简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex Market: Why Interest Rates Matter?

Abstract:Price Trends in the foreign exchange market are basically determined by changes in the interest rate policy in the global banking system.

Price Trends in the foreign exchange market are basically determined by changes in the interest rate policy in the global banking system.

The central bank in each country is responsible for determining the interest rate for the local currency, used in credit (or investment) activities at certain times, and this is one of the important factors in determining the relative value of their domestic currencies worldwide.

A firm understanding of how central banks are planning and operating monetary policy is extremely beneficial to market analysis and, ultimately, to make more favorable predictions in the dealing process.

One of the fundamental reasons for banks to adjust interest rates is to maintain price stability in the economy, as well as to keep inflation, a monetary phenomenon, at a manageable level.

What is inflation?

Inflationrefers to the increase over time of general prices of goods and services in the economy. This quantitative measure is usually expressed as a percentage, showing the constant rise in the general price of almost everything in the economy - food, clothing, property and others - where a unit of currency, in fact, has a small value over time and therefore can only afford a smaller amount of goods compared to the previous time. Inflation is the reason why the previous generations could buy a new car for just a few thousand dollars in the 1960s, but today the same quality and luxury vehicles are 10 times more expensive.

Partial and moderate inflation is seen as a natural result of healthy economic growth, and thus inflation is considered positive. However, over inflation can have devastating effects on the economy - for example, galloping inflation is a disease, a terrible crisis, that has occurred in Zimbabwe in 2008, where its citizens actually used trolleys to carry loads of almost worthless currency everywhere to buy goods. The country finally had to abolish the payment status of the Zimbabwean dollar a year later, when the price of a loaf of bread was worth 1.6 billion!

For this reason, most central banks regularly use problem-detecting indicators to check the status of their economy, including Consumer Price Index (CPI)and Personal Expenditure (PCE).

How do interest rates impact inflation?

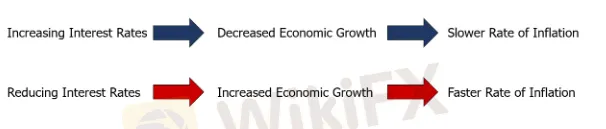

Central banks around the world often consider the decision to raise deposit rates as one of their efforts to keep inflation at a stable level.

This is because higher and less competitive interest rates generally limit economic growth, on the other hand encourage businesses and consumers to save more and borrow less when loans become more expensive.

On the contrary, lower interest rates will make it more attractive to borrow money for investment as the cost of the loan also becomes lower - creating a “knock on”effect on the spending levels of the economy, stimulating economic growth.

Interest rates and forex market

Changes in interest rates, one of the most important economic factors, in countries, carried out by the central banks of each country from time to time, will cause capital flows to move in and out of countries at different speeds. An increase in domestic interest rates may limit domestic borrowing and investment, but also make many international investors more attractive as rising interest rates mean that investment rates have also increased. As a result, rising interest rates often reinforce the value of domestic currencies relative to other currencies.

Thus, many forex traders will spend a lot of time analyzing the changing trend of interest rates as an indicator of the economy - because as we see, when the interest rates rise, the value of the corresponding money will have corresponding changes.

For example, if the interest rate now ran by a central bank drops continuously over a period of time, then it would be reasonable to assume that interest rates will tend to rise again to ensure the nation's financial competitiveness. Therefore, over time, many traders in the market will put their faith in that change and they will gradually act to comply with such a judgment - especially at the end of a currency cycle, when official decisions are published.

What is the interest rate differential (IRD)?

The expectations of leading economic experts on interest rate trends are influenced by the annual important economic reports, and traders also rely on this information to make their predictions; one of the best examples is the US Federal Reserve's 'dot plot', which is released after every Fed meeting that includes personal forecasting from the top 16 Fed experts.

In fact, comparing interest rates between two countries in a currency pair is a common method used by traders to identify whether a given currency is strengthened or weakened - the difference between these two interest rates are called interest rate differentials and may assist investors in identifying market movements, which are sometimes unclear in the first place.

In general, when the gap between the two interest rates increases, the higher interest rate copper will be strengthened and vice versa, on the other hand, when the gap is narrowed, the value of the low interest rate currency will increase relatively. In some cases, completely divergent interest rates, moving in opposite directions, can create very strong fluctuations in the market!

Prime rate differential also depends on trade, where currencies from low-interest countries will be converted to higher-interest currencies to capitalize based on the rapid increase of currency. A trader would know that the interest rate causes the trouble named Swap.

What is Swap?

Swap (or Rollover)is the amount you need to pay or receive for holding an order overnight.

In forex trading, because we trade in currency pairs, each of these currencies will have a different interest rate. When holding a currency pair overnight, traders must pay or receive an amount from the difference between the two interest rates. If the interest rate of the currency pair you buy is higher than the interest rate of the currency pair you sell, you will receive an overnight fee, depending on the rules of each broker. If the interest rate of the currency pair you buy is lower than the interest rate of the currency pair you sell then you will have to pay back the fee.

In the case of EURAUD pair

Current interest rate is:

The interest rate of EUR is 0% while the AUD is 0.25%

So when dealing

Swap fee for Buying EUR and Selling AUD orders is -1.68 $, and for Selling EUR and Buying AUD orders is 1.13 $

Assuming we can calculate a fair exchange rate, with a short position on EURAUD we can bring in more profit than a long position.

Similarly, there will be companies that borrow money from Europe with interest rates of 0 - 1% and then will send to countries with higher and stable interest rates such as Vietnam, Indonesia, Malaysia, etc. to benefit the interest rate difference.

For example:

Above is the financial statement of Vinamilk (VNM), which borrowed more than USD 200 million at an interest rate of 2.5% at USD/VND exchange rate of 23,300.

Then, under the bank deposit, VNM reversed this amount of USD when converting it into VND with an average savings interest rate of 7.5%/year, so this company has a profit of more than USD 14 million per year if the price of dong does not fluctuate too much.

At the end of the article, the author would like to remind traders that it is vital to always look at fundamental analysis like interest rates news because it will greatly determine the trend of the currency pairs and involve so many economic sectors. Increasing or decreasing interest rates will have a great impact on the entire economy of the country and will then determine the currency's exchange rate.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator