简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

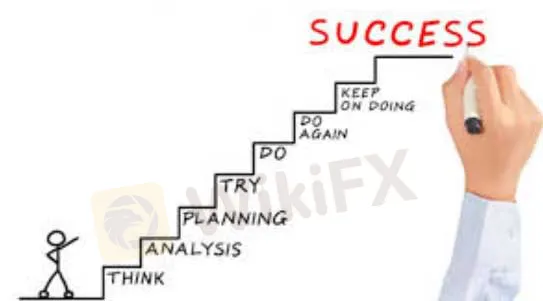

Key to Successful Forex Trading!

Abstract:How can traders be aware of their trading abilities?

Although many virtuosos strut their stuff in the forex market, others tell a different story. How can traders be aware of their trading abilities? WikiFX has summarized several points herein for your reference to help you have a better understanding of your competence and incompetence, assisting you to improve your transactions!

1. Outstanding traders observe trading charts and review their transactions every day. They verify their ideas and trading patterns based on markets at any time.

2. Brilliant traders theoretically understand signals and relevant risks, equipping themselves with methods of avoiding risks, even if the number of signals they are specialized in is not numerous. As for mediocre ones, they know plenty of signals and are prone to cutting-edge techniques instantly used in practice, but they only have a smattering of understanding in this regard.

3. Effective trading systems are more significant than countless approaches from the perspective of excellent traders as high-quality systems are conducive to emotional stability and the exclusion of wrong signals.

4. Virtuosos clearly understand the risk tolerance of their positions, strictly setting up stop-profit and stop-loss points. They decidedly exit the market when it is unfavorable.

5. Standouts have clear plans before trading because they are on their guard against losses. Mediocrities often conduct operations in face of signals, thus discarding their plans!

Download WikiFX to get lessons from experts who have traded forex for over 20 years. (bit.ly/wikifxIN)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Scalping vs Day Trading: What are the Differences

Discover the differences between scalping and day trading in this informative blog post. Learn about their unique strategies, risks, and benefits to help you decide which trading style is best for you.

A Trading Fallacy Regarded as a Myth!

Several trading fallacies considered to be correct are disclosed herein in a bid to help you get away from mistakes.

Scalping in Forex Trading: A Dangerous Game!

Scalping is not an ideal trading method, so employing it in conjunction with other approaches flexibly is better than on its own.

Most Lucrative Techniques in Forex Trading

As forex trading is gradually booming, various trading methods are springing up on the market.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator