简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

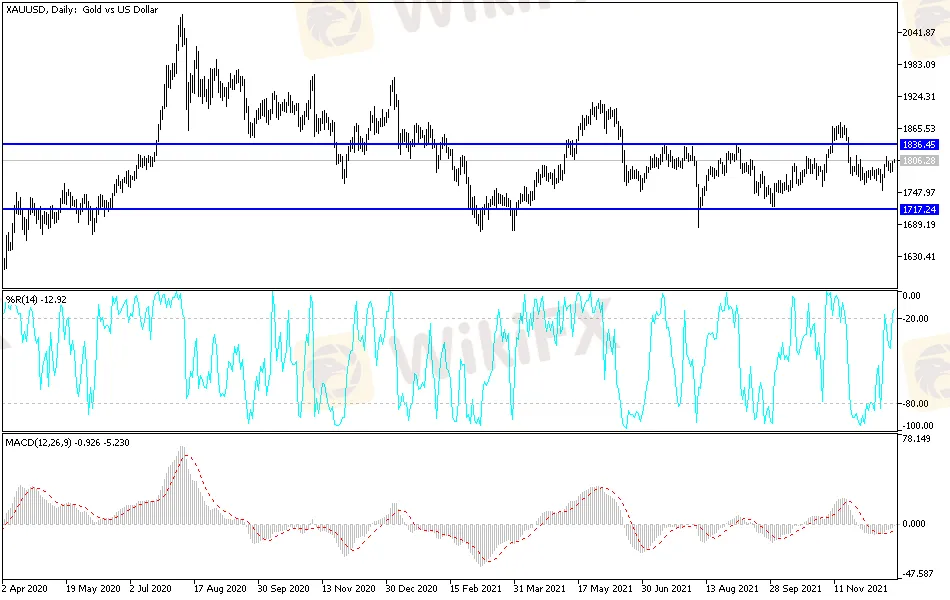

Gold Technical Analysis: New Bullish Momentum

Abstract:The US dollar's gains stopped, which helped gold prices move upwards, stabilizing around the level of $1808 as of this writing. Prices stabilized as investors headed towards the end of the year holiday. Risk sentiment remains the same as Omicron's concerns have eased somewhat and US President Biden said a deal could still be reached with Senator Joe Manchin to push the $2 trillion Build Back Better bill through Congress.

The US dollar's gains stopped, which helped gold prices move upwards, stabilizing around the level of $1808 as of this writing. Prices stabilized as investors headed towards the end of the year holiday. Risk sentiment remains the same as Omicron's concerns have eased somewhat and US President Biden said a deal could still be reached with Senator Joe Manchin to push the $2 trillion Build Back Better bill through Congress.

There are indications that the US and UK are not heading towards widespread shutdowns as previously feared. US President Joe Biden announced more federal vaccination and testing sites to combat the winter surge in Covid-19 infections, while British Prime Minister Boris Johnson ruled out stricter pandemic rules before Christmas.

Meanwhile, media reports indicate that the US Food and Drug Administration may authorize two Covid-19 pills from Pfizer Inc. and Merck & Co. Inc. As soon as this week.

On the economic side, according to official figures, the US economy grew at a rate of 2.3% in the third quarter, which is slightly better than previously thought. But the prospects for a strong recovery in the future are clouded by the rapid spread of the latest type of coronavirus. The third and final look at the performance of GDP, the country's total output of goods and services, was higher than last month's estimate of 2.1% growth.

The newfound strength came primarily from stronger consumer spending than previously thought, as well as companies rebuilding their inventories more than initial estimates revealed. The third-quarter gain of 2.3% came on the heels of explosive growth that began the year as the country emerged from the pandemic, at least economically. Growth jumped to 6.3% in the first quarter and 6.7% in the second. The emergence of a summer delta variant was blamed for much of the slowdown in the third quarter.

US consumer confidence increased this month as Americans shrugged off concerns about price hikes and the highly contagious COVID-19 omicron variant. The Conference Board, a trade research group, said its consumer confidence index - which takes into account consumers' assessment of current conditions and their expectations for the future - rose to a reading of 115.8 in December, the highest reading since July. In November, it scored 111.9. Consumers' view of current conditions has softened slightly, but their outlook for the next six months is brighter.

Their inflation forecasts have actually fallen this month - possibly due to lower gasoline prices in recent weeks - even though the government reported that prices rose in November at the fastest annual rate since 1982.

Technical Analysis

Stability of the gold price around and above the 1800 psychological resistance is still supporting a bullish trend, thus increasing the opportunity for buying and moving towards the levels of 1818, 1827 and 1845. On the downside, the $1775 support level will remain crucial for a bearish trend. I still prefer buying gold from every bearish level. Bear in mind that the approaching holidays affects the stability in the markets with weaker liquidity, and therefore unstable movements.

It is better to close all investment deals before the closure to avoid price gaps in one direction after the holidays, as the epidemic carries many surprises for the markets and investors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HTFX Clone Firm Exposed

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

TradeExpert: A Forex Broker Under Scrutiny

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

WikiFX Review: Is IQ Option trustworthy?

IOTA Leads Blockchain Innovation in Southeast Asia by 2025

Currency Calculator