简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Rupee Fights August Curse With Wall of Money Into Nations Banks

Abstract:India‘s rupee has been shielded from the headwind it typically faces in August, thanks to the robust foreign inflows into share sales by the nation’s marquee lenders.

India‘s rupee has been shielded from the headwind it typically faces in August, thanks to the robust foreign inflows into share sales by the nation’s marquee lenders.

ICICI Bank Ltd., Axis Bank Ltd. and mortgage lender HDFC Ltd. have raised a combined 350 billion rupees ($4.7 billion) this month. Founders of Bandhan Bank Ltd., Indias most profitable lender, sold 106 billion rupees of shares to investors including BlackRock Inc. Together with smaller offerings from companies including Info Edge (India) Ltd., stocks inflow in August reached $3.5 billion, the highest in Asia ex-China.

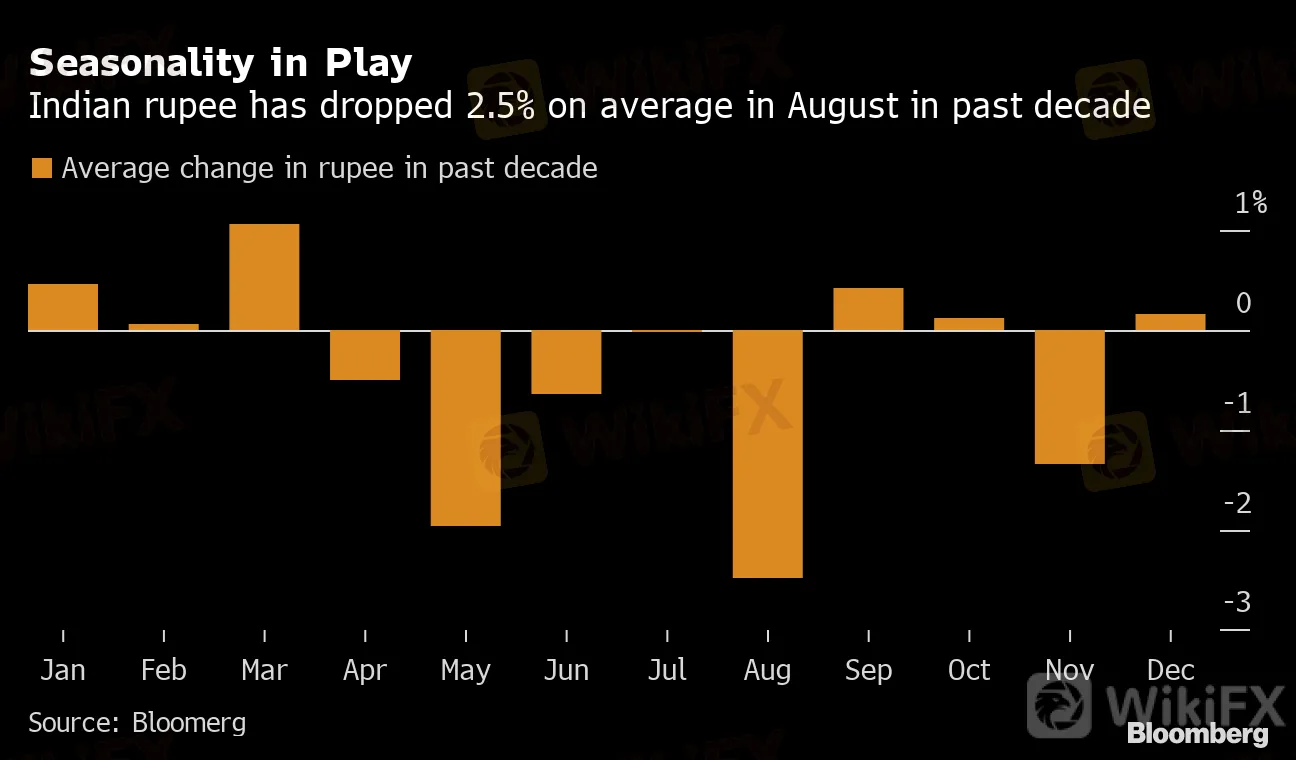

The fundraising and a weak dollar have meant the rupee is stable this year in August, versus an average decline of about 2.5% in the month over the past decade. A seasonal pattern has seen the currency weaken this month in six of the past 10 years, though analysts arent able to put a finger to the exact cause.

Seasonality in Play

Indian rupee has dropped 2.5% on average in August in past decade

Source: Bloomerg

“Rupee has been trading within a narrow range so far this month, with a weaker U.S. dollar helping to offset the seasonal rupee weakness,” said Khoon Goh, head of Asia research at Australia and New Zealand Banking Group in Singapore. Strong equity inflows during the month are also helping the rupees cause, he said.

The currency still remains in the lower rungs of the Asian pack as the Reserve Bank of India continues to soak up dollars. The nation‘s foreign exchange reserves are at an all-time high of $538 billion, largely due to the RBI’s dogged purchases of the greenback.

— With assistance by Masaki Kondo

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator