简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

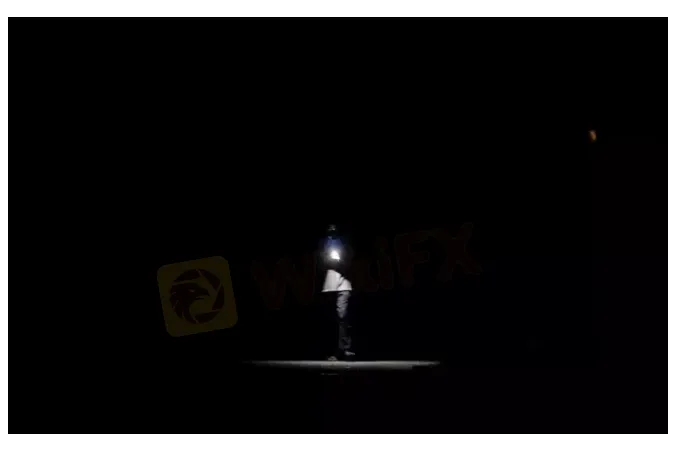

Sri Lanka to turn off street lights as economic crisis deepens

Abstract:Sri Lanka is turning off its street lights to save electricity, a minister said on Thursday, as its worst economic crisis in decades brought more power cuts and gloom to its main stock market, triggering a halt in trade as prices slid.

The island nation of 22 million people is struggling with rolling power cuts for up to 13 hours a day as the government is unable to make payments for fuel imports because of a lack of foreign exchange.

“We have already instructed officials to shut off street lights around the country to help conserve power,” Power Minister Pavithra Wanniarachchi told reporters.

A diesel shipment under a $500 million credit line from neighbouring India is expected to arrive on Saturday, Wanniarachchi said, but she warned that the situation was not likely to improve any time soon.

“Once that arrives we will be able to reduce load shedding hours but until we receive rains, probably some time in May, power cuts will have to continue,” Wanniarachchi told reporters, referring to the rolling power cuts.

“Theres nothing else we can do.”

Water levels at reservoirs feeding hydro-electric projects had fallen to record lows, while demand had also hit record levels during the hot, dry season, she said.

‘DRIVING THE DROP’

The Colombo Stock Exchange (CSE) cut daily trading to two hours from the usual four-and-a-half because of the power cuts for the rest of this week at the request of brokers, the bourse said in a statement.

But shares slid after the market opened on Thursday and the CSE halted trading for 30 minutes – the third suspension in two days – after an index tracking leading companies dropped by more than 5%.

“Concerns on the macro side, together with news of shorter trading hours plus increased power cuts is driving negative sentiment,” said Roshini Gamage, an analyst at brokerage firm Lanka Securities.

“Overall weak sentiment is driving the drop,” Gamage said.

The CSE halted trading twice on Wednesday as worries deepened over the economy and the power cuts.

The crisis is a result of badly timed tax cuts and the impact of the coronavirus pandemic coupled with historically weak government finances, leading to foreign exchange reserves dropping by 70% in the last two years.

Sri Lanka was left with reserves of $2.31 billion as of February, forcing the government to seek help from the International Monetary Fund and other countries, including India and China.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Malaysia's economy is on track to sustain its robust growth, with GDP expected to exceed 5% in 2025, according to key government officials. The nation's economic resilience is being driven by strong foreign investments and targeted government initiatives designed to mitigate global economic risks.

Tradu Introduces Tax-Efficient Spread Betting for UK Traders

Tradu’s introduction of tax-efficient spread betting and groundbreaking tools like the Spread Tracker signals a new era of accessible, competitive, and innovative trading solutions for UK investors.

Trading Lessons Inspired by Squid Game

The popular series Squid Game captivated audiences worldwide with its gripping narrative of survival, desperation, and human nature. Beneath the drama lies a wealth of lessons that traders can apply to financial markets. By examining the motivations, behaviours, and strategies displayed in the series, traders can uncover valuable insights to enhance their own approach.

How Far Will the Bond Market Decline?

Recently, the yield on the U.S. 10-year Treasury bond reached a new high since April 2023, soaring to 4.7%.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator