简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BOE Says No Plans to Tighten Policy Before All-Clear on Economy

Abstract:The Bank of England gave a strong indication it will maintain monetary stimulus until the economy is close to a full recovery from the fallout of the coronavirus pandemic.

SHARE THIS ARTICLE

Share

Tweet

Post

The Bank of England gave a strong indication it will maintain monetary stimulus until the economy is close to a full recovery from the fallout of the coronavirus pandemic.

Officials led by Governor Andrew Bailey said Thursday they have no plans to tighten policy until there is clear evidence that “significant progress” toward eliminating slack in the economy and “achieving the 2% inflation target sustainably.”

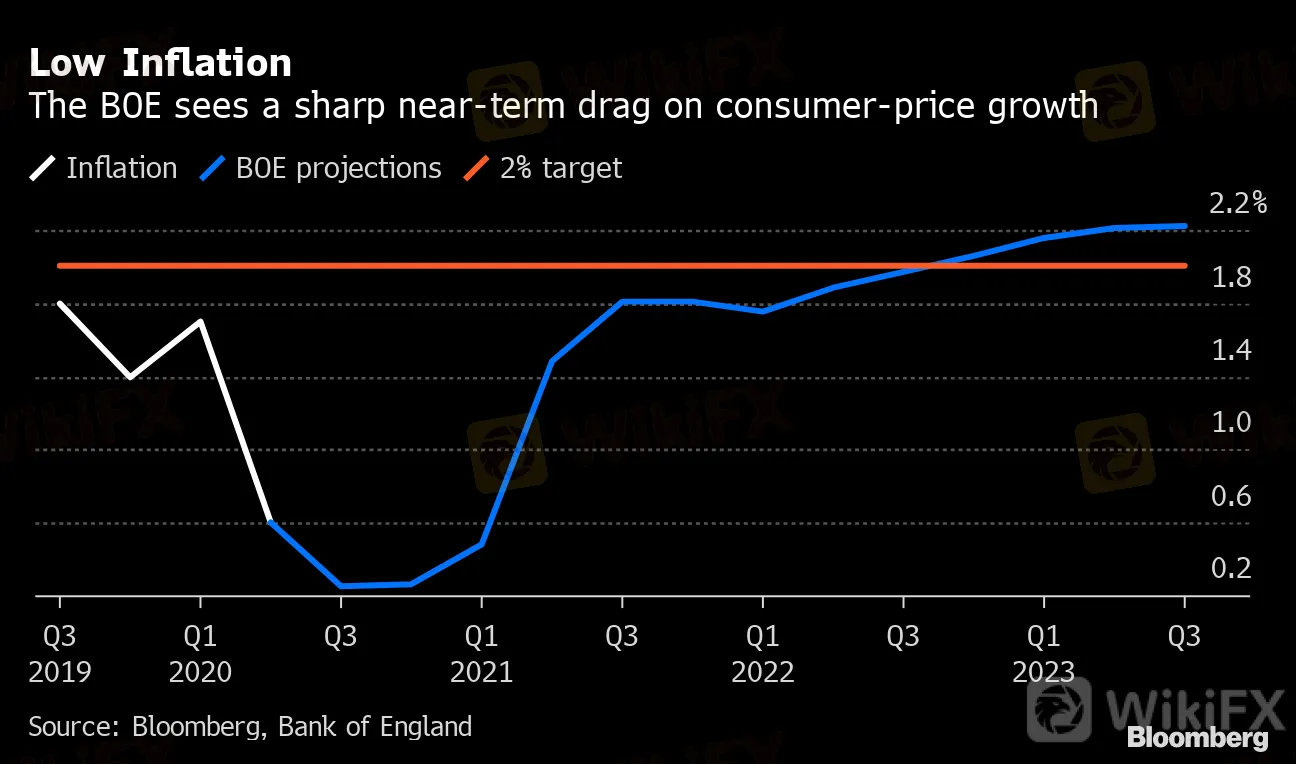

Low Inflation

The BOE sees a sharp near-term drag on consumer-price growth

Source: Bloomberg, Bank of England

{11}

The comments offer new insight amid a focus on what policy makers do next as lockdowns take hold in parts of the country. With the governments program to support jobs scheduled to end soon and the deadline for Brexit transition is fast approaching, economists expect more bond purchases and investors are pricing in a move to sub-zero rates in the next two years.

{11}

But the BOE‘s new projections see inflation getting back to the 2% target within its forecast horizon, which could suggest it currently doesn’t see a need to ease further. The new forward guidance could be an attempt to offset any investor concern that it will tighten too soon.

The pound gained 0.4% to $1.3163 as of 7:50 a.m. in London after the Monetary Policy Committees announcement.

It voted unanimously to keep the asset purchase target at 745 billion pounds ($980 billion) while holding the benchmark interest rate at a record-low 0.1%. The pace of bond purchases will be reduced to 4.4 billion pounds a week from Aug. 11.

Officials said that the downturn will be less severe than outlined in a scenario it published in May, although the risk to the outlook is skewed to the downside, with gross domestic product not expected to exceed 2019 levels until the end of 2021. Inflation is expected to fall further below the target and average around 0.25% in the latter part of the year, before returning in about two years.

BOE Says U.K. Bank Losses to Be ‘Somewhat Less’ Than Expected

{21}

Policy makers expect unemployment to rise materially to about 7.5% by the end of the year. Most officials agree that the labor market will be key to the recovery. Economists are warning more than 3 million could be out of work before the end of 2020. That would be the worst since the de-industrialization of Britain under Margaret Thatcher in the 1980s.

{21}{22}

“The Committee does not intend to tighten monetary policy until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably”

{22}{777}

--Bank of England August Policy Decision

{777}

Consistent with the government‘s stated policy aims, the BOE’s forecasts dont include a second nationwide lockdown, but do assume a slow recovery with the possibility of more restrictions.

Road to Recovery

The U.K. economy may not return to pre-crisis levels until the end of 2021

Source: Bank of England

Note: Figures based on market interest rate expectations, include backcast

On the feasibility of implementing negative rates, officials said that their reviews is ongoing. However, they did note that their effectiveness relies on transmission through the banking sector, something that could be negatively affected by the current disruption from Covid-19.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator