简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Battered Rupiah Likely to Face Another Month of Losses

Abstract:Indonesias rupiah has depreciated more than any other emerging-market currency this month. Past performance suggests August will see further losses.

Indonesias rupiah has depreciated more than any other emerging-market currency this month. Past performance suggests August will see further losses.

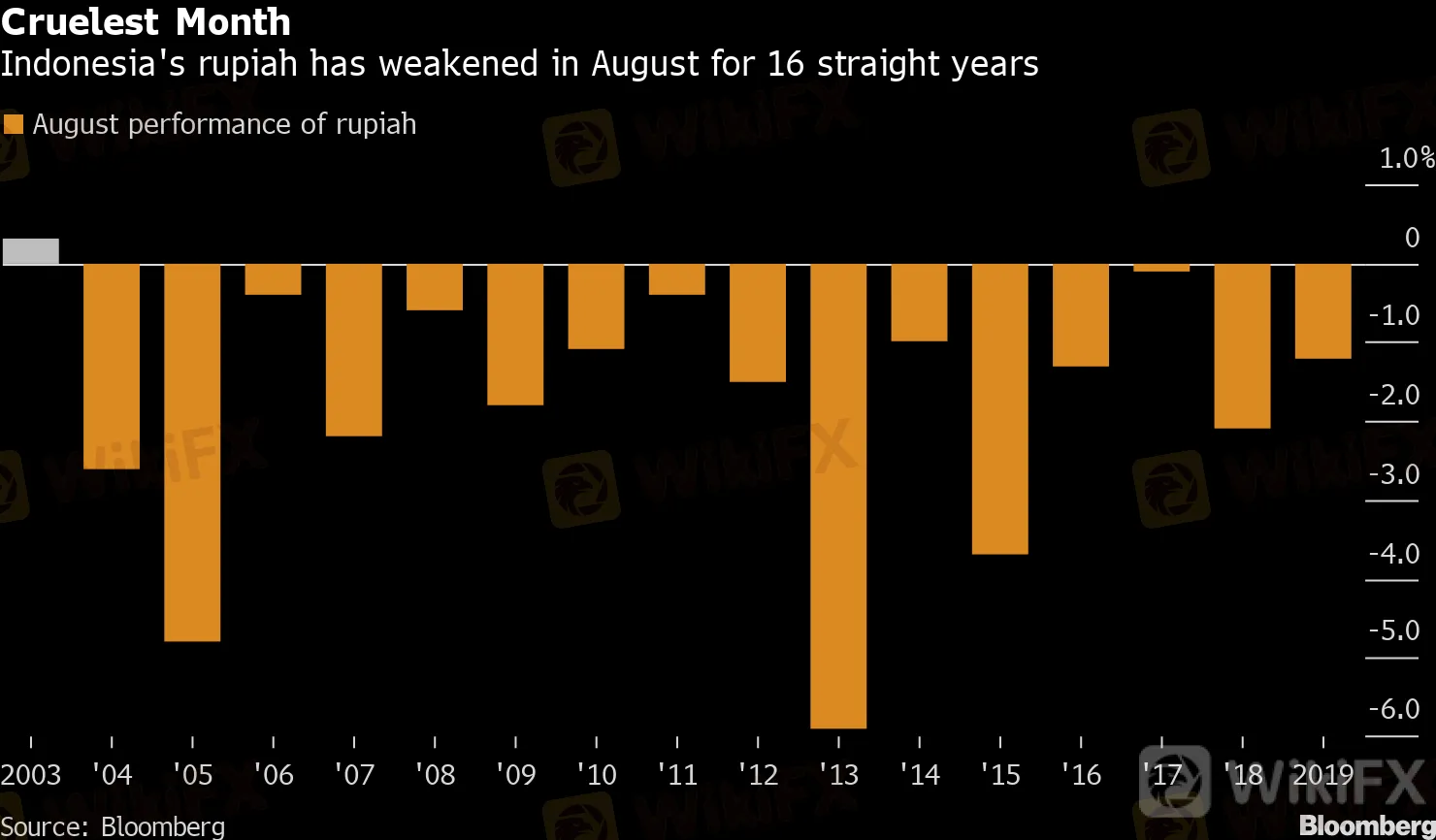

The record shows the rupiah has weakened against the dollar in August for 16 consecutive years, the only emerging Asian currency to show such a trend. It may have less to do with sentiment or policy though, and more to do with the fact that dividend payments are made to overseas investors from April to July and withdrawn the following month, according to Australia & New Zealand Banking Group Ltd.

Cruelest Month

Indonesia's rupiah has weakened in August for 16 straight years

Source: Bloomberg

“We are approaching a period of the year which has tended to see the rupiah come under pressure,” said Khoon Goh, head of Asia research at ANZ in Singapore. “The reason behind this August effect has usually been attributed to repatriation of dividends by foreign investors.”

The rupiah may extend declines toward 14,850 per dollar, which appears to be a key level of support, Goh said, without specifying a time-frame. The currency closed at 14,741 on Tuesday, having lost 3.2% this month.

Read More: Bank Indonesia Rate Reduction Cements Rupiah Losses

Indonesias currency has tumbled since early June as the central bank cut interest rates twice and signaled there may be more easing to come. Policy makers reduced the benchmark to 4% last week, the lowest level since the current rate system was adopted in 2016. They have also pledged to buy billions of dollars of bonds directly from the government to helped finance virus-recovery spending.

Things were very different last quarter. The rupiah was the best performer in emerging markets during the three months through June 30 as investors were attracted to the countrys relatively high real yields amid the unprecedented global stimulus.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator