简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Markets Week Ahead: Dow Jones, Nasdaq 100, US Dollar, Yen, AUD/USD, RBA, USD/CAD, BoC

Abstract:Dow Jones, S&P 500 and Nasdaq futures slipped 0.89%, 1.42% and 2.25% respectively. The VIX market ‘fear gauge’ closed at its highest since February. In the Asia-Pacific region, the Nikkei 225

Markets Week Ahead: Dow Jones, Nasdaq 100, US Dollar, Yen, AUD/USD, RBA, USD/CAD, BoC

Global market mood soured last week, extending a slump since November. On Wall Street, Dow Jones, S&P 500 and Nasdaq futures slipped 0.89%, 1.42% and 2.25% respectively. The VIX market ‘fear gauge’ closed at its highest since February. In the Asia-Pacific region, the Nikkei 225, Hang Seng and ASX 200 dropped 1.98%, 1.27% and 2.20% respectively. Conditions were relatively tame in Europe, with the FTSE 100 gaining 0.39% as the DAX 40 fell 0.67%.

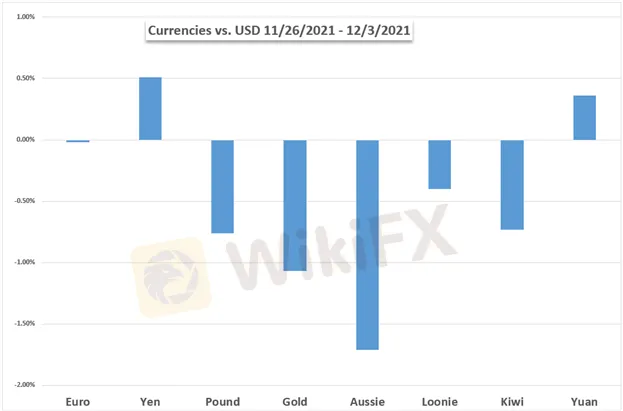

Risk aversion meant that forex traders flocked into the safety of the highly liquid US Dollar, which soared against the Australian and New Zealand Dollars. The similarly-behaving Japanese Yen and Swiss Franc also outperformed. Taking a look at commodities, growth-linked crude oil prices softened, extending a bear market. Gold prices managed to hold some ground, capitalizing on a further decline in longer-term Treasury yields.

Driving the worrying mood in sentiment appears to be a combination of the emerging Omicron Covid-19 variant and the Federal Reserve‘s hawkish pivot. This past week, Chair Jerome Powell retired the word ’transitory‘ from describing inflation estimates. Policymakers at the central bank have also expressed the possibility for tapering quantitative easing faster than anticipated. This follows persistently elevated inflation readings in the world’s largest economy.

Speaking of inflation, the US will release the next CPI report on December 10th. Headline inflation is expected at a whopping 6.8% y/y in November, up from 6.2% in October. That would be the highest rate in almost 40 years. The core reading, which excludes energy and food items, is estimated at 4.9% y/y from 4.6% prior. Further upside surprise could increase hawkish Fed policy bets for 2022, risking volatility in markets.

Outside of the US, AUD/USD traders will be eyeing the Reserve Bank of Australias last interest rate decision of the year. For USD/CAD investors, the Bank of Canada is also on tap. Both central banks are not expected to adjust benchmark lending rates, so investors will be tuning in to gauge their outlook for 2022 and how policy could shape up. Meanwhile, Chinese stocks that are listed on US exchanges continue bracing for volatility on delisting concerns. What else is in store ahead?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator