简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

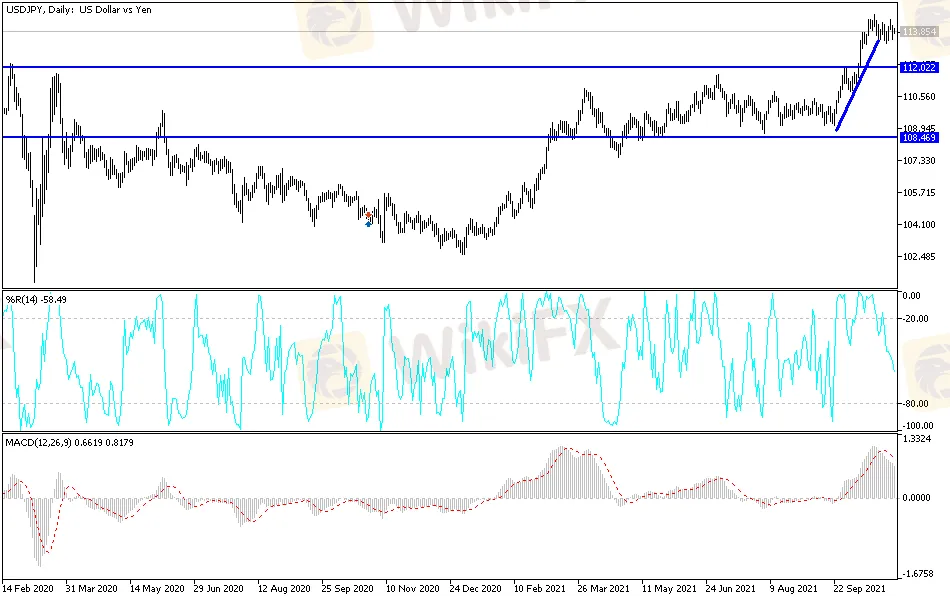

USD/JPY Technical Analysis: Awaiting FOMC with Bated Breath

Abstract:All financial markets, not just the USD/JPY, are cautiously waiting for what the US Federal Reserve will announce later today. Prior to this event, the currency pair was subjected to selloffs that pushed it towards the 113.46 support level, ceding slightly its gains above the 114.00 psychological resistance that often supported the upward path of the currency pair throughout the last month's trading.

All financial markets, not just the USD/JPY, are cautiously waiting for what the US Federal Reserve will announce later today. Prior to this event, the currency pair was subjected to selloffs that pushed it towards the 113.46 support level, ceding slightly its gains above the 114.00 psychological resistance that often supported the upward path of the currency pair throughout the last month's trading.

The dollar rose 2.3% against the Japanese yen during the month of October, bringing the 2021 year-to-date gains to nearly 9.5%. The BoJ will lag most high-income countries in the tightening cycle, and higher US yields are a critical driver of the dollar's gains against the yen. Japan's headline inflation and core metric, which excludes only fresh food, may be on the rise, but they are barely above zero, in any case, due to the rise in energy prices. In response to the weak yen, Japanese investors seem to have boosted their investments in foreign bonds, while foreign investors have increased their holdings of Japanese stocks. On the other hand, the Liberal Democratic Party and the Komeito Party maintained a majority in the House of Representatives. A large supplemental stimulus budget is expected to help boost the economic recovery now that the official emergency has been lifted.

Economic growth in the United States slowed more than expected in the third quarter to the weakest pace in the pandemic recovery period as faltering supply chains and an increase in COVID-19 cases slashed spending and investment. According to official figures, the US gross domestic product grew at an annual rate of 2 percent after a pace of 6.7 percent in the second quarter, and the slowdown reflected a sharp decline in personal consumption, which grew at a pace of only 1.6 percent after a rapid jump of 12 percent in the previous period. Shortages, transportation bottlenecks, price hikes and the delta variant of the coronavirus have all affected spending on goods and services.

The Treasury said this week that it plans to borrow $1.02 trillion this quarter, the largest amount since the government began passing $1 trillion rescue packages to the economy in the spring of 2020. The Treasury said the borrowing estimate for the first quarter of October and December would follow $103 billion in actual borrowing in the July-September quarter, the period in which the debt limit came back into effect after being suspended for two years.

Treasury officials said they expect to borrow another $476 billion in the next quarter from January to March.

Borrowing $1.02 trillion for the current quarter is the largest since the government borrowed $2.75 trillion in March 2020 after the COVID pandemic shut down the economy and pushed millions of people to work. Congress has begun passing more than $1 trillion in rescue packages to cushion the economic blow from the shutdowns.

Technical Analysis

According to the performance on the daily chart, the USD/JPY will remain stable around the 114.00 psychological resistance, supporting the bullish trend and motivating the bulls to move towards stronger highs, the closest of which are the resistance levels at 114.75, 115.60 and 116.30. This is especially true if the expectations of raising US interest rates come as desired by the markets. On the downside, breaking the 113.00 support motivates the bears to launch and change the direction of the pair, which is still bullish.

The currency pair will be affected by the announcement of the ADP reading to measure the change in US non-farm employment, then the ISM purchasing managers index for services, ending with the important monetary policy decisions of the US Federal Reserve and the statements of Chairman Jerome Powell.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator