简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Lagarde‘s Next Colleague at ECB Won’t Start Out Rocking the Boat

Abstract:Frank Elderson, the Dutch supervisory official selected by euro-area governments for the European Central Bank‘s Executive Board, gave his backing to the institution’s emergency measures in a signal that he wont start out by rocking the boat.

Frank Elderson, the Dutch supervisory official selected by euro-area governments for the European Central Bank‘s Executive Board, gave his backing to the institution’s emergency measures in a signal that he wont start out by rocking the boat.

{4}

Steps taken in response to the coronavirus pandemic have been “effective in preserving favorable financing conditions for all sectors and jurisdictions across the euro area,” Elderson said in a written response to questions from the European Parliament, which was seen by Bloomberg News.

{4}

{6}

“The ECB should continue to use all its instruments to ensure that financing conditions remain favorable to support the economic recovery and counteract the negative impact of the pandemic on the projected inflation path,” he said.

{6}

Read More: Elderson Wins Euro-Area Race to Join Lagardes Team at ECB

Elderson, who is currently head of supervision at the Dutch central bank, faces a hearing in the EU Parliament on Monday. The assembly gets to weigh in on his nomination but doesnt have the power to block him. Lawmakers have repeatedly complained about the lack of female candidates for such positions.

“I sincerely hope that you will consider me on the basis of my qualifications,” Elderson said when asked whether he would accept the appointment even if the parliament were to vote against him.

A spokeswoman for the Dutch central bank declined to comment on the document.

The 50-year-old would join the ECBs top team as it continues to battle the fallout from the coronavirus. Its emergency asset purchases are scheduled to run until mid-2021, and most economists expect the program to be extended for another six months.

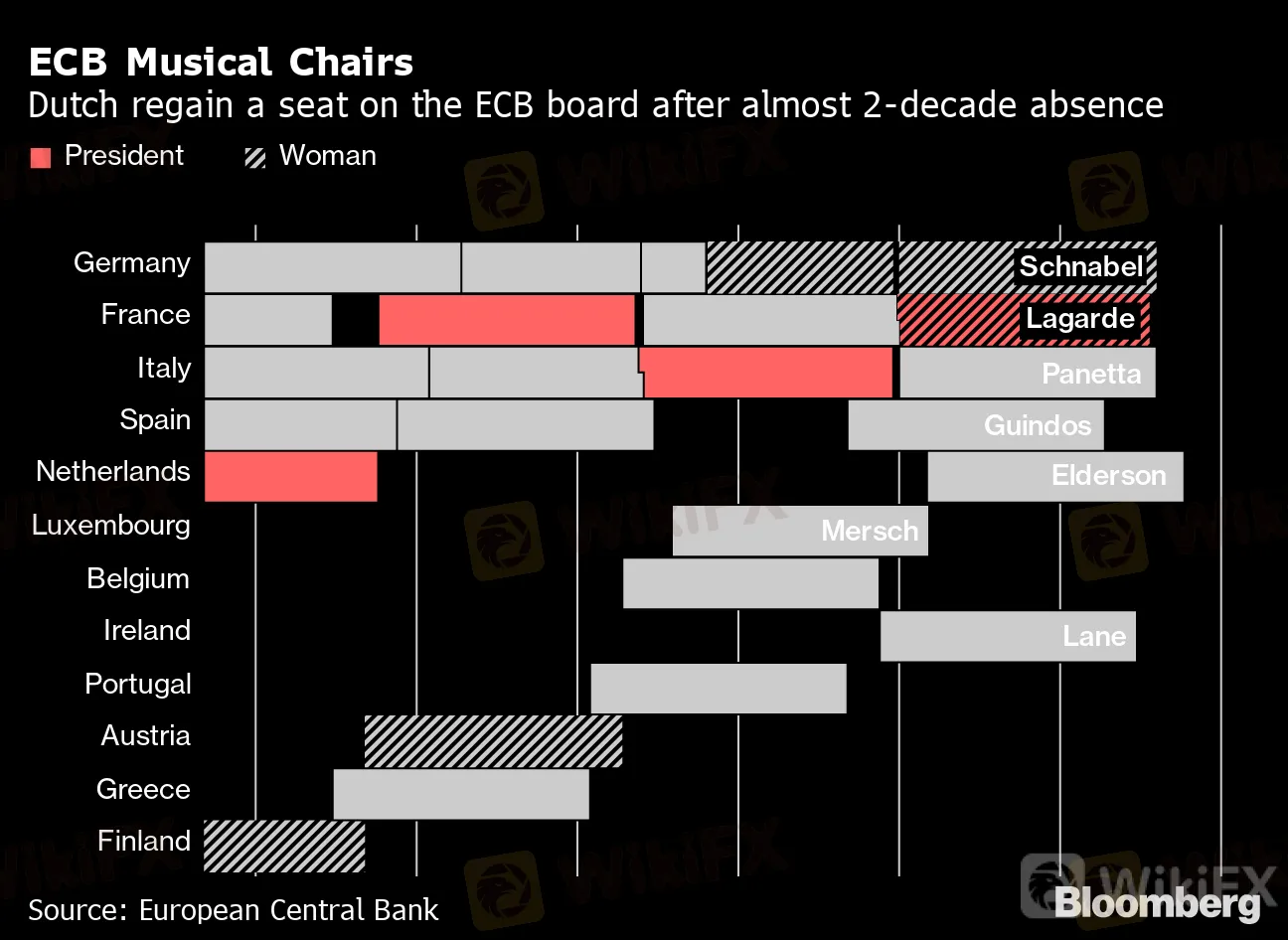

ECB Musical Chairs

Dutch regain a seat on the ECB board after almost 2-decade absence

Source: European Central Bank

Asked whether the purchase plan should get a more permanent character, Elderson said it is “temporary, targeted and proportionate,” with its calibration “directly linked to the evolution of the pandemic and its consequences for the transmission of monetary policy and the economic outlook.”

The Dutchman, who chairs the Network for Greening the Financial System, also highlighted the ECBs responsibility in accelerating the transition to a carbon-neutral economy.

{24}

The designs of long-term lending and asset-purchase programs “have important implications on the capital allocation in the economy and it is important that these policies are ‘future proof,’ without compromising the effectiveness of monetary policy in attaining the primary objective,” Elderson said.

{24}

“It would be an important step to acknowledge that acting in accordance with the principle of an open market economy does not necessarily imply that the ECB should under all circumstances strictly adhere to market neutrality, in particular in the presence of market failures,” he added.

Elderson, who is likely to be nominated to be the vice chair of the ECBs watchdog for lenders, also addressed financial stability and bank supervision.

He argued banks must prepare for a likely deterioration in asset quality as a result of the pandemic, warned against any fragmentation of European regulation, and called on the ECB to “step up their game” to ensure its supervisory approach is fit to handle technological innovation.

— With assistance by Nicholas Comfort

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator