简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dollar Gets Its Last Chance This Week to Mount a Reversal Via Inflation

Abstract:Nasdaq, AMC, USDJPY, Dollar and USDCAD Talking Points:

While the S&P 500 joined the Nasdaq 100 in marked an increasingly extreme level of inactivity, there remains a heighted speculative appetite for assets like AMC

A surprise tumble from the Japanese Yen, pushing pairs like USDJPY and EURJPY through technical boundaries, will need assistance to translate into momentum

Top event risk to end the week is the Fed‘s favorite inflation indicator, the PCE deflator, which can tap into fear for ’risk assets or confidence for the Dollar

Most of the benchmark risk assets are comfortable with slipping into the warm and still waters of pre-holiday weekend trade, but there remain certain outliers and event risk that traders would do well to track closely. On the data side, Friday‘s US PCE deflator touches upon one of the most heavily discussed fundamental themes of the past weeks: inflation and the outlook for Fed monetary policy plans. Meanwhile, there are specific assets that reflect retail interest and unique fundamental interest that seem to be making a concerted effort to overlook the flashing light from the market-at-large. While possible to charge the market in a last-minute surge in volatility, it seems an improbable course; and these exceptions to the rule are far more likely to see the market dry up beneath them. For a baseline of activity across the market, the S&P 500 joined the Nasdaq 100 in carving out an extremely restricted trading range this past session. The span over the past three trading days was the smallest we’ve seen since December 2019 – the combination of holidays and quiet pre-pandemic period. While its possible the markets may find some heat before liquidity is totally drained, the potential impact is greater in a bearish resolution than bullish given the long-term bullish bias (a balancing move).

Chart of the Nasdaq 100 with 20 and 200-Day Moving Average and 1-Day Historical Range (Daily)

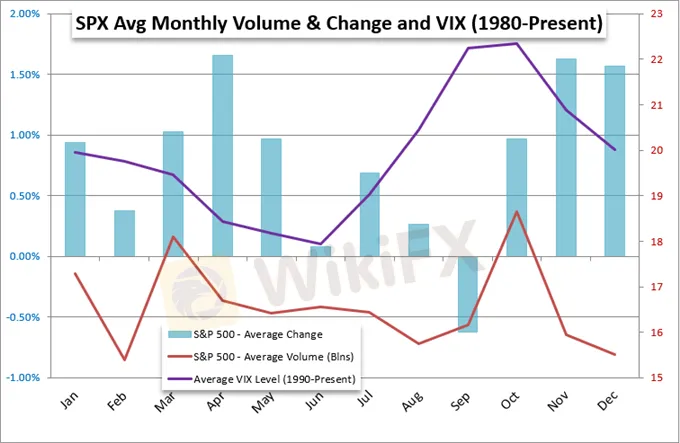

Ultimately, the market conditions we are heading to is a well-known curb in seasonal terms. Historically, June sees the lowest level of volatility of any calendar month for the S&P 500-derived VIX according to history. After the incredible 15-month, stimulus-driven recovery from the pandemic; it is reasonable to expect the market to be cautious in further advance. There is certainly little fundamental discount to point to in order to inspire the ‘money on the sidelines’ that seems to always be available in abundance according to those with a permanent optimism over the outlook. Considering the doldrums often kick off in earnest around this period, it seems this holiday weekend is ready to serve expectations willingly. Again, if we are to break from these statistical norms, it is more likely to occur with a bearish move.

Chart of S&P 500 Performance, Volume and VIX Volatility by Calendar Month

While the broader market is called by the holiday siren song, there are still those traders that are new to trading – or simply looking to press any advantage – and willing to eschew historical norms. Considering cryptocurrencies are still consolidating (perhaps the institutional interest has hit critical mass to trade like a ‘normal’ market), the attention seems to be held on meme stocks. GameStop seemed to fall off the pace however with a ‘mere’ 4.8 percent advance while AMC accelerated. The cinema owner surged another 36 percent for a four-day rally that topped almost 150 percent intraday. This doesn‘t look to be deep value but rather a collaborative drive that has pushed volume over 700 million shares turnover. It’s possible to keep this ticker at these levels, so long as investors are willing to hold their leveraged positions for the indefinite future rather than book profit…

Chart of AMC Overlaid with GameStop (Daily)

Another remarkable move that came out of the blue was the Yen crosses‘ extraordinary charge. USDJPY rallied 0.6 percent Thursday in a move that caught majors observers by surprise. There are usually two reliable catalysts for this pair: risk trends or the Dollar. As we discussed above, there was very limited speculative appetite for assets with such limited response like carry trade. As for the Greenback, the currency eased back against most counterparts this past session. So, this was one of the rare times that the Japanese currency was taking matters into its own hands. This is genuinely a very unusual turn of events in the FX market – particularly when it is not exactly clear what drove it. There is some speculation that the MSCI’s de-listing of Japanese company tickers from the World Index and I remember the days when the Ministry of Finance and Bank of Japan intervened on behalf of the currency. Regardless, if the market doesnt come to agree on what leveraged the move, follow through will be very difficult to muster.

Chart of USDJPY Overlaid with an Equally-Weighted Yen Cross Index and 100DMA (Daily)

HOW ATTENTIVE ARE RISK TRENDS TO INFLATION TRENDS? FRIDAY‘S TOP EVENT RISK WILL SHOW US

Looking through the final full trading session of the week, there is one particular event that stands out as a capable candidate for generating last minute volatility: the PCE deflator. A derivative of a run of data from the Bureau of Economic Analysis that tracks consumer income and spending, it is the Federal Reserve’s preferred inflation indicator. The so-called ‘core’ measure which strips out volatile items hit a 1.8 percent annual pace in March and expected to accelerate to a lofty 2.9 percent tempo in this latest update – well above the central bank‘s target. While the Fed can absolutely live by its ’transitory‘ claim on price pressure on just one data point, markets will grow increasingly unnerved. I find it remarkable that lately there have been many more voices that state confidence in the FOMC’s views when over the past 10 years skepticism was extremely engrained. Speculation tends to support views that benefit the masses.

Chart of DXY Dollar Index Overlaid with US-Germany 10-Year Yield Spread and 20DMA (Daily)

If the PCE deflator does accelerate to the lofty tempo forecasted by economies – and especially higher – there will be a significant uptick in speculation that the Fed cannot be so sanguine about the charge in costs for goods and materials. All the remarks from various board members and Fed presidents this past week that suggests they could start discussing tapering soon will quickly find their way back to the top headlines. Whether or not this data can sway the markets so close to the Friday close remains to be seen. I would put more weight on the Dollar‘s sensitivity versus risk benchmarks like the S&P 500. If the data is notably short of expectations, the DXY’s stall at the top of its channel this past session will could push it readily back into its seven-day range. For pairs like EURUSD, that could be practical – though perhaps not particularly large a move. If the inflation stats rouse further fear and doubt of the central bank‘s ability to hold fast through the next two meetings (two weeks from now, a meeting on July 28th or the Jackson Hole Symposium in August), an attempt to revive a rally like USDCAD’s could be interesting. That said, I would expect more traction when liquidity returns next week, if there is any to be found.

Chart of USDCAD with 20-Day Moving Averages, COT Net Spec Positioning (Daily )

Stay tuned on WikiFX, more news coming soon!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator