简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices: EIA Data in Focus as WTI Trades at Steep Discount to Brent

Abstract:CRUDE OIL, BRENT OIL, PRICE SPREAD, EIA, INVENTORY, EXPORTS - TALKING POINTS

Crude oil is trading at a steep discount versus Brent crude oil, driving US exports

EIA data in focus as traders assess global oil flows amid Russia-Ukraine conflict

A large US inventory draw may see WTI prices rise faster relative to Brent prices

Brent and WTI crude oil prices are moving lower in Wednesdays Asia-Pacific session. A renewed sense of hope about a cease-fire agreement between Ukraine and Russia may be helping to cool prices. Earlier this week, oil prices sank more than 8% as China announced a two-stage lockdown in Shanghai, a major Asian finance hub.

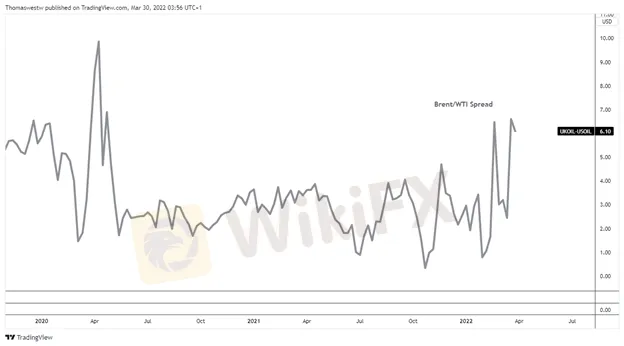

The economic sanctions levied on Russia have thrown energy markets into disarray recently. The global benchmark, Brent oil, has outpaced the rise in WTI crude prices, the US benchmark. That is likely explained by the fact that Russias supply is more influential on Brent, given the geographic nature of the global oil market. The US prices are inherently more insulated from Russian flows being cut off, as Canada, the United States, and Mexico are all substantial producers.

However, the difference in price movements resulting from those factors has pushed Brent prices to trade at the highest premium versus WTI prices since May 2020. That discount is encouraging a preference for buyers to source US oil, evidenced by a recent uptick in exports from the United States, according to data from the Energy Information Administration (EIA). In fact, exports hit the highest level since July 2021 for the week ending March 18 (see chart below).

Tonight, the EIA will report updated information on inventory and exports for the week ending March 25. The data will spread further light on the global energy situation. If the increase in exports continues, that could lead to a larger-than-expected draw in inventory levels. If so, that could shrink WTIs discount over Brent prices. Analysts see crude oil stocks decreasing by just over 1 million barrels. Moreover, the ongoing situation in Ukraine and the Covid outbreak in China may have a larger impact on broader price direction.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Review: Is FxPro Reliable?

Founded in 2006, FxPro is a reputable UK-based broker, trading on various market instruments. In this article, we will help you find the answer to one question: Is FxPro reliable?

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator