简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

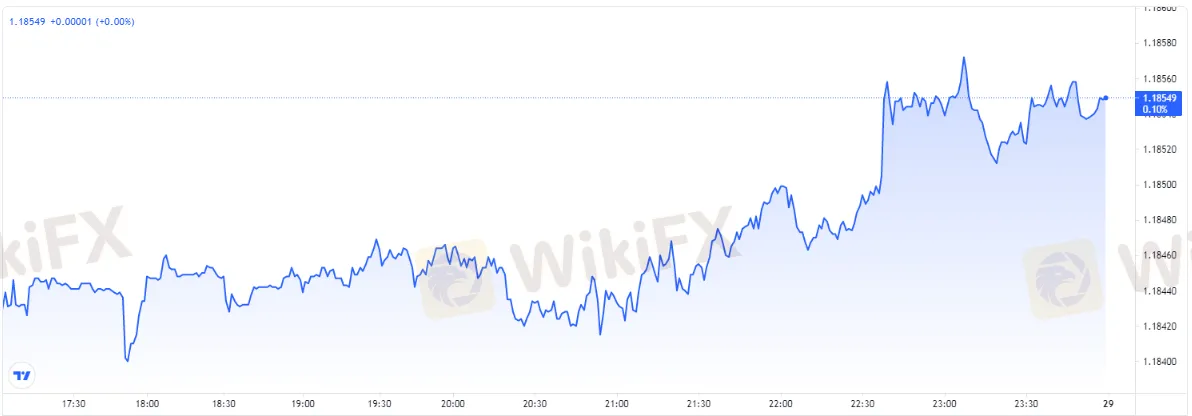

EUR/USD refreshes daily high above 1.1850 ahead of EU data

Abstract:1. EUR/USD continues to notch higher on Thursday in the Asian session 2. US Treasury yields undermine the demand for the US dollar. 3. US Dollar Index retreats towards a two-week low on Powell’s comments.

The selling tone surrounding the US dollar amid falling US Treasury yields keeps EUR/USD on the verge of daily gains. After touching the low of 1.1753, the pair continues to march higher since the beginning of the week

At the time of writing, the EUR/USD is trading at 1.1855, up 0.11% on the day.

The successive gains in EUR/USD were primarily credited to the downbeat performance of the US dollar. The US Dollar Index (DXY), which tracks the performance of the greenback against the six majors, remained on the backfoot amid falling US Treasury yields. The tug of war between growth and inflationary concerns took a toll on Fed‘s latest monetary policy’s meeting.

The Fed left the target range for its federal rates unchanged at 0-0.25% and assets purchasing also remained unchanged at the current pace of $120 billion.

In addition to that, Fed Chair Jerome Powell cautioned that although there has been substantial improvement in the economy still there is a way to go before the central bank would adjust its ultra-accommodative policy, which also kept investors away from the US dollar.

On the other hand, the single currency is boosted by the upbeat economic data and general risk-on mood. The IHS Markit Eurozone Composite PMI rose to 60.6 in June from 59.5 in the previous month.

Being said, the stronger economic data in the US and Eurozone improved the risk appetite and drove market participants towards riskier assets. The risk-on market sentiment favors EUR/USD upside gains.

The important data on the economic calendar to look out for would be the EURO Unemployment Rate, Consumer Confidence data, and German Haromized Inflation Rate. The US Gross Domestic Product (GDP) and Initial Jobless Claims would also be on the traders radar.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator