简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

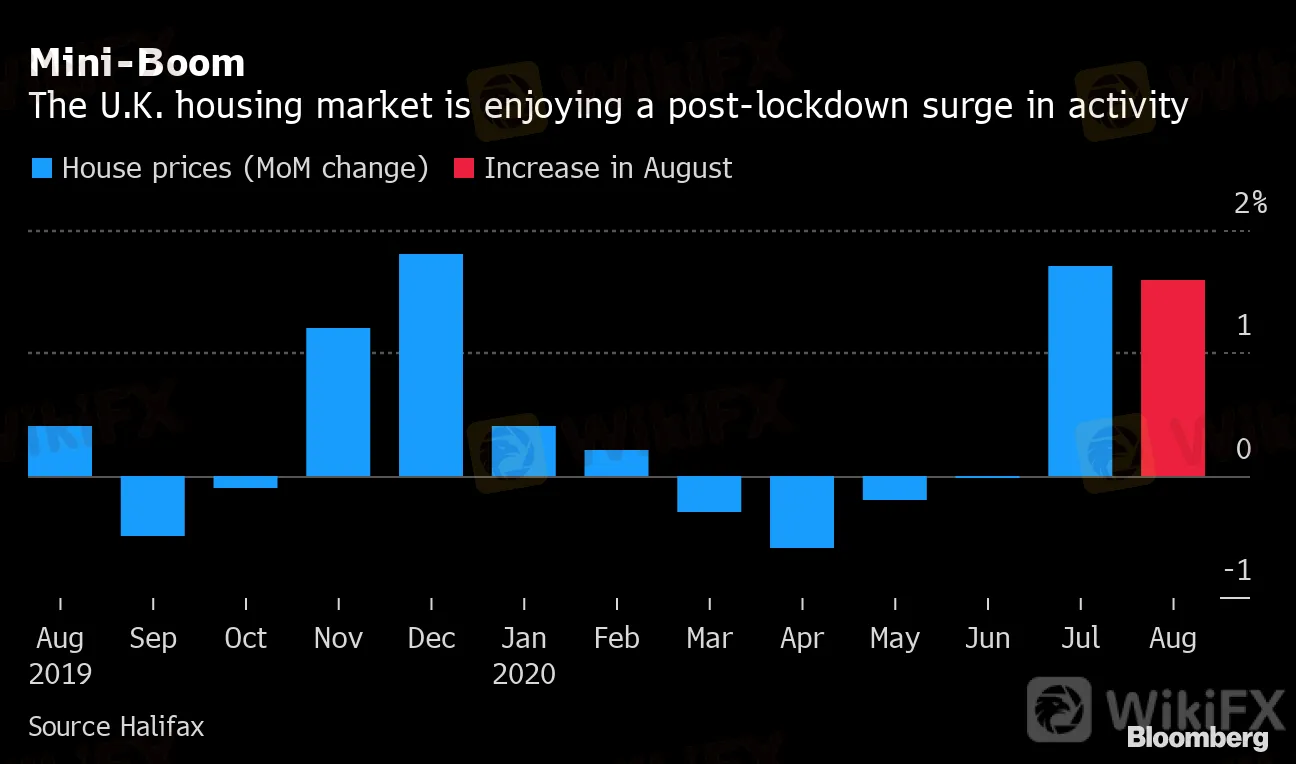

U.K. House Prices Gain Most Since 2016 as Tax Cut Fuels Boom

Abstract:U.K. house prices rose by the most in four years in August as buyers rushed to take advantage of a tax cut that is helping to bolster a post-lockdown spurt in property transactions.

U.K. house prices rose by the most in four years in August as buyers rushed to take advantage of a tax cut that is helping to bolster a post-lockdown spurt in property transactions.

Average house prices rose 1.6% from July to a record average of 245,747 pounds ($325,000), mortgage lender Halifax said Monday. From a year earlier, prices gained 5.2%, the strongest since 2016.

Mini-Boom

The U.K. housing market is enjoying a post-lockdown surge in activity

Source Halifax

Its just latest indicator of a mini boom in the market after it was shut down during Covid-19 restrictions earlier this year. Property website Rightmove last week said the value of agreed sales jumped to the highest in a decade in July and Bank of England data showed mortgage approvals rising.

One-in-seven homes are selling in just a week, with the number more than doubling from a year ago, Rightmove said. Three bedroom, semi-detached and four bedroom detached houses are seeing the greatest demand, while properties in London are taking the longest to sell.

The housing market‘s emergence from the coronavirus doldrums has been given extra fuel from Chancellor of the Exchequer Rishi Sunak’s decision to temporarily waive the tax on the first 500,000 pounds of any property purchase. The outlook remains uncertain, though, as the economic hit continues to take hold and joblessness expected to surge.

“It remains highly unlikely that this level of price inflation will be sustained,” said Russell Galley, managing director at Halifax. “With most economic commentators believing that unemployment will continue to rise, we do expect greater downward pressure on house prices.”

(Updates to add details from third paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator