简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Where Are the Oil Prices Headed in 2021?

Abstract:There’s a renewed optimism for a global economic recovery in 2021 on the news of distribution of vaccines in major economies across the world starting in few weeks’ time.

WikiFX News (13 Feb.)- There‘s a renewed optimism for a global economic recovery in 2021 on the news of distribution of vaccines in major economies across the world starting in few weeks’ time.

A high confidence in global economic recovery is, typically, considered to bring weakness in the US dollar. A falling US dollar on the back of global economic recovery & continued stimulus spending in the US, as well as other major economies, are bullish for oil prices. In addition, vaccines would allow people to resume life in a normal way supporting more consumption-led spending that would drive up the oil prices.

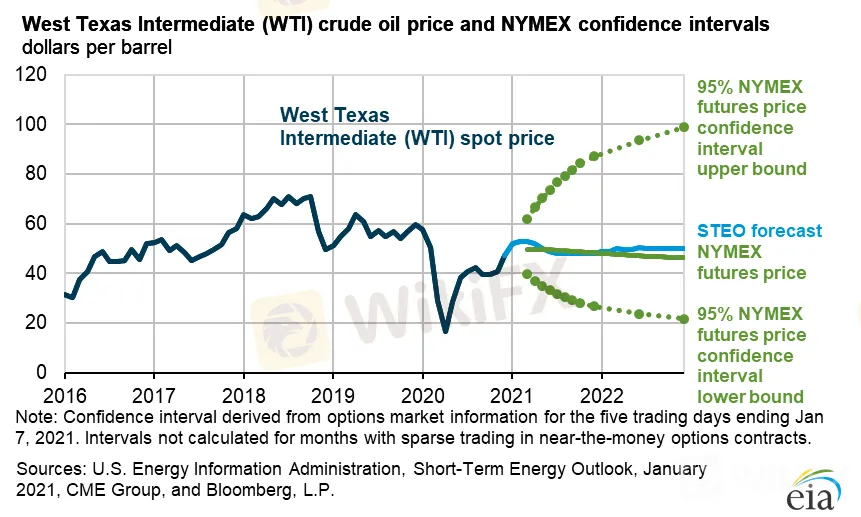

In the latest Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration or EIA indicates an average of $49/b for Brent in 2021 which is around 14% higher than the expected average for the fourth quarter of 2020. EIA expects that while inventories will remain high, they will decline because of the rising global oil demand and lower than expected increase in OPEC+ oil supply. EIA forecasts Brent prices will average $47/b in the first quarter of 2021 and rise to an average of $50/b by the fourth quarter.

Other key driver for the recent increase in oil prices has been the deal to slowly cut the OPEC production cap in the first quarter instead of 2 million barrels a day. OPEC+ agreed to raise oil supply by 500,000 barrels a day in the next month, well below the 2 million barrels mark.

A positive outlook for the next year doesnt necessarily support a low volatility environment for crude oil prices as over the medium to long term period the uncertainties will remain in the following aspects:

- consumption patterns due to changes in behaviors caused by multiple lockdowns across the globe.

- a slower than expected economic recovery.

- changes in global production of crude oil - OPEC & non-OPEC.

- shape & structure of US-China Trade related alignment.

- the pace of Energy transition, primarily led by leading global economies, towards green energy.

Crude oil prices will continue to demonstrate volatility. Companies that can adapt, deploy and harness the benefits of data and modern risk management processes, tools & technologies will thrive and be best placed to respond to challenges posed by the evolving global economic & political situations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oil Prices Fall amid Worries over New Coronavirus Strain

A new variant of the coronavirus is ravaging Britain. What's worse, it is spreading to Europe and other countries.

Greater Market Risks May Hamper Oil Prices

WTI crude once jumped to as high as $45.92 this week but stopped just shy of $46.0 with a consolidation around $45.47.

Oil Prices Hit Fresh High on Uncertain Outlook

WikiFX News (6 Aug) - WTI crude oil embraced a steep rise in prices, up 4.5% to the high level of $43.68, compared to its low level of $41.76. It has recorded a fresh five-month high since March 6. Nevertheless, the outlook of oil remains uncertain because of the insufficient upward momentum in future oil prices resulted from the sluggish job growth in the United States.

Oil Prices Surge with Expansion of Production Cut

After yesterday’s OPEC+ Joint Ministerial Supervisory Committee (JMMC) meeting, oil prices started rising to a new weekly high.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator