简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

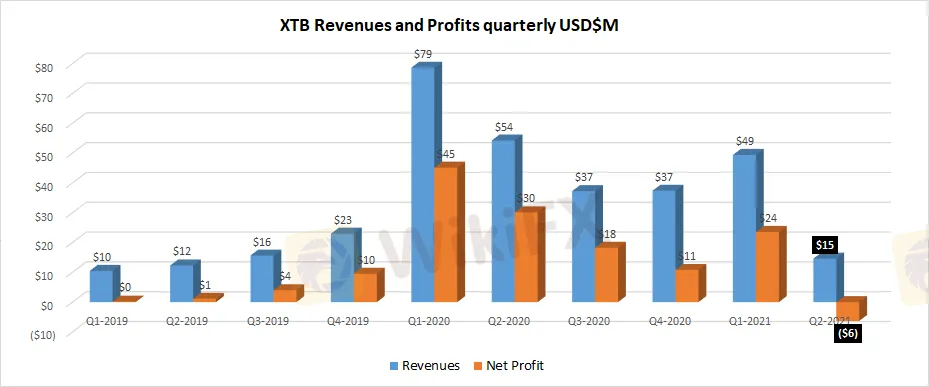

XTB shares plummet 25% after posting $6M Q2 loss, 70% revenue drop

Abstract:Retail FX and CFDs brokerage group XTB has just reported its financial results for Q2, including a loss of PLN 23.9 million (USD $6 million) for the quarter after revenues dropped by 70% QoQ, coming in at PLN 55.2 million (USD $15 million) versus PLN 186.7 million in Q1.

Retail FX and CFDs brokerage group XTB has just reported its financial results for Q2, including a loss of PLN 23.9 million (USD $6 million) for the quarter after revenues dropped by 70% QoQ, coming in at PLN 55.2 million (USD $15 million) versus PLN 186.7 million in Q1.

As a result, shares of XTB (WSE:XTB) were trading down by more than 25% in early trading on the Warsaw exchange, at a 52-week low of PLN 12 per share (yesterdays close was PLN 16.57).

After a good first quarter of 2021 at XTB, when the Group generated PLN 186.7 million in operating revenues, the second quarter (April and May) brought low volatility on the financial and commodity markets, which translated into a decline in revenues and profitability per lot. Along with lower volatility, the transaction activity of clients also decreased. There was a more predictable trend with the market moving within a limited price range. This led to market trends that were more likely to be predicted than in the case of greater market volatility, which created favorable conditions for range trading.

In this case, XTB recorded a greater number of transactions at a loss, which led to a decrease in XTB‘s market making result. As a consequence, the profitability per lot amounted to PLN 63 and reached the lowest level in the last 5 years. Since XTB’s presence on the WSE, a lower level was recorded only in the second quarter of 2016 -PLN 59, which only confirms the exceptional nature of the last quarter.

From the point of view of the conditions in the financial markets in the first half of this year the company said that it is worth noting that this was the period in which the upward trend in the cryptocurrency market continued until mid-May. This market is characterized by the fact that clients investing in CFDs on cryptocurrencies are willing to hold their open positions much longer and not close profits in a short time, as in the case with other instruments. Such market characteristics had a negative impact on the Groups revenues (PLN 46.6 million loss on CFDs on cryptocurrencies in the first half of 2021).

As a consequence, in mid-May this year XTB has decided to change the business model for CFD instruments based on cryptocurrencies, i.e. fully securing the market position on cryptocurrencies. Currently, the entire open position of the company on these instruments is covered in hedging transactions with liquidity providers. The company plans to maintain this model indefinitely. The negative result from CFDs on cryptocurrencies can be attributed to the period when the market making model was still used, and the cryptocurrency markets continued to grow dynamically. When there is a correction in these markets in the second half of May, the market position of XTB was almost completely reduced.

The group also reported a decrease in revenues on CFD instruments based on oil and precious metals. During the period, these instruments recorded upward trends, but it was largely due to long positions concluded by XTB clients. Additionally, in the case of oil-based instruments, the extent of price movement was lower than in the previous quarter.

- END -

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator