简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Argentines Are Abandoning a Trade That Hedged Currency Risk

Abstract:Argentines are abandoning dollar-linked instruments in the local market as speculation ramps up that the government will create a weaker parallel exchange rate while giving investors less favorable terms.

Argentines are abandoning dollar-linked instruments in the local market as speculation ramps up that the government will create a weaker parallel exchange rate while giving investors less favorable terms.

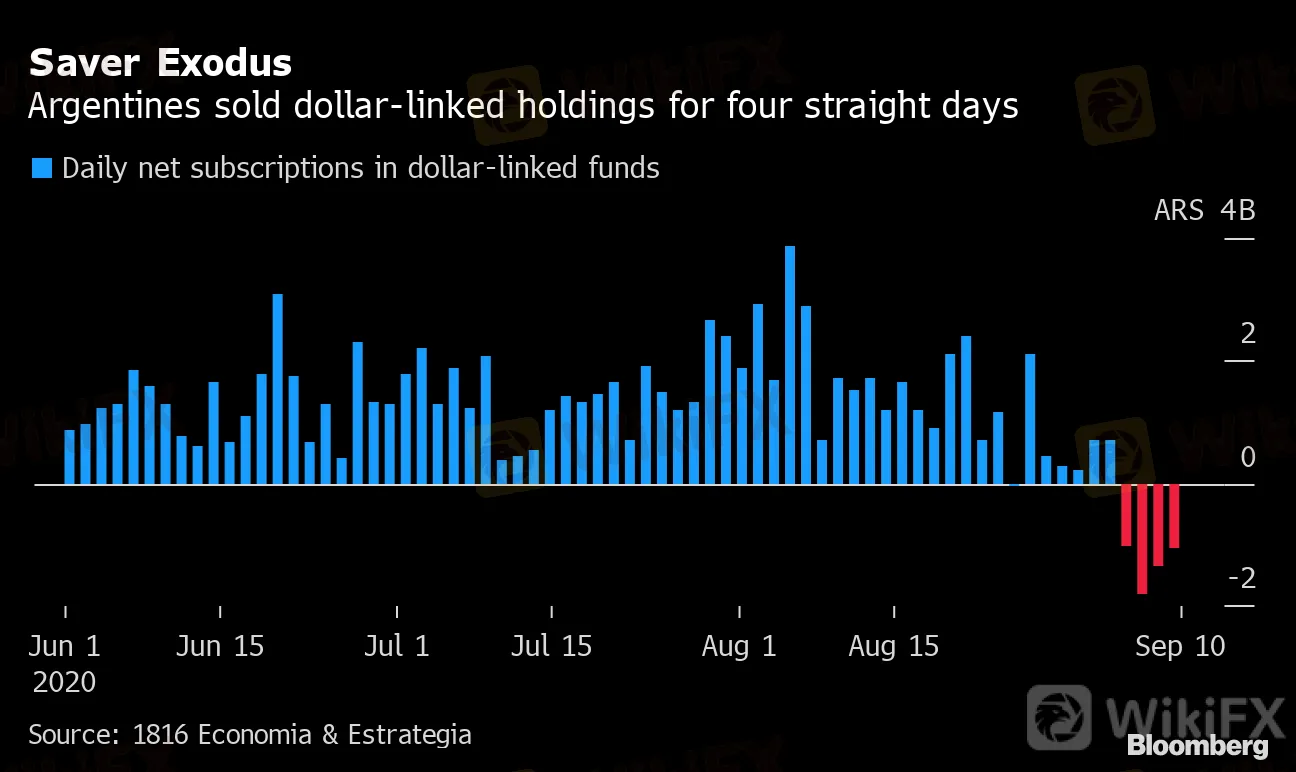

After three straight months of inflows to funds that invest in the securities, 5.2 billion pesos ($69.4 million) has been yanked out in four days, about 4.25% of total assets. The rush for the exits was sparked by local media reports that officials will establish a weaker parallel exchange rate to be used in everyday transactions, but keep the official rate for the bonds artificially strong. It would be part of efforts to keep dollars in the country and put a lid on inflation.

While a government official denied there was any such plan Monday, investor confidence was already shaken. Such a move would be a blow to savers who have sought to protect themselves from the effects of devaluation and inflation by piling into dollar-linked notes, which are bought and sold in pesos but pay interest and principal at the official exchange rate of the day.

So an investor who expected a bigger payout in the future when the government devalues faces the prospect of falling behind as the official rate stays the same even as a weaker parallel rate is used in other types of transactions.

Argentine companies issued a record $721 million of the bonds domestically in the past three months as demand soared, and some yields had even gone negative as the pandemic, a default and a lack of hard currency prompted investors to seek protection.

“In Argentina there is a lot of liquidity that does not know where to go,” said Pedro Siaba Serrate, an analyst at Portfolio Personal Inversiones in Buenos Aires. “Because the refuge is the dollar.”

Saver Exodus

Argentines sold dollar-linked holdings for four straight days

Source: 1816 Economia & Estrategia

Cecilia Todesca, the deputy cabinet chief, said in an interview published Monday by the newspaper Ambito Financiero that the government doesn‘t want multiple exchange rates. They can sometimes be used “as a transition” but “it’s not an equilibrium solution,” she said, according to the report.

Parallel exchange rates are nothing new in Argentina, where capital controls have forced savers to come up with creative ways to get their hands on dollars to preserve wealth. The latest foreign-exchange limits were introduced last year and have progressively tightened under President Alberto Fernandez.

{22}

Argentines are limited to buying just $200 every month at the official rate of about 75 pesos to the dollar. Those seeking more will pay 73% more to skirt the restrictions -- 130 pesos to the dollar -- via a series of financial transactions known as the blue-chip swap.

{22}{777}

There hasnt been an official alternate exchange rate since the late 1980s, when the government created a system for financial transactions that valued the peso at 35% below the rate used for commercial dealings. The gap eventually grew to 215%, according to the book “Historia Económica de la Argentina.”

{777}

Another move in that direction would be a disappointment for investors just as the country emerges from a $65 billion default promising that it has a viable plan to shore up the economy, spark growth and curb currency volatility. Officials are set to begin talks to refinance a $44 billion loan from the International Monetary Fund, while the economy is poised for its third straight annual contraction. The peso has lost 75% of its value since the end of 2017 and inflation is running at more than 40%.

(Adds governments comment in third and seventh paragraphs.)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues HSBC Australia Over $23M Scam Failures

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Understanding the Impact of Interest Rate Changes on Forex Markets

Currency Calculator