简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Forecast: Gold Volatility Surging as Real Yields Tumble

Abstract:FALLING REAL YIELDS, RISING VOLATILITY TO FUEL GOLD RALLY -nGold outlook has brightened considerably over the last few weeks thanks to lower real yields - Gold price volatility is expected to continue accelerating higher as indicated by the GVZ Index - Inflation fears are rising quickly and stand to outpace modest rises in nominal interest rates

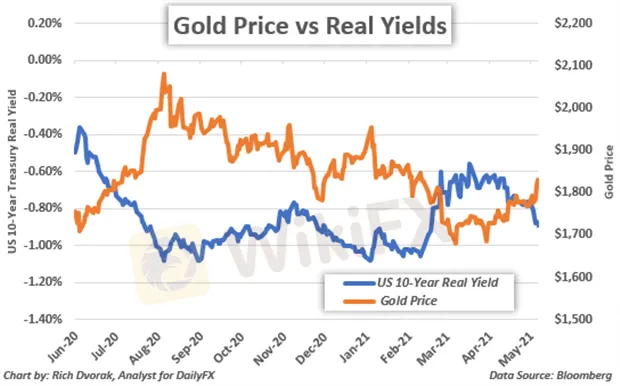

Precious metals like gold and silver have traded quite favorably over recent weeks. Gold price action, for example, has now climbed nearly 10% from its 08 March low around $1,680/oz. The strong rebound being staged by gold bulls seems to largely track the reversal lower in real yields. This has followed a sharp rise in inflation expectations, which is a trend that may persist and even outpace perkiness across nominal interest rates. Even with the ten-year Treasury yield recoiling 12-basis points higher off Fridays swing low, gold prices have been able to extend higher. That said, the Federal Reserve just released its monthly survey of consumer expectations earlier today, which detailed another rise in short-term inflation expectations from 3.2% to 3.4%.

GOLD PRICE CHART WITH TEN-YEAR REAL YIELDS OVERLAID: DAILY TIME FRAME (02 JUNE 2020 TO 10 MAY 2021)

Several other gauges of inflation have shown building price pressures, too. Five-year inflation swaps have risen above 2.5% to hit their highest reading since January 2018. Prices for major commodities have been ripping higher and threaten to weigh on consumers‘ pocketbooks. Business activity surveys like the ISM’s monthly PMI report have highlighted constrained supply chains and production bottlenecks that stand to seep into the economy. Even so, Fed officials have professed that rising inflation is likely to be transitory and how the central bank is willing to stomach modest inflation overshoots above the 2% average inflation target. This brings to focus high-impact inflation data due for release this coming Wednesday, 12 May at 12:30 GMT.

GOLD PRICE CHART WITH GVZ INDEX OVERLAID: DAILY TIME FRAME (10 JULY 2020 TO 10 MAY 2021)

Chart by @RichDvorakFX created using TradingView

Meanwhile, taking a look at the GVZ Index suggests that gold volatility is expected to continue accelerating higher. The GVZ Index reflects 30-day implied volatility for the SDPR Gold Trust ETF ($GLD). Broadly speaking, gold price action tends to move in the same direction of and hold a positive correlation with gold volatility. By extension of this generally direct relationship between gold prices and gold volatility, there could be enough bullish momentum behind the precious metal to challenge – and perhaps eclipse – its 200-day SMA. A reversal lower in expected gold volatility, however, could indicate that bulls are looking to unwind the recent rally.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

SEC Warns on Advance Fee Loan Scams in the Philippines

Russia Turns to Bitcoin for International Trade Amid Sanctions

Rs. 20 Crore Cash, Hawala Network, Income Tax Raid in India

Hong Kong Stablecoins Bill Boosts Crypto Investments

BEWARE! Scammers are not afraid to impersonate the authorities- France’s AMF said

Currency Calculator