简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Short-Term Trading Strategy with High Profit Ratio

Abstract:This paper will introduce several strategies that bring about a high-profit ratio.

WikiFX Strategies (23 Mar.) - Short-term forex trading is popular among investors for its little principal but high returns. This paper will introduce several strategies that bring about a high-profit ratio.

1. Trade on short-term support/resistance

It is the best approach to execute short-term trading, with the core lying in spotting the key prices and trading breakouts. The only thing you need to do for risk management is to put stop-losses above and below the key price levels. Stay assertive when exiting the market, otherwise, your short-term trading will turn into a long-term one.

2. Trade on the short-term trend

To gain as much as possible once the trend favors you. If the intraday trend is interrupted, you could open another position in the breakout direction. If a currency pair embraces three rallies within the same trendline, chances are the price will start trending clearer. At this time, what you need to do is to trade on it.

A stop-loss is also required, which should be set at the price around the third rebound. In the case of a promising trend, to place a stop-loss manually is acceptable. Such trades could last until the price breaks the trendline.

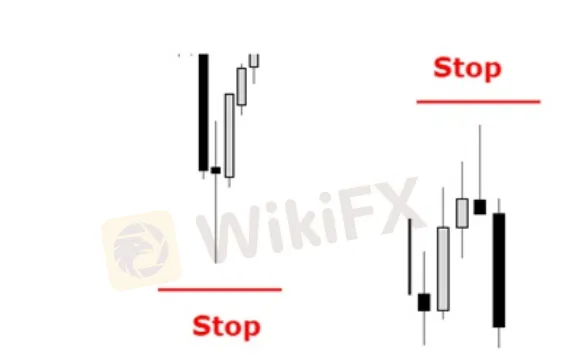

3. Candlestick patterns

The reversal pattern on the chart is the key issue, which is adopted as the trading signal with the time frame set to 1 minute, 5 minutes, and 15 minutes. An effective stop-loss often sits in the side where the reversal candlestick is opposite to the trade, including the candlestick wicks.

Download WikiFX (bit.ly/wikifxIN) to get lessons from experts who have traded forex for over 20 years.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

Quadcode Markets: Trustworthy or Risky?

5 Questions to Ask Yourself Before Taking a Trade

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator