简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

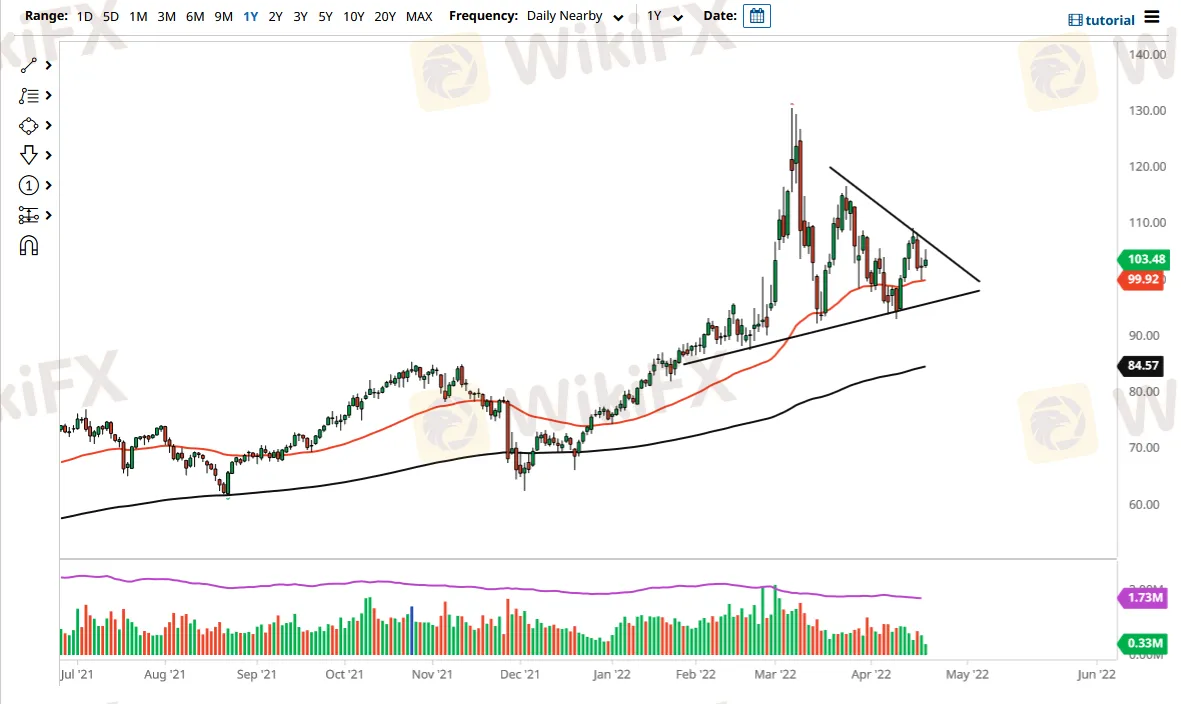

WTI Crude Oil Forecast: Crude Oil Market Gives Up Gains

Abstract:The West Texas Intermediate Crude Oil market rallied during the Thursday session rather quickly, but as you can see has given back a huge portion of the gains. By doing so, we are forming a bit of a shooting star that is preceded by a hammer. This typically means that you are going to try to form some type of consolidation area in the markets, so we may hang around this area for a while. This would make a certain amount of sense because quite frankly there are a lot of things going on that could cause major issues.

The first major problem of course is the Russian invasion of Ukraine, as the Russians are a major producer of crude oil, and the rest of the world is trying to find a way, not to buy it. That will put a certain amount of pressure on the market, as supply will start to dwindle. Furthermore, the Americans have worked against their interests over the last year or so, as the crude oil market has fallen significantly as far as production is concerned.

If we turn around a break down below the 50 Day EMA underneath, that could open up a move down to the uptrend line that I have marked on the chart. Breaking that uptrend line would be extraordinarily negative and would have the market free falling. In that scenario, we probably go looking to reach the 200 Day EMA, which is near the $85 level.

There is a lot of questioning of the potential demand at this point, as the market has to worry about the idea of demand destruction due to a recession coming, perhaps even worries about whether markets can sustain the uptrend. On the other hand, if we were to turn around a break above the $110 level, then it is likely that this market will go much higher, perhaps showing signs of keeping the overall uptrend. The 50 Day EMA should offer short-term support, so please keep that in mind, as it will be an area that people will pay close attention to. You can see that I have a couple of trendlines drawn on the chart, but quite frankly this is a market that looks as if it is compressing for a bigger move sooner or later.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator