简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex: What is COT? How Do Traders Use It?

Abstract:The forex market moves on the basis of large traders, the “market makers”. So the sentiments offered by the traders are very important in determining the market moves.

Click Here: After you read it, Daily Routine with WikiFx

The Commitment of Traders Report, or COT report for short, is a weekly sentiment report that can provide forex traders with critical information on currency pair positioning. In this article, we will define the COT report and explain how to use it in forex trading.

What Exactly Is a COT Report?

The Commitment of Traders (COT) report is a weekly publication that shows the aggregate holdings of various futures market participants in the United States. The US Commodity Futures Trading Commission (CFTC) creates it and releases it every Friday at 15:30 east coast time.

The report covers all assets, but forex traders are most interested in the currency section. All large traders who move the market must report their positions on a regular basis. Institutional traders, hedge funds, large banks, and others are among the major market drivers. And the influence these traders have on the markets can sometimes be significant enough to drive trends. The best strategy for retail forex traders is to trade like large financial institutions.

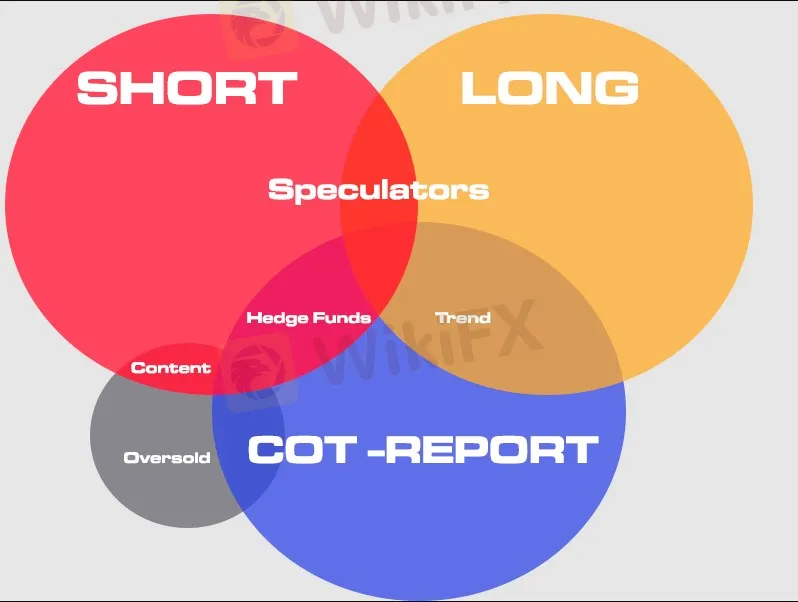

According to the COT report, there are three major groups:

1. Commercial trader

Commercial traders are large institutions that use the futures market to hedge against risks associated with unfavorable price movements that may affect their investments. They only trade to reduce risk, not to make money.

2. Non-Commercial trader

This information typically pertains to large speculators, such as Commodity Trading Advisors and other similarly large institutions, who speculate in specific futures markets. These institutions blindly follow the trend. They buy when the market is rising and sell when the market is falling.

3. Non-Reportable trader

Non-reportable traders lack the large bank accounts that commercial and non-commercial traders have. They are smaller-account speculators who want to profit from the futures market as well. This category includes retail traders.

How to Locate the COT Report

The CFTC makes the COT reports available to the public on its website. You can easily access the COT report by following the steps below:

1. Go to the CFTC's website. Scroll down until you find the table titled “Current Legacy Reports.” The “Chicago Mercantile Exchange” is what we require.

2. To access the most recent COT report, click on “Short Format” under “Futures Only” on the “Chicago Mercantile Exchange” row.

3. Simply press CTRL+F and type in the currency you're looking for.

These steps will lead you to the most recent weekly report. If you need more information on previous data, visit the CFTC website's historical data section. If you need to look at the weekly reports for a specific month, go to the Historical Viewable section of the website.

How to Use the COT Report in a Trading Situation

There are two common approaches to applying COT data. The first is to try to imitate the positioning of this larger group. The second step is to determine whether the market has reached an extreme – is it a consensus trade that may reverse?

1. Use of the COT Report as a Forex Volume Indicator

Given that non-commercial traders are frequently large speculators, we anticipate that they will generally favor the major trend. As a result, we keep an eye out for when these traders move significantly in one direction and look to position ourselves accordingly.

Keep an eye on an asset's open interest numbers when using the COT Report as a volume indicator. When the open interest in an asset increases, it indicates that more people are trading the asset's futures contract.

To improve your results, use the COT report data to supplement your technical analysis from other forex trading tools.

2. Profiting from reversals

Riskier traders examine the COT for opportunities to go against the grain. When you bet against the position taken by a large portion of the market, you run a high risk. As a result, most traders who are interested in doing this hedge their bets by opening positions in uncorrelated pairs.

The COT report can be used in two ways to identify potential reversals in the forex market. The first method is to use the report's spreads data. When the spread between commercial and non-commercial traders is wide, a reversal may occur.

The other method entails keeping track of where non-commercial traders are accumulating their positions. When you notice that their positions on a specific futures contract are reversing, and a reversal on the underlying asset is possible.

Conclusion

The COT report is a powerful tool that allows any trader to take different paths when developing their trading strategy. The most important thing to remember is that COT data is just another tool that should not be used in isolation when developing a trading strategy.

The goal of using this report is to follow the smart money and discover where money is going and where it is going. If you look at this report for a long enough time, you will begin to notice concrete patterns. Understanding the fundamentals of modern portfolio management and institutional asset class rotation is extremely beneficial.

Remember that before making any decisions, it is best to confirm signals from the COT report with data from other aspects of technical analysis, as well as fundamental analysis.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator