简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Indias Economy Heads for Double-Digit Decline as Virus Spikes

Abstract:Indias economic recovery prospects have gone from bad to worse after the nation emerged as a new global hotspot for the coronavirus pandemic with more than 5 million infections.

Indias economic recovery prospects have gone from bad to worse after the nation emerged as a new global hotspot for the coronavirus pandemic with more than 5 million infections.

Economists and global institutions like the Asian Development Bank have recently cut Indias growth projections from already historic lows as the virus continues to spread. Goldman Sachs Group Inc. now estimates a 14.8% contraction in gross domestic product for the year through March 2021, while the ADB is forecasting -9%. The Organisation for Economic Co-operation and Development sees the economy shrinking by 10.2%.

The failure to get infections under control will set back business activity and consumption -- the bedrock of the economy -- which had been slowly picking up after India began easing one of the worlds strictest and biggest lockdowns that started late March. Local virus cases topped the 5 million mark this week, with the death toll surpassed only by the U.S. and Brazil.

“While a second wave of infections is being witnessed globally, India still has not been able to flatten the first wave of infection curve,” said Sunil Kumar Sinha, principal economist at India Ratings and Research Ltd., a unit of Fitch Ratings Ltd. He now sees Indias economy contracting 11.8% in the fiscal year, far worse than his earlier projection of -5.8%.

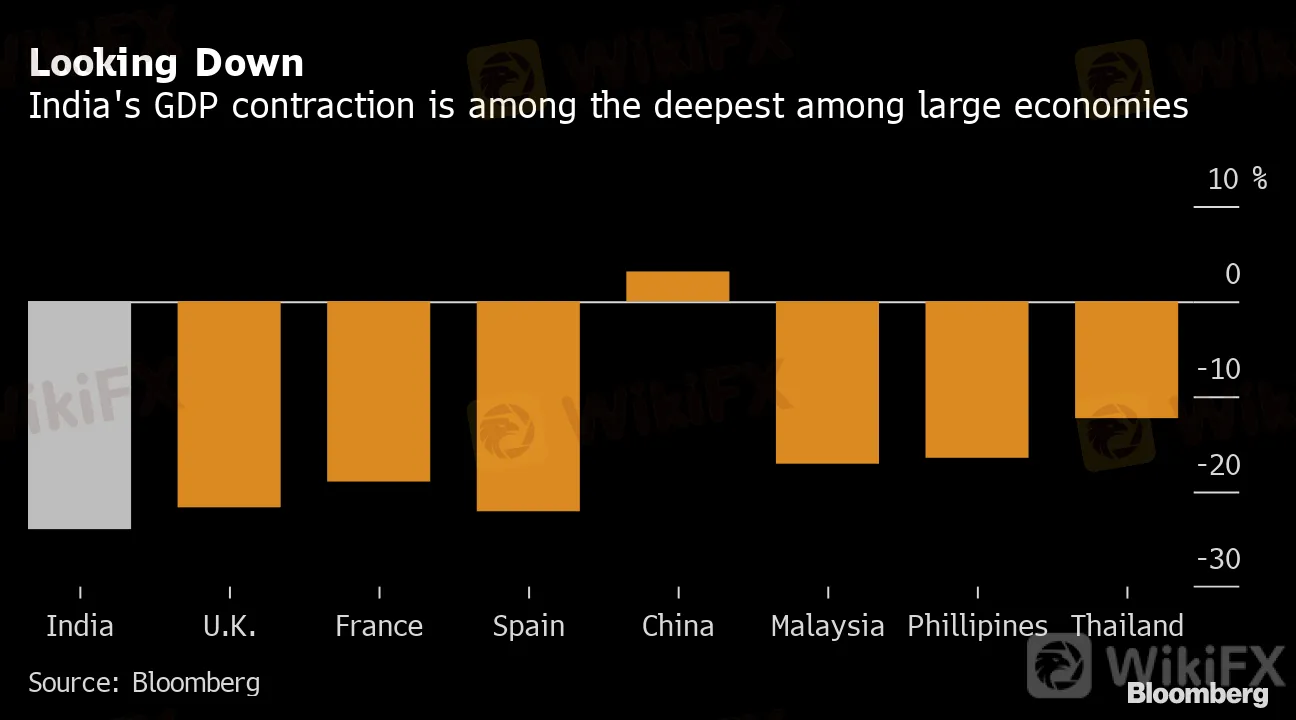

Goldman Sachss latest growth forecast came last week after data showed gross domestic product plunged 23.9% in the April-June quarter from a year ago, the biggest decline since records began in 1996 and the worst performance of major economies tracked by Bloomberg.

Looking Down

{18}

India's GDP contraction is among the deepest among large economies

{18}

Source: Bloomberg

While there are some signs that activity picked up following the strict lockdown, a strong recovery looks uncertain.

{24}

“By all indications, the recovery is likely to be gradual as efforts toward reopening of the economy are confronted with rising infections,” Reserve Bank of India Governor Shaktikanta Das told a group of industrialists Wednesday.

{24}

Lower Potential

{26}

The central bank will likely release its own growth forecast on Oct. 1 when the monetary policy committee announces its interest rate decision. In August, the RBI said private spending on discretionary items had taken a knock, especially on transport services, hospitality, recreation and cultural activities.

{26}

The plunge in GDP, as well as ongoing stress in the banking sector and among households, will curb Indias medium-term growth potential. Tanvee Gupta Jain, an economist at UBS Group AG in Mumbai, estimates potential growth will slow to 6% from 7.1% year-on-year estimated in 2017.

What Bloombergs Economists Say

India went into the Covid-19 pandemic already suffering a downward trend in growth potential. We expect a 10.6% contraction in fiscal 2021, rebound in 2022, and slower path for growth as scars from the virus recession drag on the remaining years of the decade.

Click here to read the full report.

Abhishek Gupta, India economist

Read: India Faces Dwindling Policy Options After Record GDP Slump

In addition to that, corporate profits have collapsed, putting a brake on investments, which in turn, will curb employment and growth in the economy.

Falling Investments

Gross capital formation in India has contracted sharply

Source: Government of India

NOTE: Percentage change is year-on-year

India is “likely to see a shallow and delayed recovery in corporate sector profitability over the next several quarters,” said Kaushik Das, chief economist at Deutsche Bank AG in Mumbai, who has downgraded his fiscal year growth forecast to -8% from -6.2%. That will “reduce the incentive and ability for fresh investments, which in turn will be a drag on credit growth and overall real GDP growth,” he said.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator