简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Where Will Declining Gold Head? Investment Banks Suggest Further Gains

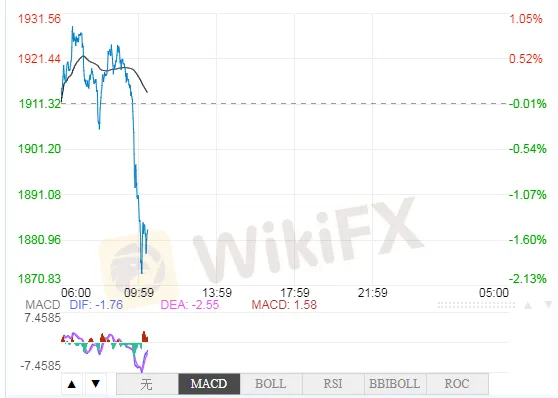

Abstract:Gold prices recorded the biggest loss for seven years this Tuesday, returning markets into anxiety about precious metals. Nevertheless, they are expected to rise again according to Commerzbank.

WikiFX News (15 Aug)- Gold prices recorded the biggest loss for seven years this Tuesday, returning markets into anxiety about precious metals. Nevertheless, they are expected to rise again according to Commerzbank.

On Tuesday, spot gold breached below $1,910/oz, down 6% on the day.

According to Carsten Fritsch, the analyst of Commerzbank, gold prices saw extensive gains in the last few weeks - first penetrating $1,920, then soaring above $2,000, and even approaching $2,100 last week. “The scale of the upswing over the past four weeks has been excessive. Sentiment towards gold became positive in the extreme, with only a minority of participants sounding a note of caution,” said Fritsch.

In addition, this rally was largely driven by investors appetite, which might be enough to put premium on gold prices but not enough to sustain the uptrend. “The price rise was almost solely attributable to robust investor demand, with all other demand components playing hardly any role. It is understandable that investors now appear to be taking profits.”

However, the analyst indicated that a very significant correction like in mid-March is very unlikely. Most importantly, Fritsch noted, this is not the end of the road for gold and silver prices, and the rally will resume after prices consolidate lower.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

You can also find us here-

Vietnam: www.facebook.com/wikifx.vn

Thailand: www.facebook.com/wikifx.th

Indonesia: www.facebook.com/wikifx.id

South Asia: www.facebook.com/wikifxglobal

Italy: www.facebook.com/wikifx.it

Japan: www.facebook.com/wikifx.jp

India: www.facebook.com/wikifx.in

Pakistan: www.facebook.com/wikifx.pk

Bangladesh: www.facebook.com/wikifx.bd

Arabian countries: www.facebook.com/wikifx.arab

Russian countries: www.facebook.com/wikifx.russian

French countries: www.facebook.com/wikifx.French

Western Pacific area: www.facebook.com/wikifx.westernpacific

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator