简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Few reasons why Ethereum decoupling from Bitcoin might have to wait

Abstract:Ethereum has comfortably established itself above the $4500-mark, while Bitcoin continues to trade north of $65000.

Ethereum has comfortably established itself above the $4500-mark, while Bitcoin continues to trade north of $65000. Now, even though the top two assets have more or less similar quarterly ROIs, BTC charted 49% three-monthly ROI v. USD while ETH reaped 55% ROI over the same timeframe.

Here, it can‘t be denied that Bitcoin has largely been the driving force behind the crypto-market’s gains.

BTC v. ETH

The ‘Ethereum flipping Bitcoin’ narrative has been around for quite some time now. However, ETHs straight-up northbound movement since 1 October has further fueled the narrative that Ethereum could decouple from Bitcoin and also, flip the top asset.

Nonetheless, the fact remains that “Bitcoin is digital gold” is a much clearer and well-established narrative than “Ether is oil for Dapps.”

That being said, Bitcoin‘s market dominance and first-mover advantage have always fueled rallies triggered by BTC’s price hike, followed by Ethereums and then, other altcoins.

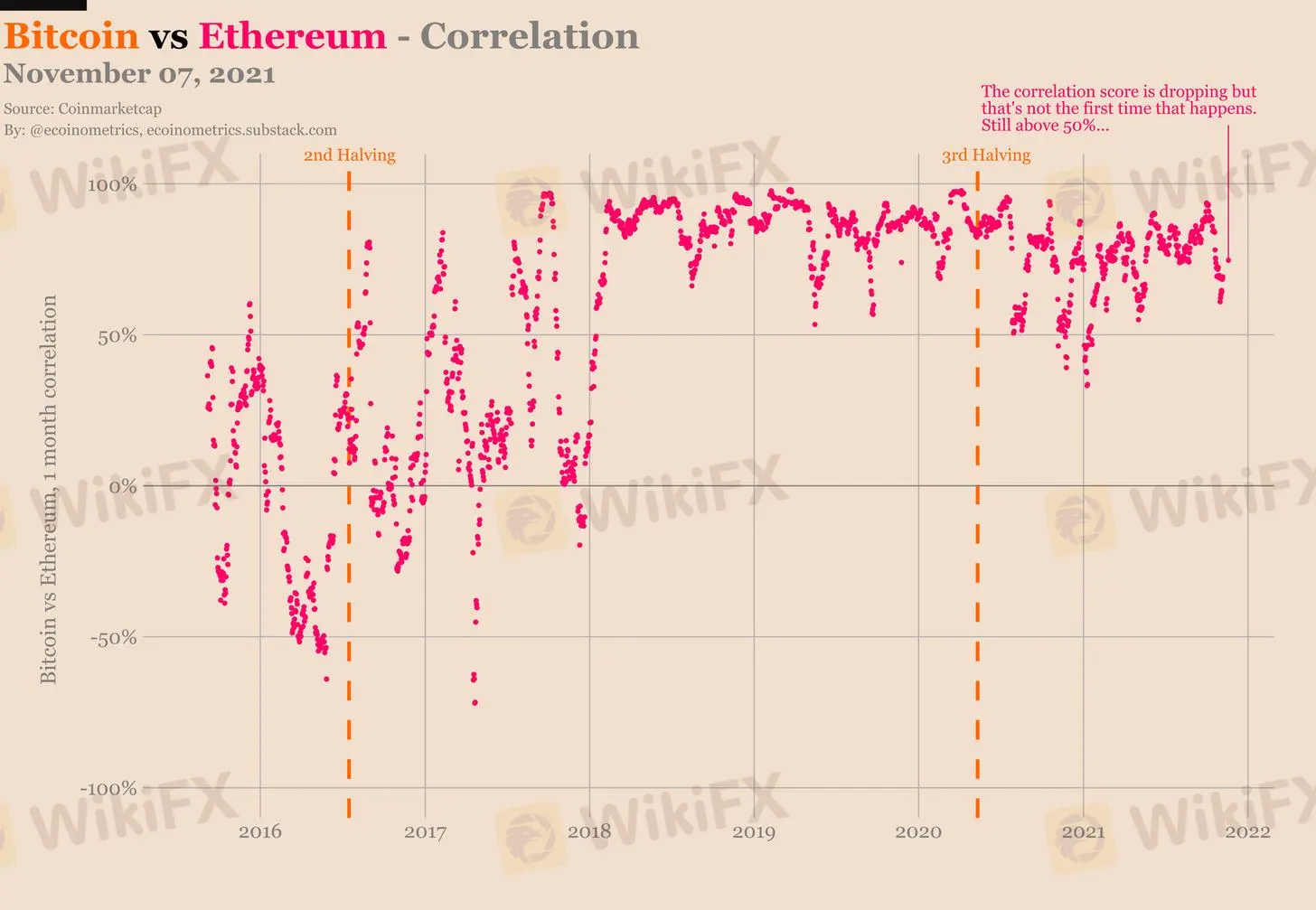

In fact, most cryptos, especially Etherum, still have a high correlation with BTC.

Notably, while the BTC v. ETH correlation score seemed to be dropping, it still held above 50%.

Now, towards the beginning of November, the ETH-BTC one-month realized correlation went down to as low as 60%. However, it soon picked up. At the same time, while the one-month correlation is still pretty low in relative terms, it has high values, having climbed as high as 93% over the last month.

Decoupling might have to wait?

Looking at the price action of the top two assets, in terms of recovery, ETH has performed better than BTC. Bitcoin is up by 7.2x this cycle, which is still much below the peak of 29.5x in the previous cycle. Even so, the same was much higher than the bottom multiplier of the previous bear market at 4.9x.

On the contrary, Ethereum is up by 24.3x, also below its peak of 120x in the previous cycle, but above the bottom multiplier of 7.2x in the previous bear market.

This, however, puts Ethereum ahead of Bitcoin in terms of its recovery run.

While BTC is digital gold, can the narrative of ‘Ethereum: Powering the Metaverse’ change the game for ETH? Well, seems like the network might not be ready for the same.

As highlighted by a recent Ecoinometrics report, Ethereum‘s current state of the network “isn’t ready to power any kind of Metaverse at scale.” Why? Well, mostly because very few people are going to use NFTs for gaming purposes if interacting with them costs $100 to $200 in gas on average.

This means that Ethereum will need mature L2 ecosystems to operate at scale, which isnt happening in the near future.

That being said, looking at their relative price, ETH/BTC is still 50% below the all-time high it set in 2017.

Notably, while ETH recovered and rallied better than BTC, it also fell harder during the bear cycle. Additionally, BTC gains have been key to triggering market-wide rallies and even Ethereum recovery.

So, looks like Ethereum decoupling from BTC still looks like a distant dream. However, the top two assets could have a more parallel trajectory.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator