简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Natural Gas Holds Key Technical Support, Path of Least Resistance Remains Higher

Abstract:NATURAL GAS, ENERGY, INFLATION, WHITE HOUSE, FEDERAL RESERVE, INFLATION – TALKING POINTS

Natural Gas Holds Key Technical Support, Path of Least Resistance Remains Higher

NATURAL GAS, ENERGY, INFLATION, WHITE HOUSE, FEDERAL RESERVE, INFLATION – TALKING POINTS

Natural gas futures climbed as much as 7% on Thursday before cooling off

Forecasts for milder weather across the US eased upward momentum

Inventories remain low, with stockpile growth offering a negative surprise

Natural gas prices continue to climb as market participants grow weary of low stockpiles ahead of the winter season. Global energy prices have soared of late, with large supply shortages now threatening the post-pandemic economic recovery. Major factories have been forced to close across Europe as rising energy costs have reduced the ability to produce products profitably. Rising gas prices have caught the attention of the White House, with top officials meeting to discuss solutions to alleviate domestic price pressures.

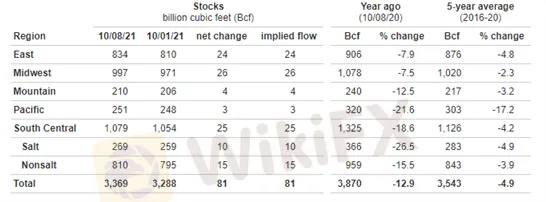

WEEKLY US NATURAL GAS INVENTORIES

Courtesy of the EIA

A US government report Thursday showed natural gas inventories posted a smaller-than-expected gain, further stoking fears of a widespread shortage over the winter months. For the week ending 10/8, inventories grew by 81 billion cubic feet (Bcf), short of the median Bloomberg estimate of 94 Bcf. The current month futures contract reached an intraday high of $5.964 per million British thermal units, but settled lower as mild temperatures look set to sweep across much of the United States in the coming days. An additional report from the Energy Information Administration noted that US homeowners could be facing the highest winter energy bills since 2007-08, which will place additional pressure on the Federal Reserves “transitory” stance on inflation.

HENRY HUB NATURAL GAS FUTURES (DAILY TIMEFRAME)

Chart created with TradingView

Natural gas futures crucially held key trendline support during the recent pullback, indicating that the uptrend may continue in the near-term. Front-month futures pulled back in early October after a brief test of the 2014 high of $6.493, finding support in the form of an ascending trendline. With the uptrend remaining intact, price may look to break back above $6.00 en route to a retest of the 2014 high. The fundamental outlook remains constructive for higher prices, despite efforts by politicians to increase supply to the market. Should price reverse lower through trendline support, price may gravitate toward the psychological $5.00 level before it eyes the 50-day moving average below.

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator