简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

1 Minute to Know NAGA Before Trading

Abstract:The NAGA broker (NAGA Group) has been providing services in the Forex currency market since 2015. NAGA is a member of a German financial holding company NAGA Group AG, that is in demand on the Frankfurt Stock Exchange. The company applies modern technologies and introduces innovative solutions to compete with traditional financial institutions represented by banks and intermediaries in the investment market. Over 500 thousand active traders and passive investors currently use NAGA brokerage services. The broker is authorized by a CySEC in Cyprus and a technology company operating in Germany.

The NAGA broker (NAGA Group) has been providing services in the Forex currency market since 2015. NAGA is a member of a German financial holding company NAGA Group AG, that is in demand on the Frankfurt Stock Exchange. The company applies modern technologies and introduces innovative solutions to compete with traditional financial institutions represented by banks and intermediaries in the investment market. Over 500 thousand active traders and passive investors currently use NAGA brokerage services. The broker is authorized by a CySEC in Cyprus and a technology company operating in Germany.

While trading with NAGA you may access flexible leverage that allows you to control and manage risks better and according to your trading style. Since NAGA is a European broker, the company offering fully complies with ESMA restrictions, therefore, falls under recent updated to use lower leverage levels. The maximum leverage available for retail traders is 1:30, while professionals may access higher ratios once the professional status is confirmed. NAGA has only one account. Traders get access to a digital asset exchange, your own cryptocurrency wallet and NAGAs native cryptocurrency (NGC).

All you must do is simply sign up and equip yourself with a single, all-in-one NAGA account. Naga offer seven ways to trade: Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading. The assets and products available to you on the Naga trading platform depend on the region of the world you are in and what entity you have an account with.

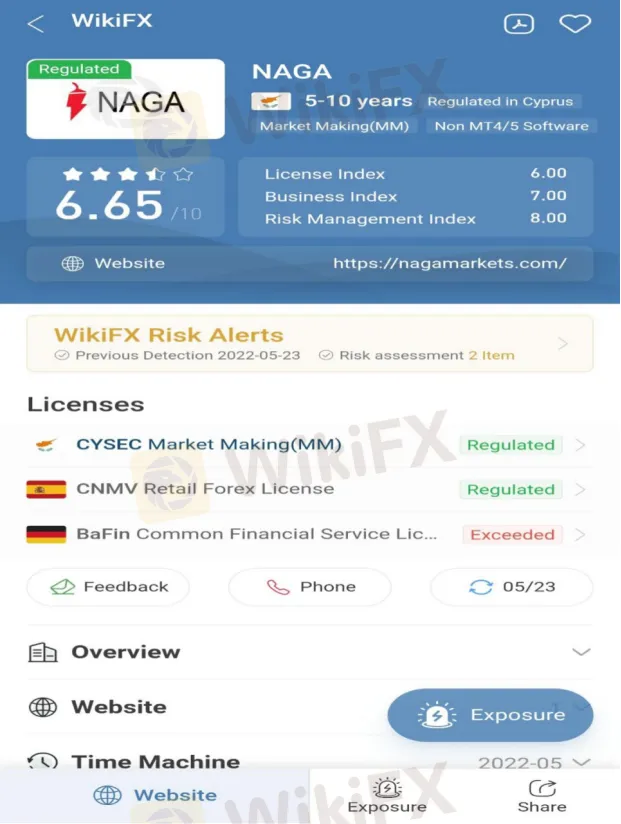

Is NAGA Regulated?

NAGA is a regulated international broker whose terms and conditions are perfect for professional traders and experienced investors with a focus on stocks.

Naga is regulated. This means Naga are supervised by and is checked for conduct by the Cyprus Securities and Exchange Commission (CySEC) under licence No. 204/13, Financial Conduct Authority (FCA) no. 609499, The Federal Financial Supervisory Authority (BaFin) reg. 135203, Commissione Nazionale per le Società e la Borsa (Consob) reg 3844, Comisión Nacional del Mercado de Valores (CNMV) reg 3591 regulatory bodies.

Regulated brokers are highly unlikely to manipulate market prices due to the regulations imposed. Therefore Naga is reliable broker with great range of trading instruments and very competitive social trading environment. Platform and costs are good, there is education and research tools.

On the negative side the conditions are different depending on the enityt and there is no 24/7 support.

With NAGA, Forex has a fast order execution time and over 500 instruments on the platform. Real Stocks traders can invest with no commissions. It has fast order execution time, over 400 real stocks to invest in with zero commissions and no hidden fees. Buy, store, sell and trade major cryptocurrencies, all in one solution. NAGA provides a digital wallet to store cryptos on a proprietary crypto-exchange platform with 10+ of the most popular cryptos. Trade and benefit in commodities like coffee, wheat, natural gas, crude oil, and numerous other global commodities.

Fast order execution time with investment opportunity for portfolio diversification. You can trade CFDs on the worlds top Exchange Traded Funds (ETF) on a trusted and reliable platform and discover other 500+ trading instruments on offer. Fast order execution time on over 500 instruments on the platform. NAGA offers low spreads for all traders despite trading account size, so any investor will get better trading conditions. Typical spread for EUR/USD is 1.2 pips, which is considered a good spread among industry offering. As for other instruments, there could be commission charges for some assets which you will find directly from the platform. While using social trading all costs and spread of the profit between master account and copy account will be calculated automatically.

Naga is one of the few brokers that offer both of the MetaTrader platforms; MT4 and MT5. To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here.

Naga is one of a handful of brokers that offer the cTrader platform developed for traders. For a list of forex brokers that offer the cTrader platform, check out our comparison of MT4 brokers.

A Naga iOS or Android native App on your phone or tablet will Work quicker Than the Avatrade Website on the same device.

Naga also offer mobile apps for Android and iOS, making it easier to keep an eye on and execute your trades while youre on the move. NAGA trading platform brings you additional capabilities and a truly great balance between a friendly interface and its sophisticated solutions. NAGA enables trading and investing in multiple markets all over the world from any device or platform you prefer.

Buy and sell any instrument, Auto Copy top investors, chat on NAGA Messenger, all from a single app. Overall, NAGA shows a company that stands on strong technology and development of trading innovation. In trading with NAGA, you will find vast investment opportunities whether you are a beginner or professional who seeks progressive trading options accompanied by good trading conditions and costs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator