简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

America's New CPI Data Report | The Fastest Inflation In Over 41 Years

Abstract:Last night at UTC +8 8.30 pm, the U.S. Department of Labour released its Consumer Price Index (CPI) data report. The CPI report for March reported a 1.2% increase after a 0.8% rise in the previous month. This figure lived up to the forecasted rate.

<WikiFX Malaysia Original: Editor - Fion>

Last night at UTC +8 8.30 pm, the U.S. Department of Labour released its Consumer Price Index (CPI) data report. The CPI report for March reported a 1.2% increase after a 0.8% rise in the previous month. This figure lived up to the forecasted rate.

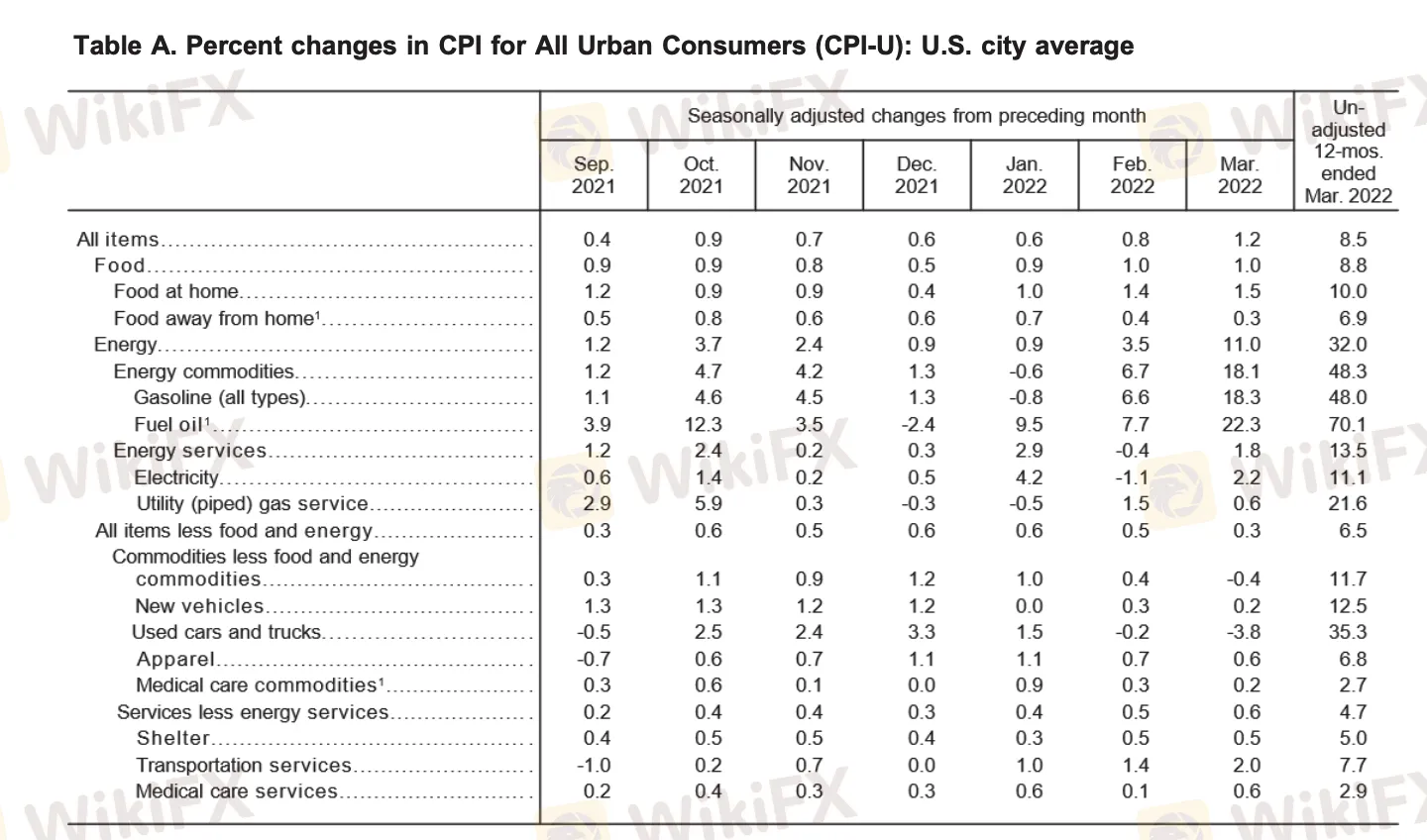

However, the Core CPI m/m which was originally expected to remain at 0.5% (as highlighted in our Mondays article https://www.wikifx.com/en/newsdetail/202204116994539231.html), dropped to 0.3% instead. From a YoY standpoint, the total increment of the CPI data report in March is 8.5%, making it the fastest 12-month inflation pace since December 1981.

This new CPI report highlights the increasingly severe inflationary situation in the U.S. Energy prices, housing costs, and food prices had climbed significantly due to the Russian-Ukraine conflict as well as the supply chain disruptions with China combating a new wave of Coronavirus.

This CPI report also shows that, excluding the more volatile food and energy prices, core CPI rose 0.3%, which is equivalent to a 0.2 basis points rise in comparison to Februarys report. The YoY increase with this exclusion is 6.5%, making it the highest value since August 1982. This puts additional weight on American households, typically the low-income groups, now have to carve out more budget for their daily expenditures.

Extracted from the CPI March 2022 Data Report

As we break the components down of Americas CPI, we could see that energy prices jumped 11% with gasoline up by 18.1% and fuel oil up by 18.3%, which was a whopping 70.1% in terms of YoY.

According to the chief economist from Grant Thornton, one of the biggest accounting organizations in the world and America, oil price could be reaching its peak and it is time to divert our attention to another sector. A bigger problem lies within the rising prices of consumer goods and services. The increase in vehicle prices, typically the used cars and trucks that recorded a YoY increment of 35.3% could pose another issue for Americans too. If the supply chain issues persist, all these problems could become more severe.

Considering that the supply chain disruptions caused by the pandemic have not yet improved and the increase in U.S. consumer demand for services such as travel, the inflation rate is unlikely to fall back to the 2% inflation target set by the Federal Reserve in the near future.

At the same time, the risk of inflation dragging the U.S. economy into recession is building up. Economists predict that Americas economic activity may shrink as consumers gradually cut back on spending due to rising prices.

The market is now widely expecting a 50 basis points interest rate hike during the May FOMC meeting.

<WikiFX Malaysia Original: Editor - Fion>

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Is Ultima Markets Legit?

Ultima Markets has played a significant role in the forex trading industry for decades. WikiFX created a comprehensive review to help you better understand this broker. We will analyze its reliability based on specific information, regulations, etc. Let’s get into it.

WikiFX Review: Is FXTRADING.com still reliable?

FXTRADING.com is an online brokerage firm that offers trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. WikiFX has comprehensively reviewed this broker by analyzing its regulations, specific information, etc. so that you have a deep understanding of this broker.

Financial Educator “Spark Liang” Involved in an Investment Scam?!

A 54-year-old foreign woman lost her life savings of RM175,000 to an online investment scam that promised high returns within a short timeframe. The scam was orchestrated through a Facebook page named "Spark Liang."

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator