简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Which Trading Tools Secure Loyal Customers?

Abstract:UFX Partners' Thomas G. Williams weighs in on features and aspects that make the difference in trading platforms

With a recent proliferation of trading platforms, and a consequential necessity to both secure our existing customers and attract new ones, the tools that we can offer are crucial. I want to highlight here the tools that I have found most useful in this regard.

Regulation

The most essential element of any business is ensuring that its customers are secure, and that their personal details and financial information remain confidential.

The regulatory framework should ensure that online platforms provide clear information

In this regard, its worth bearing in mind the comments made by Alex Chisholm, CMA Chief Executive, in October 2015, when he delivered the following remarks: “The regulatory framework should ensure that online platforms provide clear information on how they operate, and what their responsibilities are, so consumers can make informed choices.”

We find that by displaying the regulation information prominently on the homepage, customers are immediately put at ease.

Cashback Scheme

Whilst many, if not all trading platforms, offer an opening bonus to entice customers, this is not a reward system that is likely to maintain customer loyalty.

I have found that traders are far less likely to be interested in a one-off bonus than a constant cashback scheme, simply because the cashback allows traders to earn money by trading, which is the exact reason they had for joining the Trading Platform in the first place.

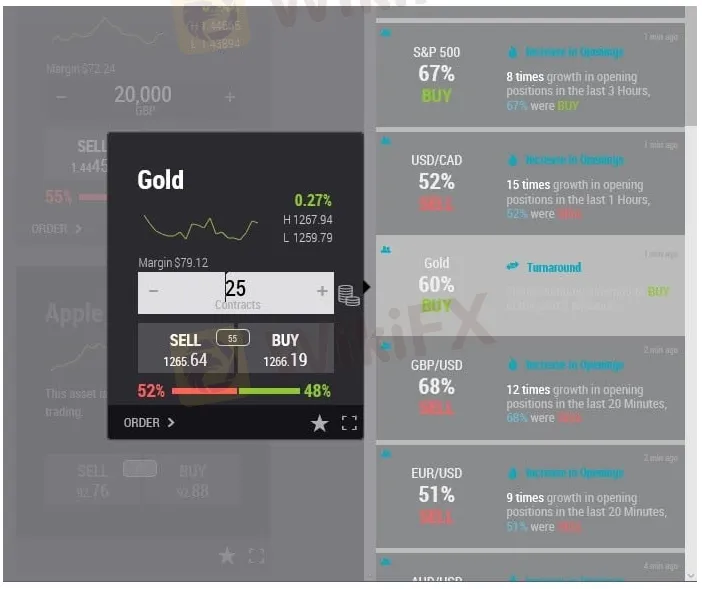

Simple Trading

From experience, I can say with certainty that a trader dislikes nothing more than the inability to place a trade because the platform has created too many obstacles. It is essential that trading is simple to effect, with all the guidance and charts available providing assistance, rather than hindrance.

The maxim that I try to bear in mind is whether the trader is able to place a trade from any page on which they find themselves, whether that be a graph or trend.

Access to Information

Customers like nothing less than having to access numerous sites to locate the information that they require to place a trade. A broker needs to ensure that a customer has access to every bit of information that he/she requires, and the less a trader relies on other forums, the more likely they are to return to the trading site time and time again.

A daily blog with a market update, graphs that can be altered to show the desired timespan, or simple trading trends all provide the information that all of our customers require.

Bottom Line

The tools that a company offers should be designed with the customer in mind. They need to be simple to use, informative, and most importantly, designed to inspire customer loyalty.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Will the Euro and US Dollar Reach Parity in 2025?

Euro-dollar parity sparks debate again as 2025 approaches, with multiple factors shaping the exchange rate outlook.

US Dollar Surge Dominates Forex Market

The global forex market continues to show volatility, with the U.S. dollar fluctuating last week but overall maintaining a strong upward trend. How long can this momentum last?

Oil Prices Soar for 5 Days: How Long Will It Last?

Last week, the global oil market saw a strong performance, with Brent crude and WTI crude prices rising by 2.4% and around 5% respectively. Oil prices have now posted five consecutive days of gains. But how long can this rally last?

How Big is the Impact of the USD-JPY Rate Gap on the Yen?

The U.S. Federal Reserve's repeated rate cuts and the narrowing of the U.S.-Japan interest rate differential are now in sight. So, why is the U.S.-Japan interest rate differential so important for the yen’s safe-haven appeal, especially when global economic uncertainty rises?

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator