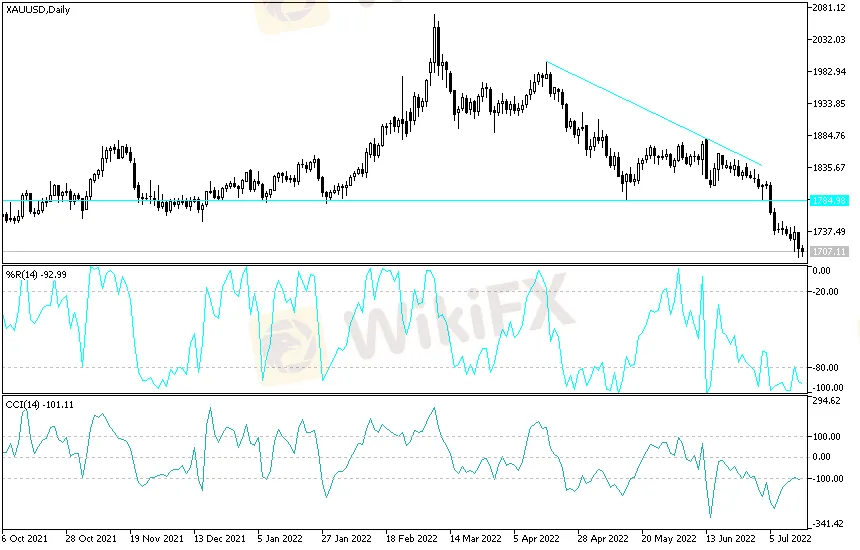

Gold Technical Analysis: Gold Preparing for Buying

Abstract:Gold futures failed to join the general market rally at the end of last week's trading, as a slew of positive economic data lifted investor sentiment. Stock traders flocked to better-than-expected numbers, as well as consumers' heightened expectations for the economy. The price of XAU/USD gold fell to the support level of $1697 an ounce, the lowest in ten months, and closed last week's trading around the level of $1707 an ounce. Accordingly, the yellow metal recorded a weekly loss of more than 2%, in addition to its decline since the beginning of the year 2022 to date by 7%.

Gold futures failed to join the general market rally at the end of last week's trading, as a slew of positive economic data lifted investor sentiment. Stock traders flocked to better-than-expected numbers, as well as consumers' heightened expectations for the economy. The price of XAU/USD gold fell to the support level of $1697 an ounce, the lowest in ten months, and closed last week's trading around the level of $1707 an ounce. Accordingly, the yellow metal recorded a weekly loss of more than 2%, in addition to its decline since the beginning of the year 2022 to date by 7%.

In the same way, prices of silver, the sister commodity to gold, headed in the opposite direction on Friday. As silver futures rose to $18.36 an ounce. Despite the modest increase by the end of the week's trading, the white metal will suffer a weekly loss of 4.5%, which will lead silver to a bear market this year.

Despite rising inflation, which touched 9.1% in June, the US economy recorded positive economic data that surprised many market analysts. According to the US Census Bureau, US retail sales rose 1% in June, beating market estimates of 0.8%. This was also up from a 0.1% decline in May. On an annual basis, retail sales are still up 8.4%. In addition, core US retail sales, which remove auto services, food and gasoline, jumped 0.8% last month, up from a 0.3% decline the previous month.

New data from the Federal Reserve shows that US industrial output fell 0.2% in June, above market expectations of 0.1%. Industrial production fell 0.5%, greater than expectations of -0.1%. Also, capacity utilization has fallen to 80%, which is lower than the average estimate of 80.6%. On the pricing front, US import prices rose less-than-expected by 0.2%, while export prices also rose at a less-than-expected 0.7%.

Moreover, the University of Michigan's US Consumer Confidence Index rose to a reading of 51.1 in July, above market estimates of 49.9. Consumer expectations slipped to 47.3, while current economic conditions advanced to 57.1. Consumer expectations for one- and five-year inflation fell to 5.2% and 2.8%, respectively.

And other factors affecting the gold market. The US Treasury market was mostly down, with the 10-year bond yield slipping 2.9 basis points to 2.93%. But the yield curve for two- and 10-year bonds has remained inverted, widening to nearly -20 basis points. This is a major indication that the US may be heading into a recession. Lower returns are generally bullish for gold as it reduces the opportunity cost of owning non-returning bullion.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of currencies, took a breather from its massive rally. The DXY Dollar Index is down 0.39% to 108.12, from an opening at 108.67. The index will continue to post a weekly boost of 1%, adding to its 2022-to-date rally near 13%.

In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures fell to $3.195 a pound. Platinum futures rose to $827.00 an ounce. Palladium futures fell to $1,836.00 an ounce.

Gold Forecast

In the near term and according to the performance on the hourly chart, it appears that the price of XAU/USD is trading within a neutral channel formation with a bearish slope. This indicates that there is no clear directional bias in market sentiment. Therefore, the bulls will target a possible bullish breakout around $1,711 or higher at $1,716. On the other hand, the bears will be looking to pounce on short-term profits around $1,702 or lower at $1,697 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a sharp descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will be looking to extend the current declines towards $1678 or lower to $1649 an ounce. On the other hand, the bulls will target long-term profits at around $1,737 or higher at $1,766 an ounce.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator