简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Clientele Feedback: What Are Investors' Opinions of RoboForex?

Abstract:Forex scams have been rising in recent years, and it's alarming. Most of the time, people lose their money to offshore brokers with no regulatory oversight.

However, sometimes even a regulated entity plays unfair. Reasons could vary, but the most apparent one is the lack of check from a well-reputed regulatory institution. Today we discuss how brokers with a weak regulatory setup like RoboForex can make clients suffer.

Summary

RoboForex is a brand name of RoboForex Group comprising two entities: RoboForex Ltd. (https://roboforex.com/) and RoboMarkets Ltd.(https://www.robomarkets.com/) The multi-regulated company has been in the business for over a decade. RoboForex provides trading services across various financial markets, such as forex, commodities, indices, and cryptocurrencies. Multiple trading platforms, flexible account types, and copy trading services are some key features available at RoboForex.

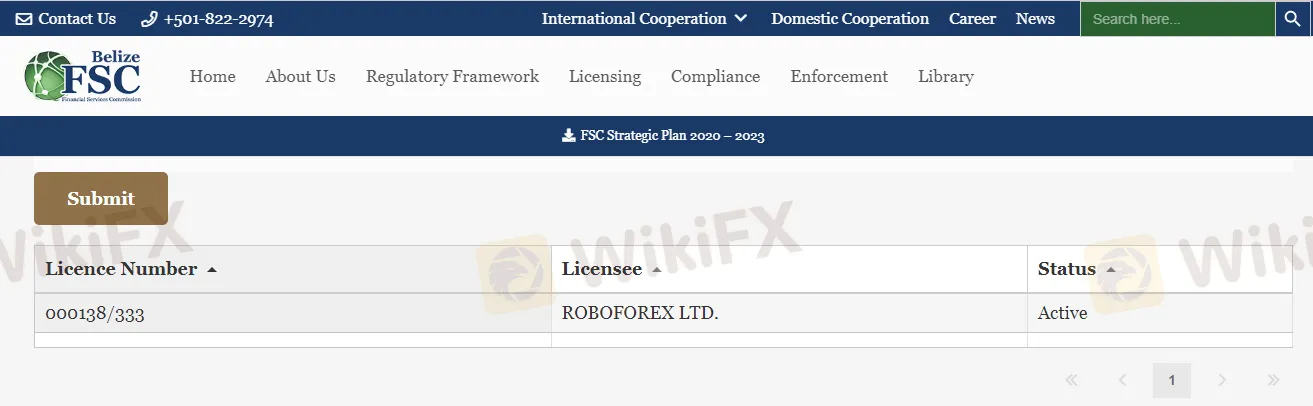

Is RoboForex Regulated?

RoboForex Group holds multiple regulations worldwide. While the RoboForex is registered and authorized by the International Financial Services Commission (IFSC), RoboMarkets has regulations from the Cyprus Securities and Exchange Commission (CySEC), and Polish Financial Supervision Authority (PFSA). The National Bank of the Republic of Belarus (NBRB) also oversees the RoboForex Group.

RoboForex clients' feedback

RoboForex has devastating feedback from clients, especially concerning withdrawal problems. Clients have also reported the broker's slippage issues, higher spreads, and poor customer support on multiple social and digital channels, including the BrokersView. Let us share some screenshots below.

Should I sign up with RoboForex?

Opening an account with RoboForex is purely at customer discretion. However, it would help if you consider the listed factors before signing up with any broker, including the RoboForex.

Regulation status

RoboForex Group holds licenses from three regulators, including IFSC and CySEC, and PFSA. The company registers international clients under RoboForex Ltd. On the other hand, RoboMarkets Ltd.'s services are available for EU/EEA clients.

Deposit & withdrawal process

Always check if the broker processes deposits and releases funds on time? Essentially, there will be no use in making profits when you can't reach your funds in time. RoboForex receives critics for having a slow withdrawal process. Some clients even accuse the company of rejecting the withdrawal requests for no justified reason.

Trading conditions

Legit brokers ensure excellent trading conditions. Elements like trade execution, spreads & commissions, technical indicators and state-of-the-art trading tools are critical for a successful trading journey. Investors blame RoboForex for employing higher spreads in addition to delayed execution with increased slippage issues.

Customer support

Customer support is integral to a company's success, and reputable firms pay special attention to clients' satisfaction. However, clients have rated RoboForex customer services being the worst.

Bottom line

A scam broker isn't necessarily always the reason behind your awful trading journey, but a brokerage with weak regulatory checks can wreak havoc. However, getting ditched by a multi-regulated firm isn't an exception either. The best thing investors can do is remain vigilant and read through customers' feedback to ascertain whether or not their prospective broker is worth opening an account. In the case of RoboForex, the company's clientele feedback speaks for itself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator