简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oil Rally May Stall on China Covid Woes, Fed Rate Hikes

Abstract:WTI crude and Brent crude oil prices rocketed higher in the first quarter of the year as Covid-related lockdowns and restrictions were rolled back across major economies, fueling a surge in demand.

WTI crude and Brent crude oil prices rocketed higher in the first quarter of the year as Covid-related lockdowns and restrictions were rolled back across major economies, fueling a surge in demand. That increase in demand quickly outpaced rising supply levels. Then, in February, Russia invaded Ukraine. A volley of Western sanctions followed, effectively severing Russias connection to global financial markets. The United States and Britain moved to ban Russian oil exports, although the European Union refrained, fearing an energy crisis.

Still, the confusion around quickly evolving sanctions as well as the removal of Russian banks from the SWIFT messaging system has made buyers and foreign shippers hesitant to take delivery from Russian ports. Although not formally targeted by much of the Western alliance, Russias oil industry, which supplies around 10 million barrels per day to the global market, was thrown into chaos. Oil prices responded with Brent crude oil hitting its highest level since 2008.

However, there is potential for a near-term pullback even as demand around the world picks up. That pullback may come if Ukraine and Russia negotiate an end to the war. Such negotiations could lead to a removal of some Western sanctions, potentially reopening the taps on Russias energy products, at least to a degree. Outside of the supply factor, an end to the war would also remove the geopolitical risk premium in prices.

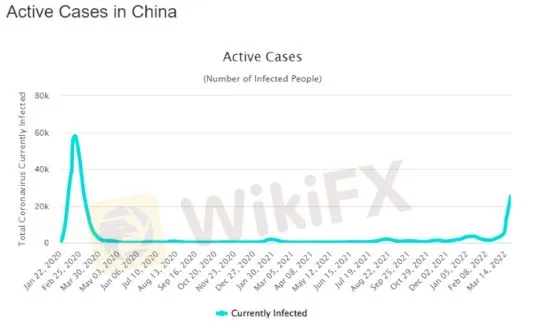

There also exists a chance that the energy market‘s demand-side may ease due to a Covid outbreak in China. A drop in demand for Asia’s largest oil consumer would likely be followed by a contraction in imports, easing pressure on strained supply capacity. China is reportedly soaking up some of Russias new spare capacity, but it still sources much of its oil from other countries.

The Beijing auto show that was scheduled for late April was canceled amid Chinas worst Covid outbreak since the pandemic began. Other major events in China are likely to suffer the same fate until the outbreak is contained. Widespread cancellations would open the door for a pullback, with bearish factors compounded by the chance for a more aggressive 50 basis point rate hike from the Federal Reserve in May.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Turkey Resumes Rate Cuts Amid Easing Inflation

Turkey’s inflation has eased, prompting the central bank to resume interest rate cuts. Striking a balance between economic recovery and inflation control has become a critical focus. However, significant challenges lie ahead, as Turkey continues to navigate complex economic conditions.

New Year, New Surge: Will Oil Prices Keep Rising?

As of the writing of this article (January 2), oil prices stand at $71.88 per barrel. Investors need to continue monitoring whether the supply and demand dynamics will continue to push prices further up.

Bursa Malaysia Dips as Investors Brace for 2025 Uncertainty

Bursa Malaysia saw a slight dip on the final trading day of the year as profit-taking and cautious sentiment dominated. The FBM KLCI declined 3.4 points to 1,634.28, with muted turnover of RM822.07 million due to year-end festivities. Blue-chip stocks, including Tenaga Nasional and Telekom Malaysia, experienced declines, while regional markets remained subdued amid global uncertainties. As 2024 approaches, investors remain cautious, balancing risks with potential opportunities.

Will the Fed Cut Rates in 2025? What to Expect

The Federal Reserve has implemented multiple interest rate cuts in 2024, bringing the rate to a range of 4.25%-4.5% by the end of the year. However, whether the Fed will continue cutting rates or shift to rate hikes in 2025 remains uncertain. The Fed's policy direction depends not only on economic data but also on internal adjustments, the policy direction of the new president, and other factors.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

OPEC's Profound Influence on the Oil Market

Just2Trade: SAFE or SCAM?

The January Effect of 2025 in Forex Markets

New York becomes first US city with congestion charge

Currency Calculator