简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly Fundamental US Dollar Forecast: When Will Fed Raise Rates or Taper?

Abstract:FUNDAMENTAL FORECAST FOR THE US DOLLAR: NEUTRAL

The US Dollar (via the DXY Index) has been creeping higher throughout July, even as US Treasury yields and Fed rate hike expectations have pulled back.

The Federal Reserves resolute stance that inflation is “largely transitory” will remain well-anchored coming out of the July FOMC meeting; all eyes are on the August Jackson Hole gathering.

The US Dollar (via the DXY Index) has been overcoming naysayers, doubters, and even negative seasonal trends as it has worked its way through July. Despite the pullback in US Treasury yields and Fed rate hike expectations, the greenback has seemingly benefited from delta variant concerns elsewhere around the world. Relatively speaking, the US is offering higher growth rates in the near-term as parts of Asia, Australia, and Europe move back towards lockdowns. The DXY Indexs close for the week produced its seventh highest close of 2021 (out of 149 trading days thus far).

US TREASURY YIELD CURVE (1-YEAR TO 30-YEARS) (JULY 2020 TO JULY 2021) (CHART 2)

Historically speaking, the combination of falling US Treasury yields coupled with dampened Fed rate hike odds has produced a difficult trading environment for the US Dollar. An otherwise typically difficult environment suggests that a more significant shift in capital is occurring globally: US equities are up, US bonds prices are up (yields down), and the DXY Index is trading higher.

US ECONOMIC CALENDAR LOADED WITH RISKThe move into the last week of the month brings forth an important smattering of event risk based out of the US. Several high rated economic releases alongside the July Federal Reserve policy suggest heightened activity in FX markets over the coming days.

On Monday, July 26, June new home sales data will be released followed by the July Dallas Fed manufacturing index.

On Tuesday, July 27, June US durable goods orders, the May US house price index, and the July US Conference Board consumer index are all due.

On Wednesday, July 28, the June US trade balance will be released in the morning followed by the results of the July FOMC meeting, as well as Fed Chair Jerome Powells press conference.

On Thursday, July 29, the initial 2Q21 US GDP report is due out alongside weekly jobless claims, while June US pending home sales will be released shortly after the US cash equity open.

On Friday, July 30, the June US PCE price index – the Feds preferred gauge of inflation – as well as June US personal income and personal spending data are due.

Based on the data received thus far about 2Q’21, the Atlanta Fed GDPNow growth forecast was slightly upgraded last week to +7.6% annualized from +7.5%. Following the US housing data, “the nowcast of second-quarter real residential investment growth increased from [-8.7%] to [-8.1%].” The next update to the 2Q21 Atlanta Fed GDPNow growth forecast is due on Tuesday, July 27.

According to a Bloomberg news survey, market participants are expecting to see a print of +8.6% annualized when the initial 2Q21 US GDP report is released on Thursday.

JULY FED MEETING TYPICALLY OVERLOOKED…The July FOMC meeting will conclude on Wednesday, and given the uptick in concerns around the delta variant, the upcoming meeting – typically overlooked as it falls between the June FOMC (which brings a new Statement of Economic Projections (SEP)) and the August gathering in Jackson Hole, Wyoming – may draw heightened interest.

FEDERAL RESERVE INTEREST RATE EXPECTATIONS (JULY 20, 2021) (TABLE 1)

Ahead of the July FOMC meeting, Fed funds futures are pricing in 2% chance of a25-bps rate cut at the forthcoming meeting – immaterial. Notably, however, longer-dated expectations have come down considerably. In fact, one month ago, Fed funds futures were discounting a 63% chance of a 25-bps Fed rate hike in September 2022; those odds have since fallen to 37%. Meanwhile, December 2022 is now the favored month for the first rate move, clocking in with a 68% chance.

The decline in Fed rate hike expectations can examined from another angle. We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the August 2021 and December 2023 contracts, in order to gauge where interest rates are headed in the interim period between August 2021 and December 2023.

EURODOLLAR FUTURES CONTRACT SPREAD (AUGUST 2021-DECEMBER 2023): DAILY RATE CHART (FEBRUARY 14 TO JULY 23, 2021) (CHART 3)

At their July high following the June US nonfarm payrolls report, there were 103-bps worth of rate hikes discounted by December 2023; now, there are just 78-bps priced-in. Markets are taking a less hawkish view of the FOMC: a full rate hike has been wiped off the board over the course of the month. Consistent with this view, the 2s5s10s butterfly – which tracks non-parallel shifts in the yield curve – has reverted, another indication that bond markets are interpreting a less hawkish Fed.

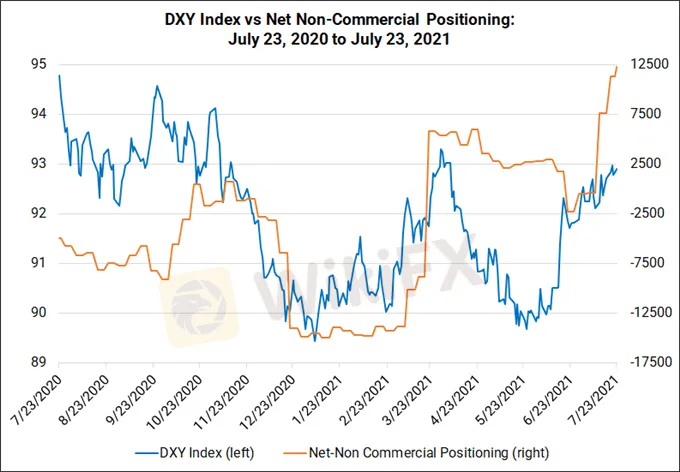

CFTC COT US DOLLAR FUTURES POSITIONING (JULY 2020 TO JULY 2021) (CHART 4)

Finally, looking at positioning, according to the CFTCs COT for the week ended July 20, speculators increased their net-long US Dollar position to 12,225 contracts. Net-long US Dollar positioning is now at a 52-week high, and is at its highest level since the last week of May 2020.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

One article to understand the policy differences between Trump and Harris

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator