简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sentiment and Forex Trading

Abstract:Market sentiment defines how investors feel about a particular market or financial instrument. As traders, sentiment becomes more positive as general market consensus becomes more positive. Likewise, if market participants begin to have a negative attitude, sentiment can become negative.

Market sentiment defines how investors feel about a particular market or financial instrument. As traders, sentiment becomes more positive as general market consensus becomes more positive. Likewise, if market participants begin to have a negative attitude, sentiment can become negative.

As such, traders use sentiment analysis to define a market as bullish or bearish, with a bear market characterized by assets going down, and a bull market by prices going up. Traders can gauge market sentiment by using a range of tools such as sentiment indicators, and by simply watching the movement of the markets, using the resulting information to make their decisions.

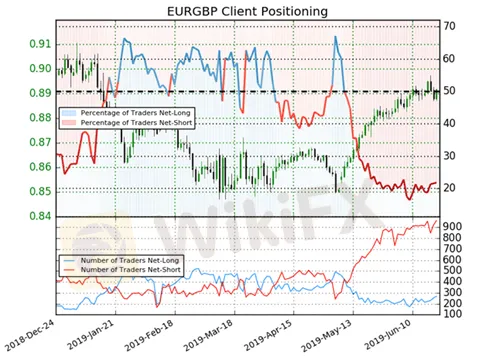

An example of net short sentiment can be seen in the EUR/GBP chart below, with 21.9% of traders net-long with a ratio of traders short to long at 3.58 to 1. The chart shows in blue the percentage of traders taking a net long position, and in red the percentage taking a net short position.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

Currency Calculator